Why Dogecoin Price is Going Down Today?

Highlights

- Dogecoin falls to $0.20 amid market dip, poised for rebound as technicals turn bullish.

- DOGE network activity dips from 1.29M to 30K addresses, reflecting reduced investor engagement.

- Analysts see potential DOGE rise to $0.45 after testing key $0.20 support level.

The price of Dogecoin has declined by over 6% in the last 24 hours following a broader market downturn. Bitcoin also dropped below $84,000, adding to the pressure on cryptocurrencies. Several factors, including market trends and economic developments, have contributed to Dogecoin’s price movement.

Dogecoin Price Plummets, Is A Recovery Near?

Dogecoin’s price has fallen to around $0.20, with analysts suggesting that it is following a familiar cycle seen in previous years. Historically, Dogecoin has gone through corrections before rebounding.

Crypto analyst Bithereum noted that Dogecoin price was moving within a falling wedge pattern, which indicated that a drop to $0.20197 was likely. This level has been tested, aligning with historical trends where Dogecoin price experiences pullbacks before rallying. Despite the drop, analysts believe Dogecoin could reverse to the upside, potentially reaching $0.45 soon.

Another factor contributing to the DOGE price decline is the decrease in network activity. According to market data, new address creation on the Dogecoin network has significantly dropped from 1.29 million in November to just 30,815. A decline in new addresses suggests lower investor participation, which can weaken buying pressure and lead to price declines.

Donald Trump 25% European Union Impact on DOGE Price

Dogecoin price recent drop also comes amid broader economic concerns. A major factor influencing the market is U.S. President Donald Trump’s announcement of a 25% tariff on the European Union.

“We have made a decision, and we’ll be announcing it very soon. It’ll be 25 per cent,” Trump said during a cabinet meeting, as reported by the Financial Times. His comments raised concerns about potential trade tensions between the U.S. and the EU, which affected global markets, including cryptocurrencies.

Following the announcement, Bitcoin price fell below $84,000, dragging the broader crypto market down. Dogecoin saw a decline of over 6% as traders reacted to economic uncertainty. Some analysts believe that fear surrounding economic policies led to increased selling pressure across digital assets. Concurrently, continued DOGE selling pressure, particularly from large investors, could lead Dogecoin to retest lower levels before stabilizing.

Dogecoin Price May Be Ready for a Rebound, Top Analyst

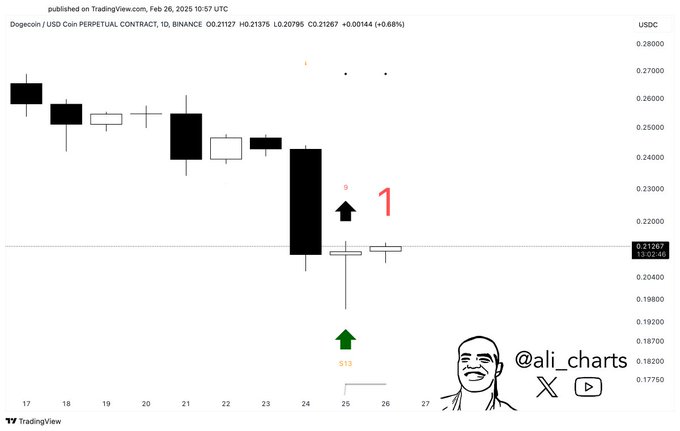

Despite the price drop, technical indicators suggest that Dogecoin price may be approaching a reversal. According to crypto analyst Ali (@ali_charts), the TD Sequential indicator has flashed a buy signal on the daily chart. This indicator is often used to identify potential trend reversals, suggesting that Dogecoin could soon experience upward momentum.

Trader Tardigrade, another analyst, pointed out that DOGE price has been following a similar pattern to its 2017-2018 bull run. If the trend continues, Dogecoin could see a strong rally, potentially moving toward the $1.70 level.

Additionally, Master Kenobi noted that Dogecoin is holding above a critical trend line that has historically acted as support. He also mentioned that Dogecoin’s Relative Strength Index (RSI) is at its lowest level since March 2023, which could indicate that the selling pressure is easing and a recovery may follow.

Consequently, crypto analysts have identified key price levels that could determine Dogecoin price next move. If Dogecoin price maintains its support around $0.20, a potential rebound could push it toward targets of $0.30998, $0.37154, and $0.45918 in the coming weeks.

Further, the rising bets of a DOGE ETF approval also keep investors enthusiastic over future movements. CoinGape reported that Grayscale Investments, CoinShares, and WisdomTree have submitted ETF filings in recent days. Traders and investors continue to eye the token for further price action shifts.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Is the Bitcoin Price Correction Really Over or Is This a Bear Market Trap?

- ‘Gambling Is Not Investing’: New Group Pushes Crackdown on Prediction Markets

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs