Why Is Bitcoin (BTC) Price Pumping Today

Highlights

- Bitcoin price hit $64,955 after Federal Reserve Chair Jerome Powell speech.

- Fed Chair Jerome Powell and Fed officials signal Fed rate cuts in September.

- Bitcoin chart showing technical strength and Golden cross pattern formation ahead.

- Bitcoin options traders turned extremely bullish.

Bitcoin price hit a high of $64,955 after Federal Reserve Chair Jerome Powell gave his strongest signal on Fed rate cuts. This triggered an upside momentum in the broader crypto market, with the market cap climbing more than 4% to $2.27 trillion today. Can BTC go parabolic this time as fundamental, technical, and macro support bull run?

Altcoins including ETH, SOL, XRP, DOGE, and other leading crypto also witnessed significant recovery on the massive rebound in market sentiment. Crypto Fear and Greed Index rebounded from fear (34) to greed (56) in just a day.

Reasons Why Bitcoin Price Is Going Up Today

Bitcoin bulls strongly targeted the $62,000 level this month. BTC price saw a 5% uptrend in the last 24 hours, with the price almost hitting $65,000. Here are the top 5 reasons why Bitcoin price is rising and may rally to a new all-time high in the coming months.

Sentiment Rebound Following FOMC and Jackson Hole Event

Positive hints of Fed rate cuts from the FOMC Minutes and Fed Chair Jerome Powell speech at the Jackson Hole Symposium were primary factors behind the sudden upsurge in Bitcoin price.

Dovish comments from Fed officials such as Neel Kashkari, Alberto Musalem, Raphael Bostic, and Mary Daly and their affirmation on starting Fed rate cuts earlier this week triggered cautious buying by investors. They also agree on potential rate cuts starting in September.

While Powell didn’t provide exact indications on the timing or extent of rate cuts, he affirmed that it’s time for a monetary policy pivot amid slowing inflation and weakening of the US labor market. He also added that the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

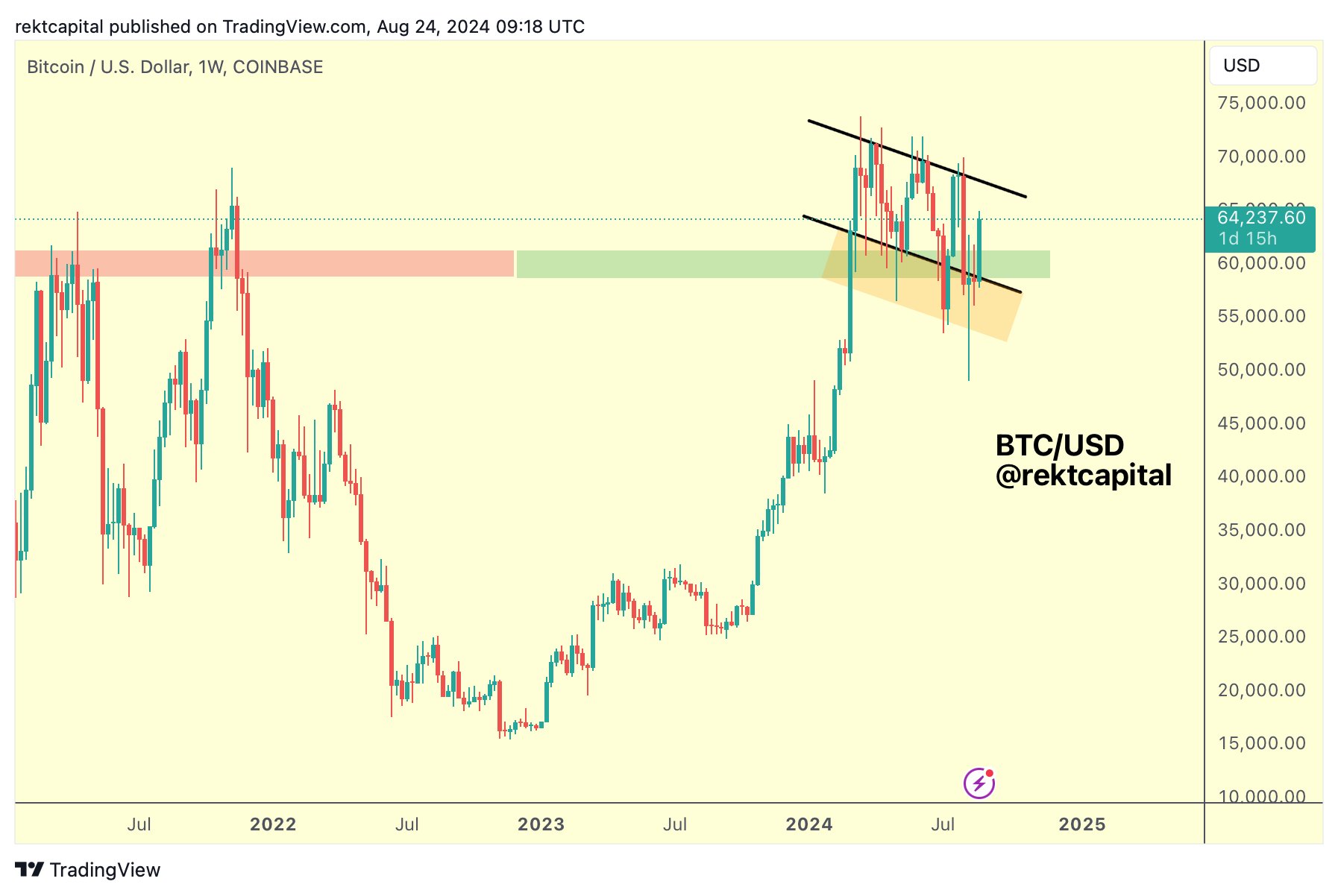

Bitcoin Chart Flashes Technical Strength

Bitcoin chart is showing technical strength and indicators flashing buy signals. Bitcoin price is currently trading above the support at $62K. It is now facing resistance at $65K.

In the daily timeframe, Bitcoin is now trading above 50-DMA (blue), 100-DMA and 200-DMA (red). Traders also expect the ‘Golden Cross’ pattern formation in the coming days as 50-DMA is likely to crossover above 200-DMA, which indicates the possibility of a long-term bull market.

Rekt Capital signaled that BTC been successfully retesting the old all-time high area as new support. He added that this is crucial as Bitcoin typically saw buying from the weekly channel (black), presenting many bargain-buying downside deviations below the pattern (orange).

Bitcoin Options Target $100K By Year-End

BTC price is currently trading above $64,000 now, just 12% away from its all-time high of 73,750. Options traders are extremely bullish on Bitcoin and further upside momentum towards $100k this year.

Deribit data shows BTC options trades are targeting Bitcoin price to hit as high as $100k in December. According to the largest BTC bulk option order on Deribit today, a trader sold 80,000 call option for the end of the year and sold a 120,000 call option for the end of the year.

Meanwhile, 60,477 BTC options with $3.88 billion of notional value is set to expire on August 30. The max pain point is at $61,000, indicating a recovery by the end of the month itself due to beginning of the interest rate cut cycle.

However, US Fed rate cuts are likely to cause volatility in the stock and crypto markets initially, with massive reshuffling of positions similar to other key events historically.

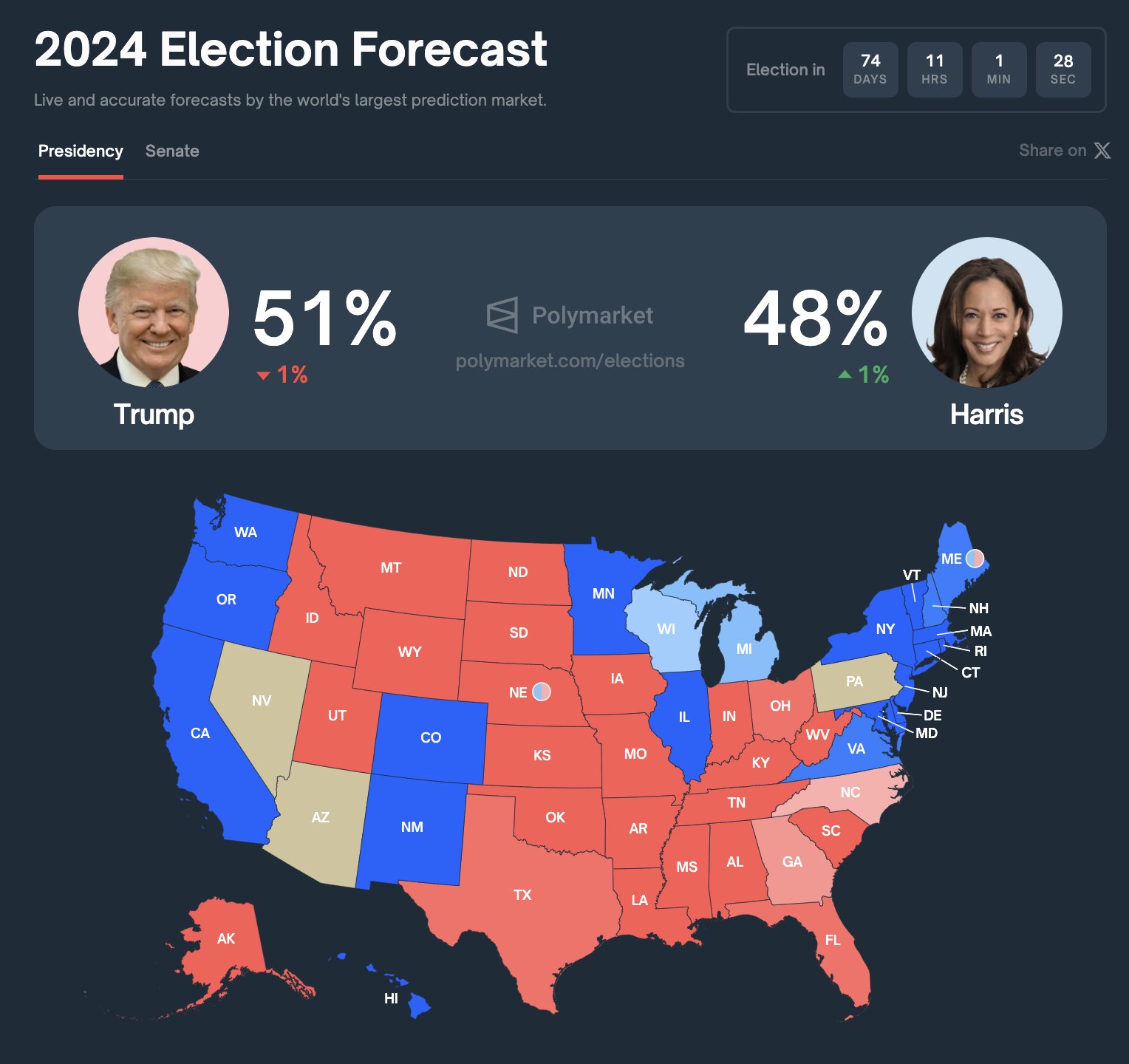

Positive Shift in US Elections Fuels Bitcoin Price

Pro-Bitcoin Robert F Kennedy Jr has officially dropped out of the presidential race. He has now endorsed Republican presidential nominee Donald Trump. This has led to a significant shift in support for Trump, including after he said to offer a top job to Elon Musk after the elections.

Donald Trump now leads Democratic presidential nominee Kamala Harris on Polymarket prediction market. The current data indicates odds of Trump winning the election dropped 1% to 50% and Harris’ odds increased by 1% to 49% after RFK Jr. dropped from the race. The trend is currently in favor of Bitcoin price.

Spot Bitcoin ETF Inflow Support Upside Momentum

Spot Bitcoin ETFs saw $252 million in net inflows on Friday, according to Farside UK data. This brings the weekly total to $506.4 million, with consecutive inflows for seven days. This helped Bitcoin price to hold above $60,000 this week.

The continuous inflow in investment reflects the strong confidence amongst institutional and retail investors in the U.S. The crypto market traders consider Bitcoin ETF flows as leading indicator of market sentiment. BlackRock reported $86.8 million in BTC ETF inflows and Fidelity saw $64 million in its BTC ETF.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise