Why Is Ethereum Price Rising Today?

Highlights

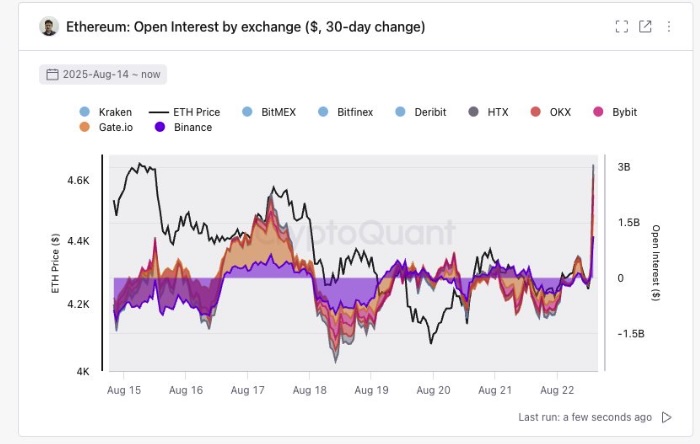

- Ethereum price rally comes with daily trading volume jumping 147% to $81.18 billion and Open Interest increasing by $3 billion.

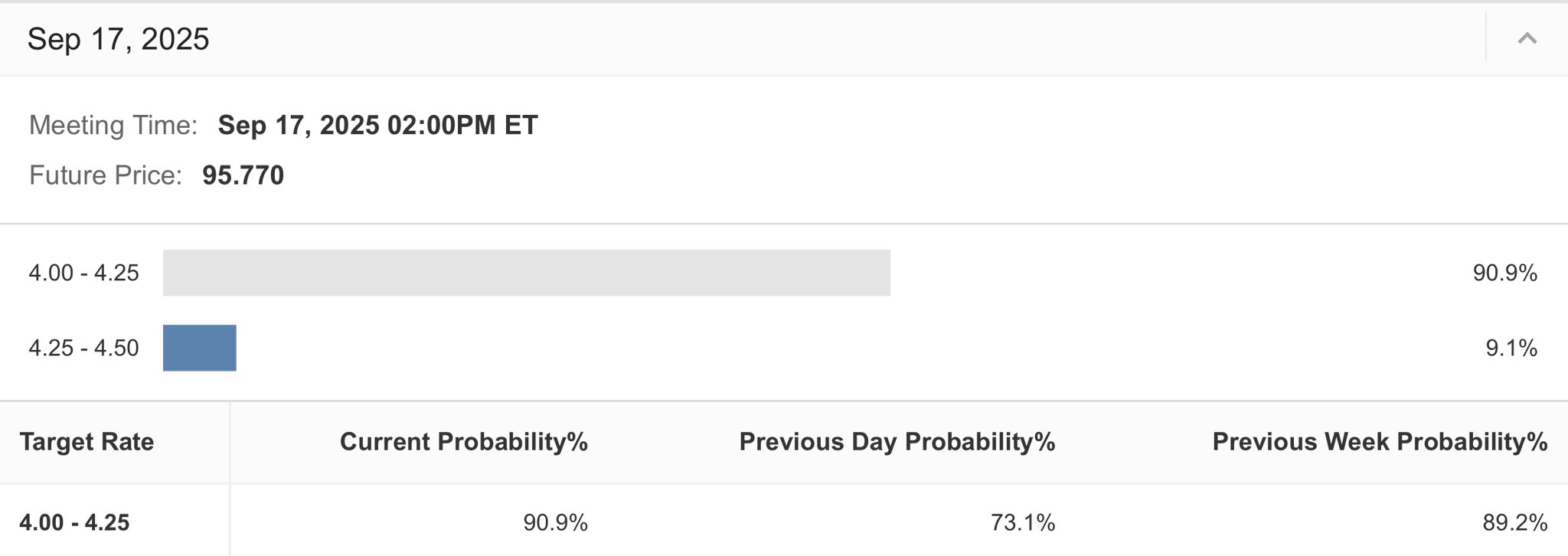

- Powell signaled prioritizing labor market support, pushing Fed rate cut odds to 90%.

- Large inflows from institutional players, treasury firms, and Ether ETFs, serve as catalyst for further upside.

Ethereum price surged by a staggering 12% today, hitting an all-time high at $4,884 earlier today, soon after Fed chair Jerome Powell hinted at interest rate cuts during the September FOMC meeting. As a result, the broader crypto market is showing strength with XRP, Solana (SOL), Dogecoin (DOGE) leading the rally. Soon after Powell’s comments, futures traders are going aggressively long on ETH, highlighting strong bullish sentiment.

Ethereum Price Smashes All-Time High After 1,381 Days

After 1381 days of waiting by investors, Ethereum has finally made a new all-time high on August 22, soon after Jerome Powell signalled a Fed rate cut at the upcoming FOMC meeting in September. ETH’s daily trading volume has surged by 147% to $81.18 billion, hinting at strong bullish sentiment among traders.

Ethereum holders are becoming active again, fueling speculation as large stacks move across the network. Open Interest in ETH is now nearing that of Bitcoin, signaling growing market attention. Within hours of Powell’s speech, the ETH open interest surged by a massive $3 billion, driving the Ethereum price rally.

This heightened volatility has created significant trading opportunities, with ETH currently having the upper hand over BTC. Currently, while Ethereum price is up by 10.8% today, Bitcoin, on the other hand, is up by 2.54% to $115,860 levels. This shows that ETH is dominating the broader crypto market rally.

Fed Rate Cut Chances Shoot 90%, Crypto Market Cheers

Soon after the Powell speech, the odds of a Fed rate cut surged to 90% as per the data from CME Fed Watch Tool. Markets are now pricing in a greater certainty of a 25bps rate cut during the next FOMC meeting on September 17.

A significant shift has occurred between Wednesday’s release of the Fed’s July 30 meeting minutes and today’s statement from Fed Chair Jerome Powell at Jackson Hole. The minutes revealed that “a majority of Fed members see inflation risks outweighing employment risks.” As a result, the crypto market stayed under selling pressure for a while.

However, during the Jackson Hole meeting on Thursday, Powell signaled a change in priorities, emphasizing that the Fed’s primary focus has now shifted toward supporting the labor market.

ETH Institutional Inflows Continue

Inflows into Ethereum from institutional players and whale entities have continued at a good pace. ETH treasury firms like SharpLink Gaming and Bitmine Technologies have adopted fundraising methods like MicroStrategy to boost their ETH accumulation. Their aggressive ETH purchases have helped fuel the Ethereum price rally in the past two weeks.

On the other hand, Ethereum ETF inflows have surged once again, with strong institutional demand. On Friday, the inflows stood at another $337 million, while recovering most of the early week losses.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs