Bitcoin Price Could Hit $92k Based On ‘Trump Trade’

Highlights

- Bitcoin price may rally to $92K after Donald Trump's win, predicts Bitwise Head of Alpha Strategies.

- Trump has taken a remarkable lead over Kamala Harris on Polymarket.

- Bitcoin and stocks have wavered due to a jump in bond yields and the US dollar.

- BTC price trades over $67K.

Crypto-friendly Donald Trump’s win in the 2024 US presidential election may trigger a Bitcoin price rally to $92K, as per ex-Morgan Stanley and Bitwise Invest’s Head of Alpha Strategies. Traders and analysts have also predicted a BTC price hitting $100K. However, experts believe wider priorities may hinder such crypto optimism.

Bitcoin Price Rally to $92K Imminent After Trump’s Win?

The market dynamics and sentiments currently hinged on the outcome of the 2024 United States presidential elections scheduled for Tuesday, November 5. Market experts hold different views on Bitcoin price rally if Donald Trump wins the election.

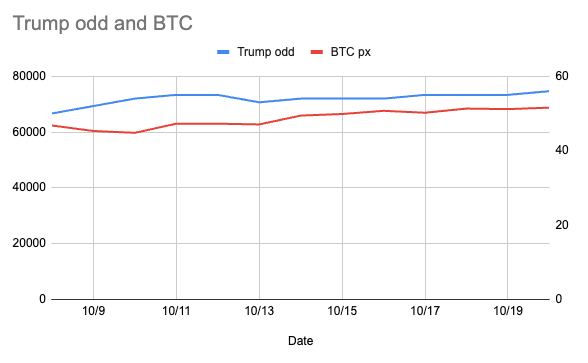

Bitwise Head of Alpha Strategies Jeff Park said Bitcoin price could hit $92,000 on Trump’s victory, based on “applying merger arb-style probability math.” Charting BTC with Donald Trump’s odds indicates “wild swings” despite Kamala Harris and Trump took turns leading on the prediction markets.

Polymarket data shows Trump has taken a remarkable lead over Harris as bets on his win rose. Whereas, the national polls data by FiveThirtyEight indicates that Harris leads with 48.1% against 46.3% for Trump. Elon Musk’s campaigning for Trump in Pennsylvania is believed to have raised Trump’s chances of winning the election.

BTC Rally Cools, Headwinds for Crypto

Bitcoin rally has cooled despite increased chances for Donald Trump to get re-elected as US president. The wider shifts in global markets are attributed in part to Trump’s possible return to the White House. Bitcoin and stocks have wavered due to a jump in bond yields and the US dollar.

“Not good for crypto at the pointy end of the spectrum. Some will point out that financial conditions were loose to start with, but it’s more the speed that the tightening is playing out,” said Tony Sycamore, a market analyst at IG Australia Pty.

Caroline Mauron, co-founder of crypto derivatives liquidity provider Orbit Markets, added that Trump’s win may lead to higher yields and ultimately a “negative impact for risk assets.” However, the win is a more important factor for the crypto market’s long-term gains.

Bitcoin Price Performance This Week

BTC price is again retesting the $68,000 resistance level after crashing below $67,000 two days ago. Investors and whales are buying the dip as the markets await the election outcome.

Analyst Justin Bennett highlighted $68,2000 as the price level the flagship crypto needs to reclaim to confirm that the local bottom is already in. In a recent X post, he also remarked that a daily close above this price level invalidates his prediction that BTC will still correct to $65,800 and $63,200 thereafter.

Meanwhile, spot Bitcoin ETFs continue to record massive inflows daily. On Wednesday, BlackRock’s iShares BTC ETF saw $317.5 million in inflows and the total inflow to 11 Bitcoin ETFs was $192.4 million.

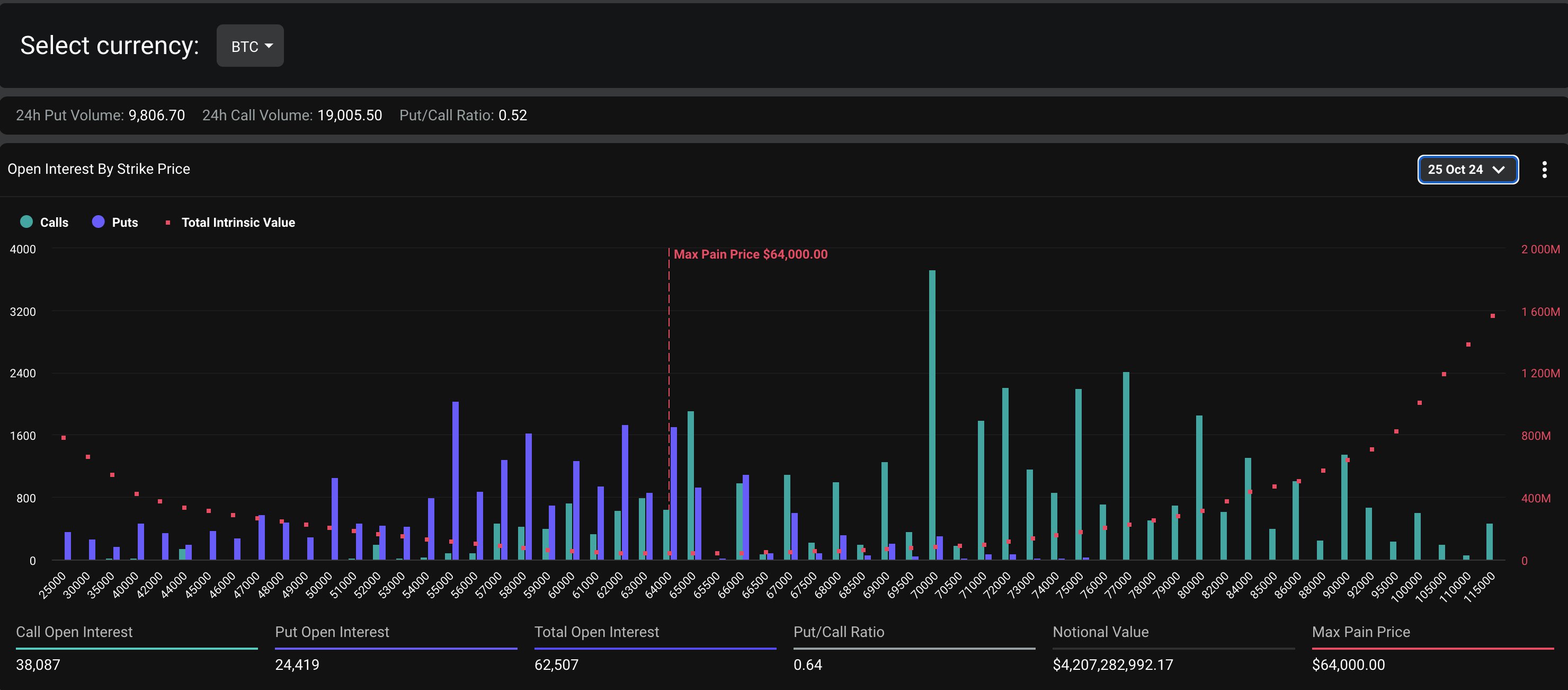

Also, the monthly Bitcoin expiry has caused investors to take a ‘sit back and watch’ approach. Notably, $5.22 billion in BTC and ETH options are set to expire tomorrow on Deribit. BTC options worth $4.21 will expire, with a max pain point of $64,000.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs