Will Bitcoin Reclaim $120K as Options Bulls Target $125K Highs Post-FOMC?

Highlights

- Bitcoin options traders target rally to $120K and even $125K after the FOMC meeting.

- Crypto market awaits the Fed Interest Rate Decision and the FOMC Economic Projection today.

- BTC options data signals bullish sentiment dominating the market.

Bitcoin options traders are bullish about Bitcoin reclaiming $120K after the FOMC meeting, despite the current volatility in markets. The crypto market awaits the Fed Interest Rate Decision and the FOMC Economic Projection release due later today for cues on market direction.

Bitcoin Options Bulls Target $120K Strike Price After FOMC Meeting

Bitcoin options traders are extremely upbeat on a rally after the FOMC meeting. The sentiment is driven by rising 25 bps Fed rate cut expectations after weak jobs data and cooling inflation data. Options bulls are targeting a Bitcoin to hit $120K and even $125K after the FOMC meeting.

Notably, $120K strike price has call bets of notional value worth $200 million for each BTC options expiry in the next three days. Also, options traders target $125K in the bullish case and $115K in the bearish case for a post-FOMC BTC options expiring on Friday.

In the last 24 hours, the 24-hour call volume was significantly higher than the 24-hour put volume. The put-call ratio was 0.68 at the time of writing.

Mixed Crypto Market Expectations

All eyes are on the FED interest rate decision today amid a rise in market sentiment, as evident from continued inflows in spot Bitcoin ETFs. While some expect a Fed rate cut to finally drive Bitcoin above $120K, others see it as a classic “sell the news” event.

Meanwhile, the global investors await the FOMC Economic Projection. Monetary policy easing by the FED will trigger a bullish sentiment in the global equities and crypto markets, fueling further upside in risk assets such as Bitcoin. CME FedWatch Tool shows high odds of three rate cuts by the Federal Reserve.

A surprise Fed cut produced an immediate rally last year, with seasonal cycles, liquidity shifts, and market structure all playing a key role in driving Bitcoin above $100K. 10x Research claims the same dynamics are in play now, with better implications due to larger capital flows and risk assets leaning bullish.

Also, the crypto research firm revealed that traders who were positioned bearishly just days ago are now flipping bullish ahead of the FOMC meeting. “Calls are rich relative to puts, ” said 10x Research analyst Markus Thielen.

Bitcoin On-Chain Data Signals High Bull Sentiment

Bitcoin on-chain data signals sentiment rising amid the FOMC meeting. According to CryptoQuant’s 24-hour Trading Volume and Change, BTC price is locked in a narrow range between $114.6K–$117.1K, with the high/low shifting upward in the last 24 hours. Amid this constructive trend, Bitcoin is holding in the upper third of the range, but without a decisive impulse before the event.

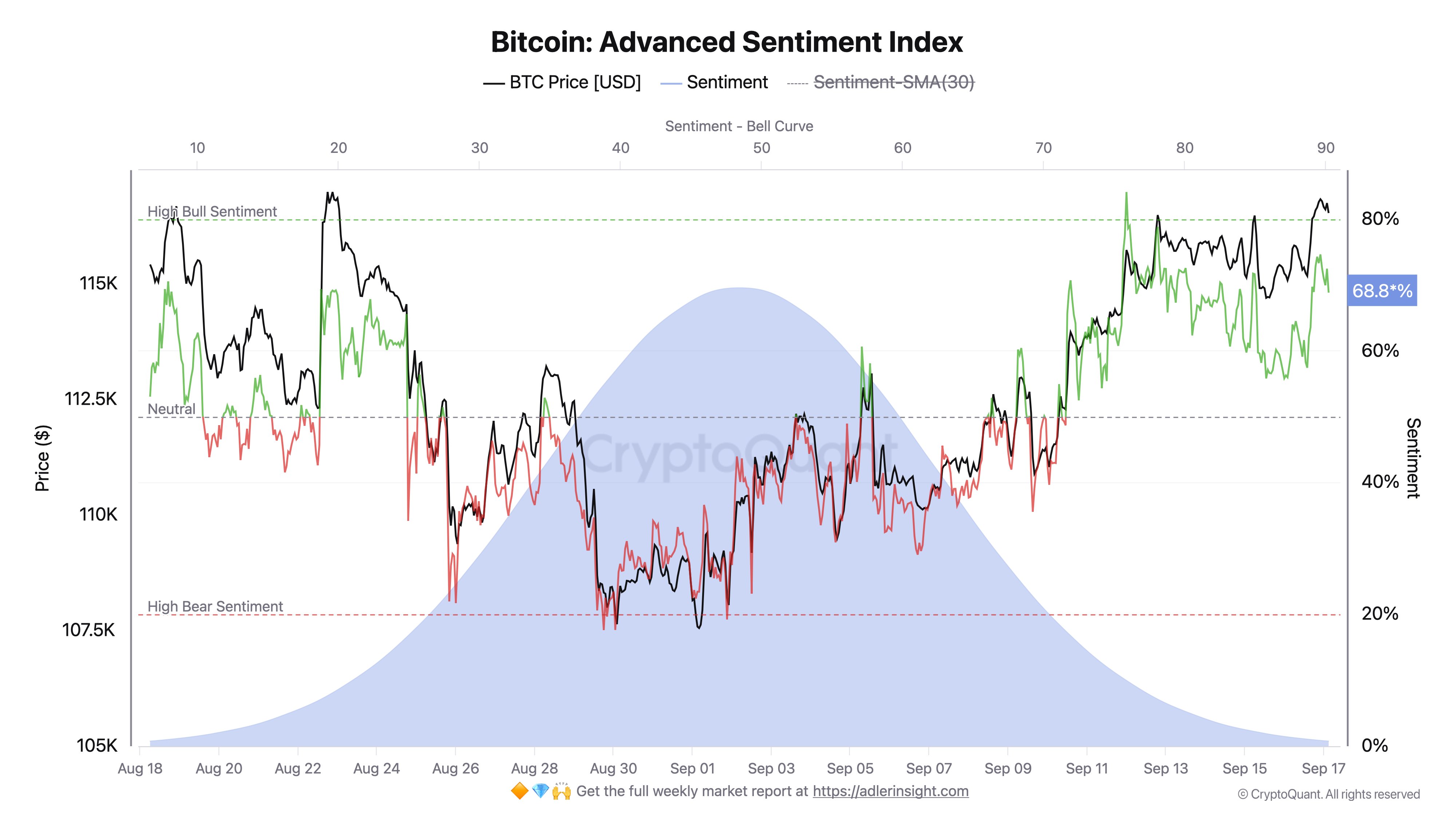

The Bitcoin Advanced Sentiment Index indicates a dominant bullish sentiment in the market, suggesting support for a further breakout in BTC price. Advanced Sentiment at 68.8% approaches the High Bull Sentiment region near 80%. A favorable FOMC outcome could trigger further upside in Bitcoin.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold vs. Bitcoin: Can Gold Outperform BTC Amid US–Iran Conflict?

- Bitcoin Faces $1.8B in Panic Selling as U.S.-Iran Airstrikes Escalate; Will BTC Crash Below $60k?

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs