Will Crypto Market Rebound or Crash Ahead as 10X Research Tips Shorting Ethereum?

Highlights

- Crypto market crash concerns mounts after $1.2 billion in long positions liquidations.

- Investors brace for $16 billion Bitcoin and Ethereum options expiry today.

- 10x Research recommends shorting Ethereum amid structural uncertainty.

- Bitcoin needs to rebound above $112K support for further upside.

Bitcoin, Ethereum, XRP, and other altcoins tumbled amid the latest crypto market crash. Over $1.2 billion in long positions were liquidated across top crypto assets as $200 billion got wiped out from the market cap.

Investors now brace for a BTC and ETH options expiry worth more than $16 billion in notional value. Can the crypto market rebound or crash more after the options expiry?

Crypto Market Braces for $16B Bitcoin and Ethereum Options Expiry

The latest Bitcoin price correction primarily happened as a result of traders and institutions taking profits due to the monthly crypto options expiry on October 31. With derivatives data now crucial amid massive trading volumes on CME, Deribit, and spot Bitcoin and Ethereum ETFs, it becomes a key indicator of crypto market direction.

During this monthly options expiry on Deribit, more than 123K BTC options of notional value $13.52 billion will expire. The put-call ratio of 0.70 and the max pain price at $114K indicate room for upside due to more call options as compared to put options.

In the latest 24 hours, put volume has surpassed call volume, with a put/call ratio of 1.35. This signals hedging downside protection by traders. Also, BTC options traders are betting for a rebound above $112K after the options expiry, according to Deribit’s daily options data.

Meanwhile, massive 642K ETH options with a notional value of almost $2.5 billion are set to expire today. The put-call ratio of 0.68. The put volume has doubled in the last 24 hours, 209K against 104k calls. The put-call ratio of 2 confirms bearish sentiment among options traders.

Also, the max pain point is at $4,100, way above the current market price of $3,836. However, the put open interests are higher at $4,000 and $3,600 strike prices, with traders opening more puts for next options expiries.

10x Research Recommends Selling ETH, Cautious BTC Buying

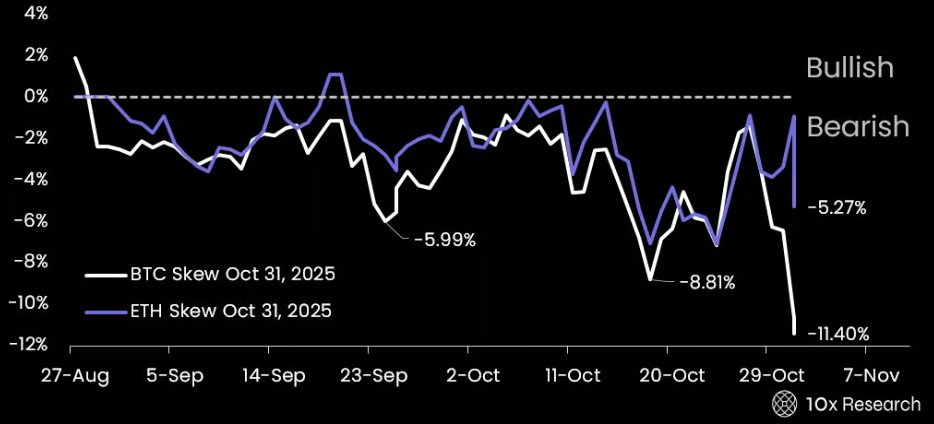

10x Research reveals a spike in BTC’s near-term implied volume while “longer maturities barely moved”, hinting a catalyst for upside. In contrast, ETH’s chart patterns are flashing structural uncertainty and a very different long-term payoff profile.

While options traders hedge BTC, 10x Research analyst Markus Thielen recommends shorting ETH as a smart move. The crypto market crashed as institutional treasuries failed to convince, spot Bitcoin and Ethereum ETFs recorded outflows, and prices fell below the support zone.

The emergence of ETH as a “digital treasury” model became one of the most powerful narratives of this summer. Bitmine’s strategy prompted institutional investors to accumulate ETH and later distribute it to retail buyers at a premium. However, 10x Research claims “something broke along the way and it’s now having a profound impact on Ethereum.”

While the firm remains cautious on Bitcoin, it turned more negative on ETH price setup. Notably, institutional investors are responding to actual flows, not macro liquidity under current crypto market conditions.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs