Will Ethereum Price Rise Or Fall After Shanghai Upgrade? New Data Reveals Answer

The Ethereum Shanghai upgrade is the most-anticipated change on the Ethereum blockchain that will fully transition it to proof-of-stake (PoS). Validators are especially waiting for the upgrade to remove staked Ethereum from the Beacon Chain. Thus, the general sentiment in the market is that the Shanghai upgrade will cause the ETH price to fall deeply.

However, CryptoQuant data indicates low selling pressure even after the Shanghai upgrade. Despite ETH staking withdrawals after the Shanghai upgrade, validators and stakers will continue to stake their ETH.

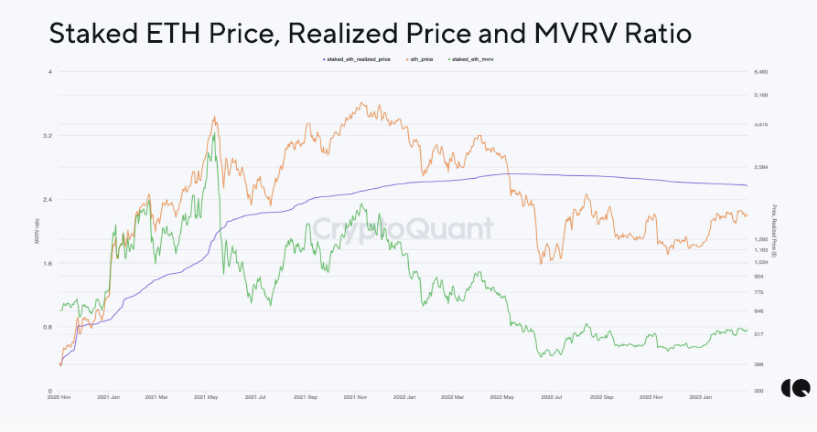

Two reasons supporting low selling pressure — most participants are at a loss and the largest Ethereum staking pool’s depositors are also at a loss.

According to Etherscan data, 17.44 million ETH worth about $28.70 billion have been deposited into Ethereum’s Beacon Deposit Contract, representing nearly 14% of the total supply. These staked ETH remains locked on the chain until the Shanghai mainnet upgrade in March.

Currently, 60% of ETH staked on the Beacon Chain are at a loss, representing 10.3 million ETH. Moreover, the largest Ethereum staking pool Lido accounts for over 30% of all staked ETH, with an average loss of nearly $1,000. Thus, the staked ETH on Lido is at an average loss of 24%.

Generally, an investor sells crypto assets when in profit. Thus, staked ETH participants are currently at a loss and selling pressure will remain low after the Shanghai upgrade. Additionally, the most profitable staked ETH was staked less than a year ago and has not seen significant profit-taking events in the past.

Ethereum Price Shows Upside Momentum

Ethereum price fell nearly 1% in the last 24 hours, with the ETH price currently trading at $1,640. The 24-hour low and high are $1,635 and $1,672, respectively. While the ETH price to remain under pressure due to the fear of a 50 bps rate hike by the U.S. Federal Reserve, a sudden fall is likely impossible.

During the recent Ethereum Shanghai upgrade on the Sepolia testnet, the ETH price remains strong above $1,660.

Also Read: Binance Seeks Crypto Services License In Singapore

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs