Will XRP Crash or Rally as Glassnode Warns Cost Basis Echoes 2022 Patterns?

Highlights

- XRP market structure resembles similar to early 2022, says Glassnode.

- The divergence creates selling pressure on long-term XRP holders and whales.

- Analysts suggest XRP price needs to reclaim $2.05 to avoid risk of dropping to $1.

XRP was unable to sustain its recent rally above $2.35 and looks to move back towards $1.85 after breaking multiple support levels. The price dropping below $2 triggered a major structural shift, as the level serves as a psychological zone for Ripple holders, according to a leading on-chain analytics platform.

Glassnode Reports Similarities Between Current XRP Structure and 2022 Pattern

The current market structure for XRP is similar to that of early 2022, according to Glassnode data. The short-term holder cost basis similarity has sparked speculation about whether the coin will crash or rally ahead.

Investors active in the 1-week to 1-month window are now accumulating XRP at prices below the realized cost basis of the 6-month to 12-month cohort. This divergence creates mounting psychological pressure on holders who entered at higher levels, indicating increased selling pressure if sentiment worsens.

Notably, XRP was trading around $0.80 in February 2022 when 1W-1M realized price dropped below 6M-12M realized price. The broader market downturn triggered an almost 60% crash to lows of nearly $0.30 as Investors and whales exited their XRP positions.

The $2 psychological level has acted as a major XRP support influencing spending behavior, as per Glassnode. Every time the price retested the level, XRP holders have triggered $0.5 billion to $1.2 billion in weekly realized losses.

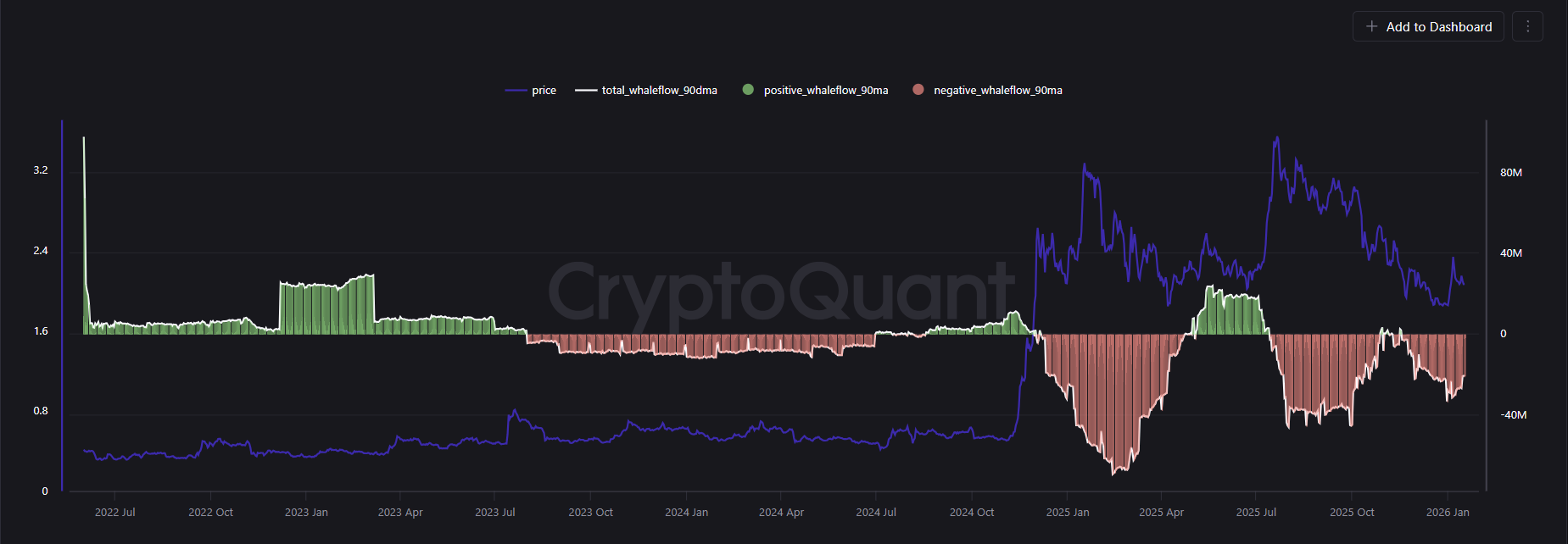

Moreover, the XRP Whale Flow 30-DMA remained in negative territory during the latest rebound in prices. It indicates continued selling pressure amid whale distribution. While selling pressure has eased, outflows still hover around $20 million per day.

Analysts on Potential Price Action

Analyst CrediBULL Crypto pointed out that lower timeframe XRP charts signal buy-the-dip opportunities for going long. However, he suggests keeping risk in check amid current market conditions. All eyes are on US President Donald Trump’s Davos speech, which could set the stage for XRP direction.

Another analyst Dom claimed the recent rally was weak as the orderflow analysis showed no strong buyer support and the push likely happened due to low liquidity.

He pointed out $1.80 as the next key support level. Any more moves down could trigger a breakdown. Bulls need to regain $2.05 for another upside move.

XRP coin saw volatile price action today, dropping more than 1% to $1.89. The intraday low and high are $1.88 and $1.95, respectively. Trading volume has increased by 15% over the past 24 hours, indicating interest among traders.

As CoinGape reported, veteran trader Peter Brandt and other crypto analysts, including Ali Martinez, predicted an XRP crash to $1 if bulls fail to defend the $1.80 level amid continued whale selloffs.

CoinGlass data showed massive selling in derivatives markets. At the time of writing, the total XRP futures open interest tumbled over 2% to $3.35 billion in the last 24 hours. The futures OI on CME and Binance plunged almost 2% and 3%, respectively, signaling bearish sentiment among derivatives traders.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs