BREAKING: WisdomTree Withdraws its XRP ETF Filing Despite Strong Inflows

Highlights

- WisdomTree files with the U.S. SEC to withdraw its XRP ETF application.

- WisdomTree has determined not to proceed at this time likely due to intense competition.

- XRP ETFs continues inflows streak, with $19.12 million in latest net inflows.

In surprising XRP news today, asset manager WisdomTree has decided to withdraw its XRP ETF application with the U.S. SEC. This comes despite continued inflows into listed XRP exchange-traded funds (ETFs), with total inflows reaching over $1.25 billion in a few weeks.

WisdomTree Exits XRP ETF Race Amid

WisdomTree Digital Commodity Services, sponsor of the WisdomTree XRP Fund trust, has requested to withdraw its registration statement on Form S-1, according to an RW filing with the U.S. SEC dated January 6.

“Pursuant to Rule 477 of Regulation C under the Securities Act of 1933, as amended (the “Securities Act”), WisdomTree XRP Fund hereby requests that the Securities and Exchange Commission consent to the withdrawal of the Trust’s Registration Statement on Form S-1,” as per the filing.

WisdomTree has decided to withdraw its registration, stating “it has determined not to proceed at this time.” WisdomTree XRP ETF also requested the withdrawal of all exhibits and amendments since the original filing on December 2, 2024.

The filings aimed at the investment objective of offering investors exposure to Ripple’s native coin XRP. However, no shares were sold under the registration.

This withdrawal happens as the broader crypto ETF market grows more competitive, with many issuers competing in altcoin products. Despite this, WisdomTree has decided to withdraw from the race.

Strong XRP Exchange Traded Funds Inflows

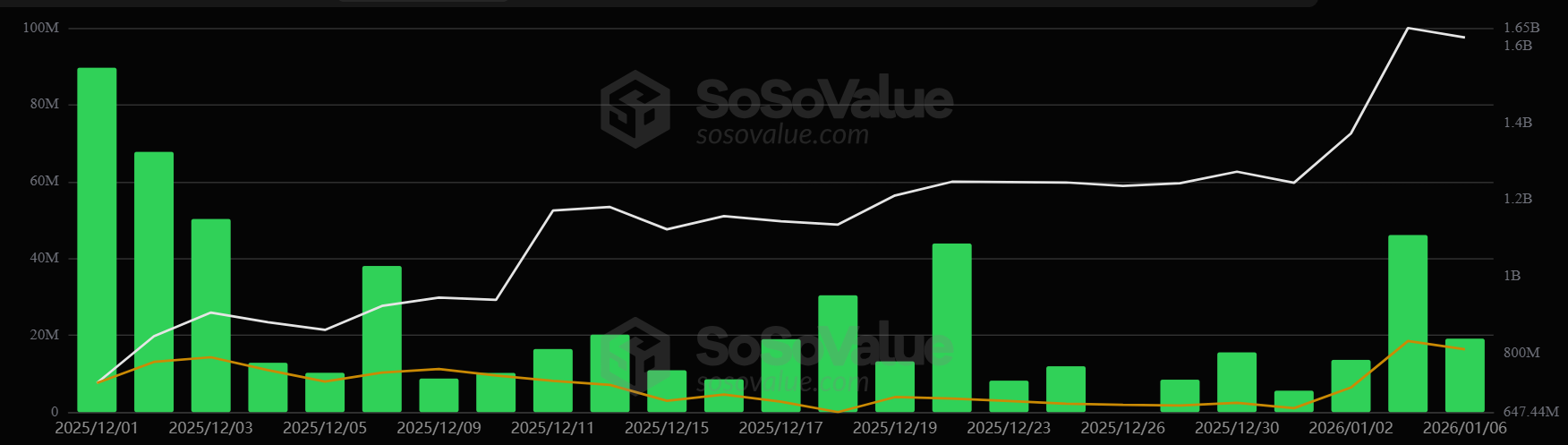

XRP ETFs started 2026 with strong interest from institutional and retail investors, bringing in significant capital in the first days of the year. U.S.-based spot XRP ETFs have recorded over $1.25 billion in total inflows, according to SoSoValue data.

On Tuesday, spot XRP ETFs saw $19.12 million in net inflows, extending the inflow streak amid recent higher trading volumes. Franklin’s XRPZ led with $7.35 million in inflows, followed by $6.49 million and $3.54 million in inflows to Canary’s XRPC and Bitwise’s XRP, respectively.

Strong inflows have pushed total net assets toward $1.62 billion. This sustained surge highlights XRP coin’s relative strength amid institutional demand, boosting sentiment for further upside.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise