XDC Hits Weekly High Amid US Treasury Token Offering Debut

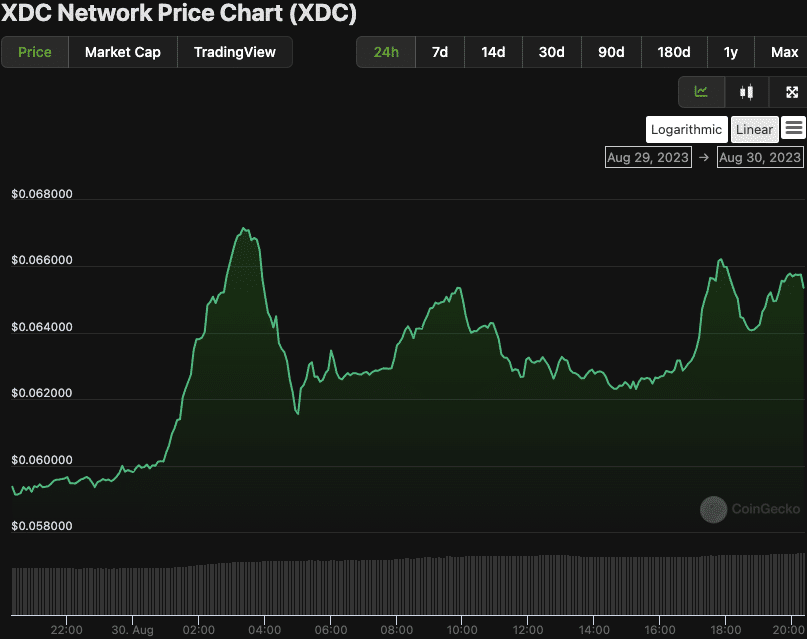

Since Tradeteq’s tokenized US Treasury offering debuted on Tuesday’s layer 1 blockchain XDC Network, positive momentum has been dominant. As a result, the XDC price increased from an intra-day low of $0.05929 in the previous 24 hours to a 7-day high of $0.06659 before encountering resistance.

This price increase may be attributed to increased interest, demand for tokenized US Treasury offerings, and the market’s positive outlook. If the $0.06659 resistance level is broken, the next resistance level for the XDC price might be around $0.07000. However, a pullback or consolidation period may occur before the price resumes its upward rally.

XDC/USD 1-day price chart (source: CoinGecko)

During the bull run, XDC’s market capitalization and 24-hour trading volume increased by 8.48% and 30.47%, respectively, to $895,110,754 and $14,775,539. This increase shows a significant flood of investors and trading activity in XDC, further supporting its rising trend.

XDC Technical Analysis

The Bollinger bands on the 4-hour price chart are broadening and rising higher, indicating the possibility of more volatility and upward movement in XDC’s price. The upper and lower Bollinger band intersections at $0.06850202 and $0.04627758, respectively, evidence the bullish trend.

With the price action near the upper band, XDC is currently trading at a relatively high level and may experience a temporary pullback or consolidation before potentially continuing its upward trend.

Furthermore, with a reading of 57.22, the stochastic RSI is moving below its signal line and drifting south, indicating a likely decline in purchasing pressure. This pattern lends credence to a possible price drop for XDC, as investors may take profits and wait for a better entry time.

Additionally, the Relative Strength Index at 68.14, XDC is approaching overbought territory, indicating that the current uptrend is losing steam, and a correction may be coming. If the RSI remains above 70, it will reinforce the overbought situation and raise the chances of a market reversal.

While XDC’s positive momentum is evident, caution is advised as indicators suggest a potential pullback due to profit-taking and overbought signals.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- $2T Barclays Explores Blockchain to Tap Into Stablecoin and Tokenization Boom

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs