XRP Lawsuit: Lawyer Predicts Ripple SEC Case Conclusion Timeline Amid Gensler’s Exit

Highlights

- Pro-XRP lawyer Jeremy Hogan predicts potential conclusion timeline for the XRP lawsuit.

- The US SEC Chair Gary Gensler's exit announcement has sparked crypto market optimism.

- Top market experts anticipate Gensler's exit to boost XRP's value significantly in the coming days.

XRP lawsuit: The exit announcement of the US SEC chair Gary Gensler has boosted the broader crypto market sentiment, sparking hopes over a new pro-crypto regulator to replace him. Amid this, pro-XRP lawyer Jeremy Hogan has predicted the conclusion timeline for the Ripple SEC lawsuit, sparking discussions in the market. Besides, a flurry of market watchers also anticipates the crypto-related SEC cases to settle or conclude with Gensler’s exit.

Lawyer Predicts Potential XRP Lawsuit Conclusion Timeline

The US SEC has recently announced that the Chair Gary Gensler is set to exit the office in January 2025. This development has sparked widespread discussion in the financial market, let alone the crypto market. Notably, the market participants deem Gensler as an anti-crypto regulator, who has so far hindered innovation and growth in the digital assets space.

Having said that, a flurry of market watchers anticipates the ongoing SEC lawsuits to conclude or settle with the new Chair replacing Gensler. Amid this, pro-XRP lawyer Jeremy Hogan has fueled market discussions with his prediction regarding the XRP lawsuit conclusion timeline.

Recently, Hogan has shared Gensler’s January 20, 2025 exit update on X, lauding the development. Commenting on that, one user asked how long it might take for the Ripple SEC case to drop or settle amid the SEC Chair’s exit. Replying to that, the lawyer said that the Ripple Vs. SEC lawsuit could conclude in 2025 spring or in the early summer. He stated:

I still think we are looking at spring next year – maybe early summer.

This comment has sparked discussions in the crypto market, especially as the investors keep close track of the high-profile case. Notably, the Ripple SEC lawsuit is one of the longest-running crypto cases, which has recently been extended with the US SEC’s move in the appellate court.

Ripple’s Native Crypto Eyes Rally Amid Several Good News

In a recent X post, a pro-XRP lawyer highlights “good news for XRP”, gaining the attention of the market participants. He has highlighted the latest launch of the WisdomTree Physical XRP ETP on Börse Xetra, SIX Swiss Exchange, and Euronext Paris and Amsterdam.

Notably, this development has once again ignited discussions over a potential XRP ETF launch in the US. Notably, big US firms like Bitwise and Canary Capital have already filed for XRP ETF with the US SEC, awaiting approval. In addition, Jeremy Hogan recently said that the investment instrument could note its US launch in the next six to twelve months, sparking market optimism amid the XRP lawsuit discussions.

Fueling the sentiment, another renowned lawyer John Deaton said that XRP market cap is poised to hit $100 billion soon, with the latest shift in the US administration. Besides, the recent rally in Bitcoin has also bolstered market sentiment, hinting that the top altcoins might also follow suit.

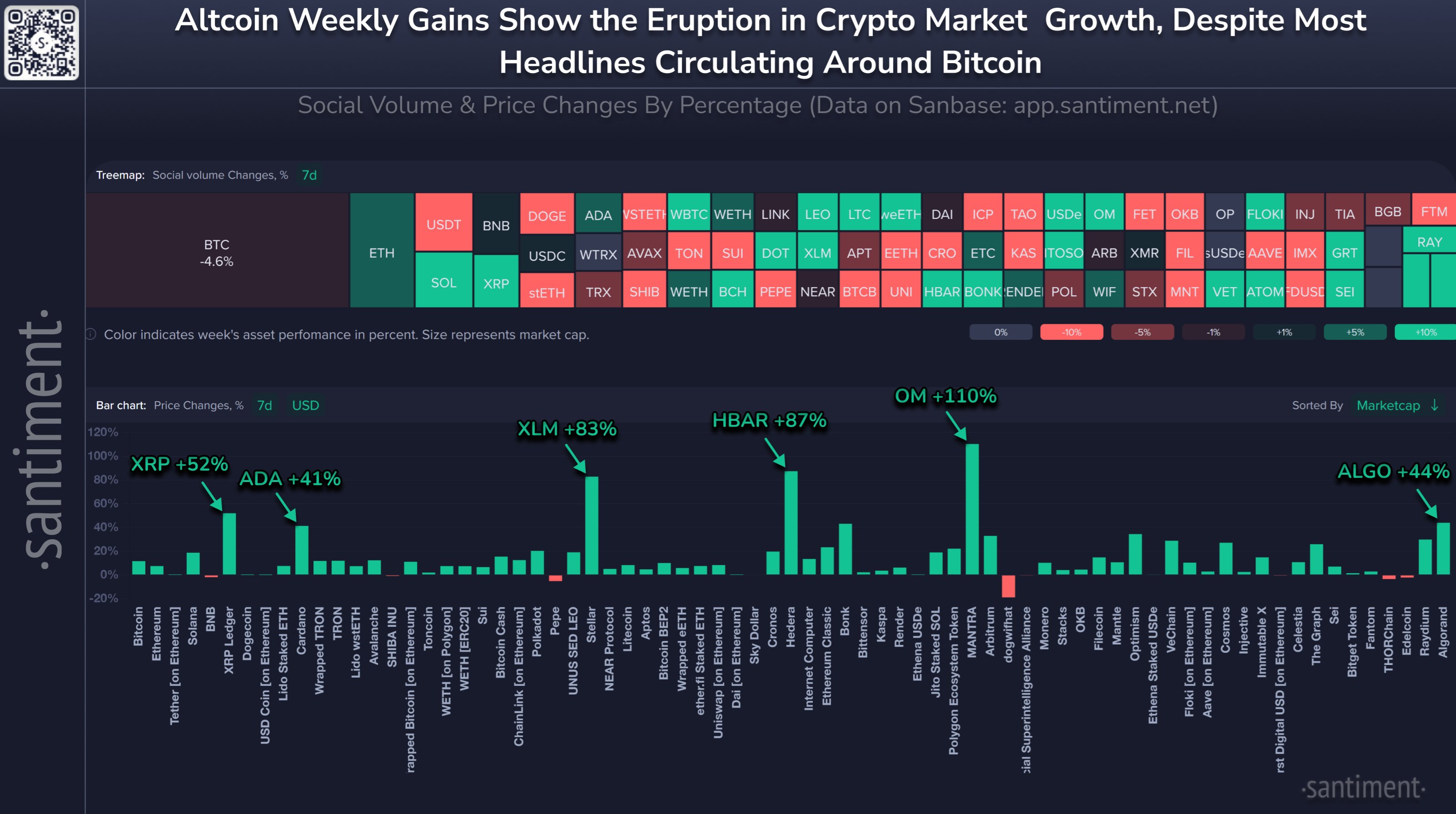

For context, a recent Santiment report highlights Bitcoin’s recent run towards the north. In addition, it noted that altcoins like XRP, Cardano, Stellar, Hedera, and other crypto might also continue to get support with the BTC’s recent surge.

What’s Next For XRP?

XRP price today recorded a massive surge, adding nearly 27% during the writing, and exchanged hands at $1.43. Its trading volume rocketed 235% to $22.29 billion, highlighting the increased trading activity in the market. Besides, CoinGlass data showed that XRP Future Open Interest rose more than 31%, indicating the growing market confidence towards the crypto. The recent comments from the lawyer on the XRP lawsuit conclusion timeline appear to have bolstered market sentiment.

Amid this, top crypto market analyst CrediBULL Crypto highlighted the soaring XRP monthly RSI, as it enters the “overbought” territory for the first time in 3 years. The analyst noted that this indicates a super bullish momentum for the crypto. Besides, the analyst has set a target of $2 in the coming days for Ripple’s native crypto, while predicting the crypto hit $3.3 in the long run.

In addition, another prominent market expert Ali Martinez has also shared a similar forecast on X recently. Martinez lauds Gary Gensler’s exit from the US SEC, saying that it is the “best thing that could happen to Ripple.” In addition, the analyst has also set a target of $2 for XRP price, sparking market optimism.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs