XRP Lawyer Reveals Regulatory Advantage Amid Ether ETF Approval

Prominent XRP advocate John E Deaton emphasizes the significance of regulatory clarity, as Ethereum (ETH) stands to benefit from recent developments. Amidst reports of potential approval for Ethereum futures Exchange-Traded Funds (ETFs) by securities regulators, the cryptocurrency market holds its breath for the next move.

A Potential Ether ETF Approval

The momentum for regulatory clarity gained traction after Bloomberg’s announcement that U.S. Securities regulators are on the brink of greenlighting ETH futures ETFs for trading. Several firms vying to list these exchange-traded funds are awaiting the U.S. Securities and Exchange Commission’s (SEC) nod. This potential green signal, as per Bloomberg, could be imminent. In recent times, Ethereum’s price has demonstrated a level of stability akin to Bitcoin, a trend often foreshadowing upcoming price shifts.

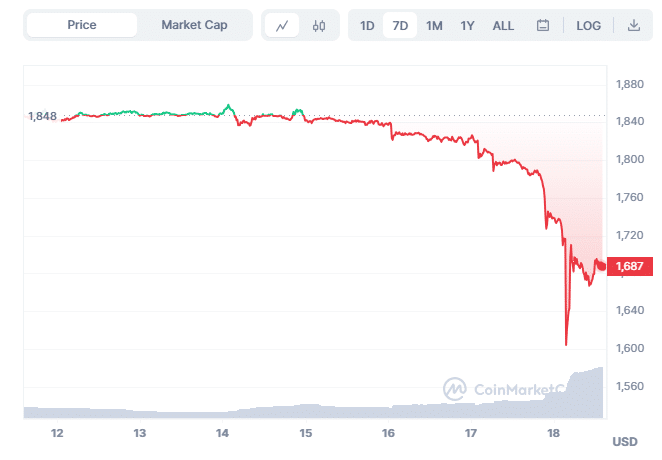

However, the recent market volatility resulted in Ethereum’s price plummeting after breaching the critical $1,800 support zone. As bearish momentum pushed it below the $1,720 and even $1,600 thresholds, the cryptocurrency is now trading at $1,683.96, which is well above the recovery wave marked at the $1,600 level. The coin is down by more than 8% in the last 24 hours.

Amid this price turmoil, major players like BlockTower Capital reacted by depositing 5,000 Ethereum (ETH), valued at over $8 million, onto Coinbase. Similarly, opportunistic investors snapped up the discounted ETH, acquiring tokens worth more than $9 million collectively, Santiment reported.

Also Read: XRP Price Bloodbath Hits 20% to $0.42, Deal or Trap?

More ETFs On The Line

Shifting the focus to the broader regulatory landscape, Grayscale Investments LLC, a prominent U.S. crypto asset manager, awaits the SEC’s decision regarding its application to transform its Bitcoin trust into an ETF. Augmenting this anticipation, Grayscale has indicated its readiness to expand its ETF team, contingent on the SEC’s verdict.

Furthermore, Valkyrie Investments entered the scene by filing for an Ethereum futures ETF, with nearly all of the fund’s assets earmarked for exchange-traded Ethereum futures. A small portion is set aside for collateral investments like cash, cash-like instruments, or high-quality securities.

Also Read: Crypto Price Today: Pepe Coin, XRP, And SEI, All Continues Track On Red Lines

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs