XRP News: Ripple Whales Buy 520M Coins Signaling Strong Recovery Ahead

Highlights

- A top crypto expert showed that Ripple whales have bagged 520 million coins amid the recent dip.

- Another data showed that XRP recorded strong inflow through the week, outpacing Solana.

- XRP price dipped 6% today but technical indicators signal a strong recovery ahead.

The Ripple whales are making headlines in the latest XRP news column with their heavy buying. According to recent data, the whales have bagged more than 500 million tokens amid the recent price dip, indicating a hovering bullish momentum in the market. In addition, separate data showed that despite the ongoing gloomy trading, Ripple’s native crypto has noted a significant inflow since the start of the week.

XRP News: Ripple Whales Bag 520M Coins

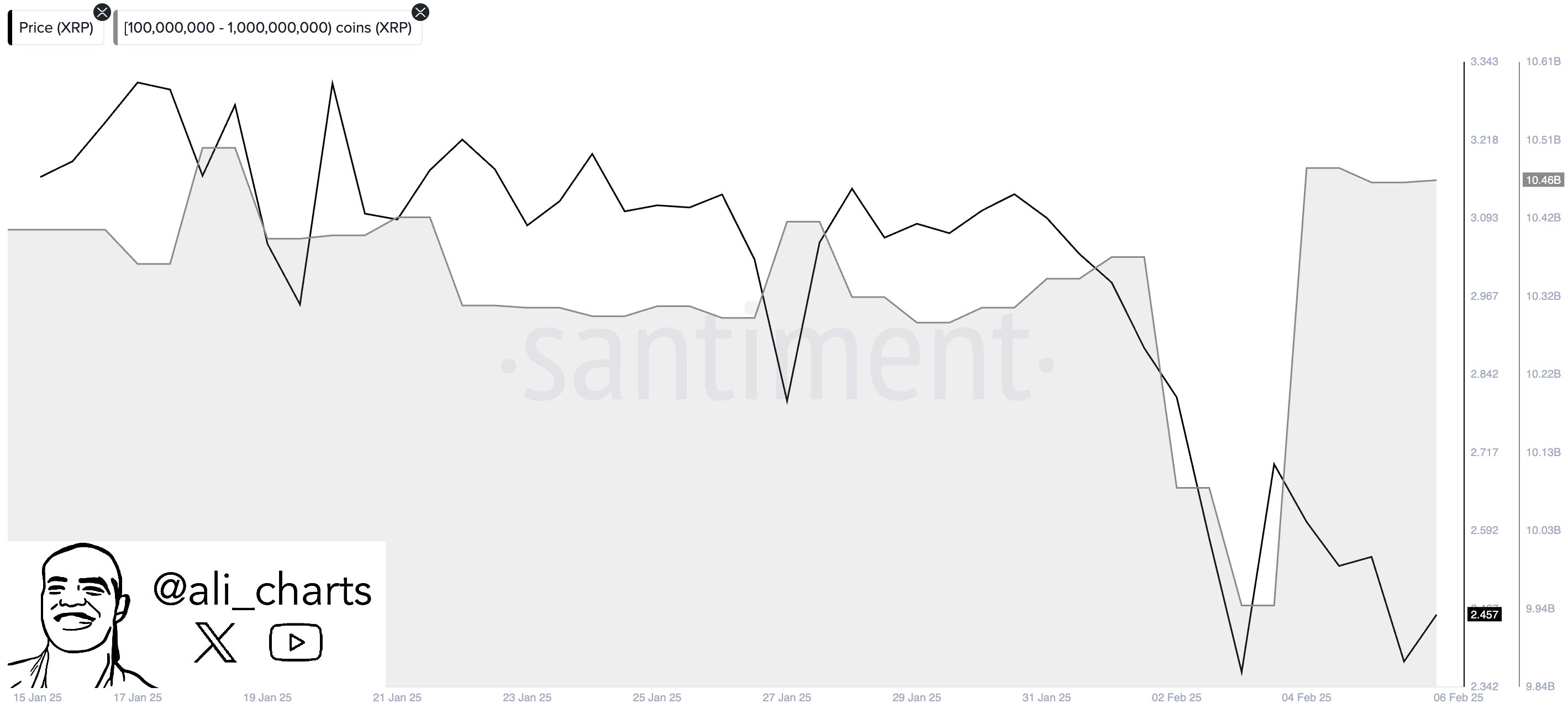

In the latest XRP news, Ripple whales have stolen the spotlight recently with their latest moves. Notably, large investors or whales are actively putting their bets on the coin amid the recent price decline, indicating renewed confidence in traders.

Prominent crypto market analyst Ali Martinez has recently highlighted the whale buying trend. According to Martinez, “whales seized the opportunity during the recent dip,” accumulating 520 million coins. This trend, if continues, could help in a strong recovery for the coin.

XRP Maintains Fund Flow Through The Week

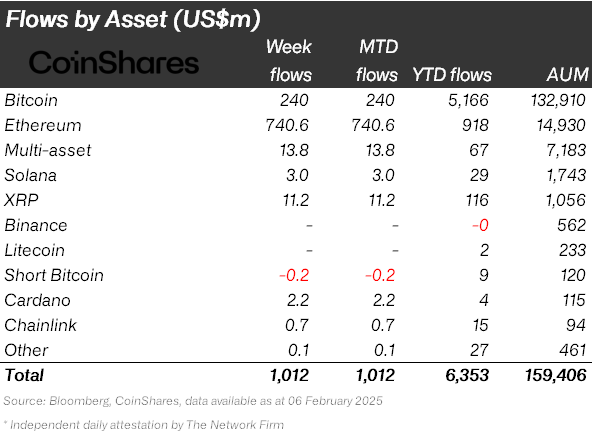

CoinShares Head of Research James Butterfill recently shared the weekly flow data for the top cryptocurrencies. Although he highlighted strong inflow into Ethereum despite the ongoing dip, it appears that XRP also remained among the top coins to record influx.

The data showed that despite the ongoing volatility, Bitcoin recorded an inflow of $240 million and Ethereum recorded an influx of $740.6 million through February 6. On the other hand, Ripple’s native crypto recorded an influx of $11.2 million, outpacing Solana’s inflow of $3 million. Notably, on a YTD basis as well, Ripple’s native crypto recorded an inflow of $116 million, compared to SOL’s $29 million influx.

What’s Next For Ripple’s Native Crypto?

XRP price today continued its run towards the south witnessing a 1/5% decline to $2.41, while its trading volume soared 8% to $7.96 billion. However, the Relative Strength Index (RSI) of the coin stayed at 32, indicating an oversold condition for the crypto. In other words, the RSI signals a potential breakout ahead for the crypto.

Meanwhile, another positive XRP news has further fueled market optimism recently. For context, CBOE has submitted 19b-4 filings to launch ETF for Ripple’s native crypto with the US SEC recently. Notably, the filing was made on behalf of 21 Shares, Bitwise, WisdomTree, and Canary Capital.

In addition, a lawyer has recently revealed a potential timeline of when the US SEC can start dropping the crypto cases. This has also sparked speculations over a potential dismissal or settlement in the Ripple Vs SEC case in 2025, which can further boost the asset’s price ahead.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise