XRP News: Will Robinhood List XRP & XRP Ledger Tokens Post Bitstamp’s Acquisition

Highlights

- Robinhood acquiring crypto exchange Bitstamp and Ripple also owns stake in Bitstamp.

- Robinhood now has tech infrastructure to list XRPL issued tokens.

- The acquisition also raised speculation of Robinhood listing XRP.

- XRP price continue to move sideways near $0.50 with no interest from traders.

XRP News: Commission-free investing firm Robinhood Markets to acquire crypto exchange Bitstamp for $200 million, expanding its push to grow extremely quickly outside the United States. Bitstamp will help Robinhood in this aspect, as it is one of the largest and most popular crypto exchanges in Europe and Asia. However, XRP community calls for XRP listing by Robinhood as the platform to gain tech infrastructure to list XRP Ledger tokens.

Robinhood said it will bring trusted and reputable institutional business to the company. The acquisition is expected to be completed in the first half of 2025, subject to conditions and regulatory approval.

Robinhood To Work With Ripple?

Ripple acquired a stake in crypto exchange Bitstamp from Pantera last year, shocking the industry as it also acquired crypto custody firm Metaco for $250 million. Ripple president Monica Long said the company’s stake acquisition in Bitstamp is a major move to help grow its global presence and go beyond payments.

Robinhood’s acquisition of Bitstamp brings back reminiscence of Ripple’s acquisition of an undisclosed amount of shares in the crypto exchange, said the crypto community. It sparked speculation of Robinhood and Ripple working together on many aspects including listing XRP on Robinhood.

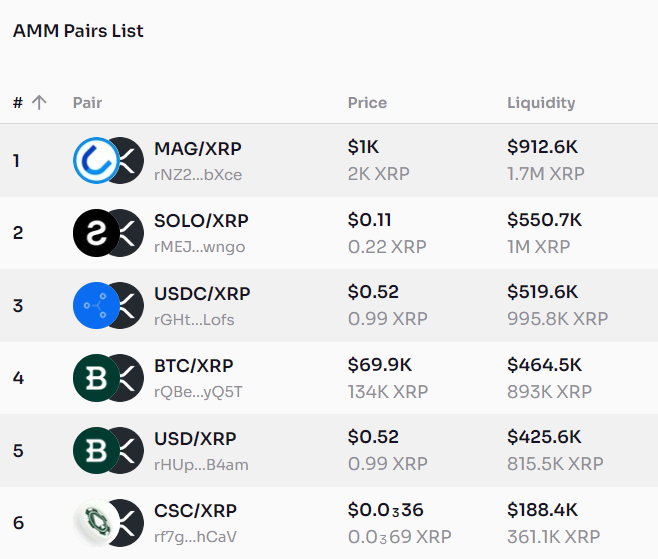

Bitstamp already has several stablecoins already issued on the XRP Ledger. This makes Robinhood indirectly have the tech infrastructure to list XRP Ledger-issued tokens. Tokens are used for cross-currency payments and can be traded in the decentralized exchange.

Also Read: Ripple Vs SEC – Lawyer Says XRP Lawsuit Going To Appeals Court, What’s Next?

XRP Price Action Remains Bearish

Ripple CEO Brad Garlinghouse and president Monica Long are confident about an XRP ETF and stablecoin, highlighting XRP as one of the crypto with regulatory clarity.

XRP price saw pullback in the last 24 hours, with the price currently trading below $0.50. The 24-hour low and high are $0.493 and $0.504, respectively. Furthermore, the trading volume has decreased slightly in the last 24 hours. The derivatives market remained muted in the last few hours, with total XRP futures open interest down over 0.40%.

XRP army currently awaits a final judgment ruling by Judge Torres in the remedies phase, setting the stage and direction for a verdict in the Ripple vs SEC lawsuit. It will also influence XRP price significantly.

Also Read:

- Why Nvidia Share Price Rally Boosted Odds of Bitcoin Price Hitting $100K?

- Cardano, Shiba Inu, Jasmy Grabs Interest Of Big Whales, Trigger Buy Signal

- PEPE & SHIB Prices To Rally? Massive Buying Hints More Gains Ahead

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise