XRP Open Interest Climbs as VivoPower Launches Treasury Expansion via Mining Swap

Highlights

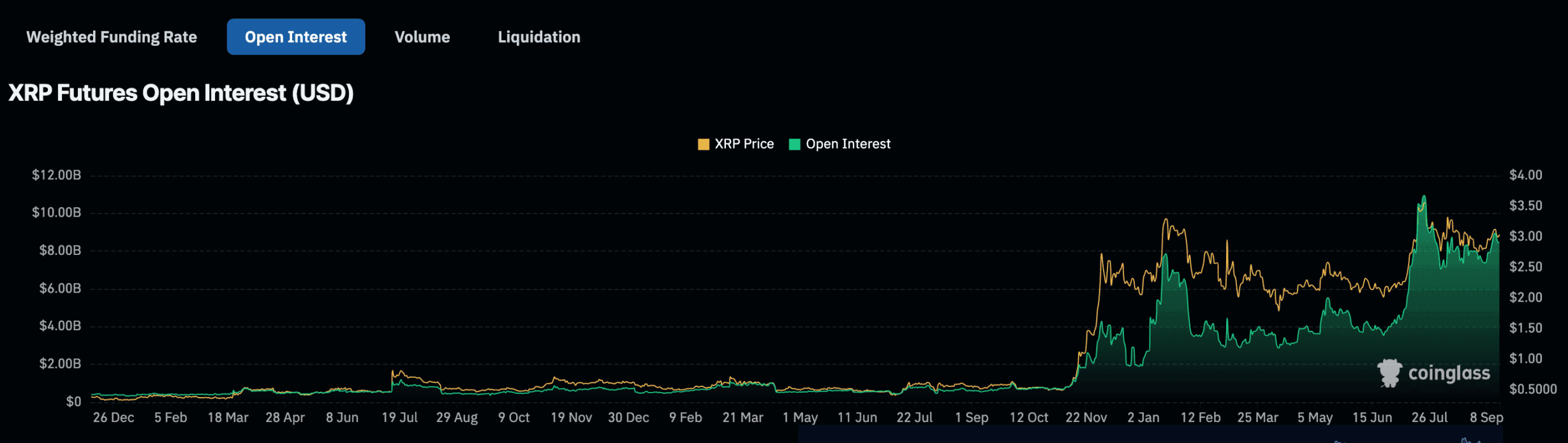

- XRP open interest rebounds to $8.45B after a 30% drop in August, signaling renewed speculative activity.

- VivoPower to expand XRP treasury by swapping mined assets from Caret Digital directly into XRP.

- VivoPower’s multi-pronged strategy positions it as a leading corporate holder of XRP, boosting institutional demand.

XRP open interest has shown a recovery in futures open interest after its decline last month. This comes as VivoPower announces plans to expand its holdings by swapping its mined tokens for the altcoin.

VivoPower Expands Treasury as XRP Open Interest Rises

In a recent press release, VivoPower International has confirmed plans to scale its proof-of-work mining unit, Caret Digital, securing bulk discounts on additional rigs. Crucially, mined assets will be swapped directly into XRP. This reinforces the company’s strategy of accumulating the token at a favorable cost basis. As part of its broader digital asset strategy, VivoPower is also exploring opportunities in cloud mining, which allows companies to access mining power without owning physical hardware. This approach could complement its mining swap initiatives and enhance flexibility in managing crypto exposure.

This comes after VivoPower announced XRP treasury plans in May. The firm became one of the first publicly traded companies to do this. The firm raised $121 million for its entry and has since pledged to dynamically manage allocations between direct purchases, mining swaps, and equity exposure.

In light of this new institutional activity, the token has gained traction as its open interest surges from recent lows.

The token’s derivatives regain momentum after a sharp decline in August, where open interest slipped 30% to $7.7 billion. According to Coinglass data, the open interest rose to $8.45 billion. This suggests a renewed wave of speculative activity after last month’s liquidation-driven downturn.

The rebound suggests traders are anticipating volatility, even as the token’s price stays below its recent high of $3.66. Rising open interest is often seen as a sign of growing conviction. This also suggests that the token may regain bullish momentum.

VivoPower Builds on Earlier Treasury Moves

This plan builds on the firm’s previous moves to establish a leading position in the treasury companies holding the altcoin. For instance, last month, VivoPower unveiled plans to buy Ripple shares worth $100 million. The equity acquisition would effectively give the firm a discounted cost of just $0.47 per token.

The company has also begun partnering with blockchain firms to unlock yield on its growing treasury. Earlier this month, the firm announced a $30 million pilot program with Doppler Finance. This would deploy XRP into structured yield strategies designed for institutional investors. That deal could scale up to $200 million depending on performance.

In another major step, VivoPower secured a Flare Networks partnership, deploying $100 million worth of XRP onto the layer-1 chain. The collaboration aims to use Flare’s decentralized finance protocols to generate revenue streams. This could expand the utility of its treasury beyond passive holding.

The company’s multi-pronged approach suggests the firm could become a major treasury firm holding the token. This could also potentially drive more demand at both institutional and retail levels for the token.

Meanwhile, the recovery in open interest suggests traders are equally optimistic. The token could see fresh momentum both on-chain and in financial markets as corporate initiatives resume.

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- Ripple CEO Hints Crypto Bill Is Near Deal, Sets April as Approval Timeline

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling