XRP Price Bloodbath Hits 20% to $0.42, Deal or Trap?

XRP has left a bloody mess as crypto markets reacted to alleged reports of Elon Musk’s SpaceX liquidating its $377 million position in Bitcoin. On top of this, the crypto market did not sit well with the Federal Open Market Committee (FOMC) minutes, which pointed to further interest rate hikes to curb inflation.

“U.S. interest rates are rising to multi-year highs. The 10-year yield has pushed to 15-year highs. This is bearish risk assets in general,” Decentral Park Capital trader Lewis Harland said in a comment to CoinDesk. “If this sell-off in bonds continues we could see continued negative price action in risk assets into the weekend.”

XRP Back on the Drawing Board

The rumors of Tesla dumping $377 million worth of BTC first appeared in the Wall Street Journal (WSJ), sending shockwaves across the crypto market. XRP, whose market structure was already in a dilapidated state following the correction from July highs of $0.93, quickly became the biggest victim of the selling pressure and plunged to $0.42.

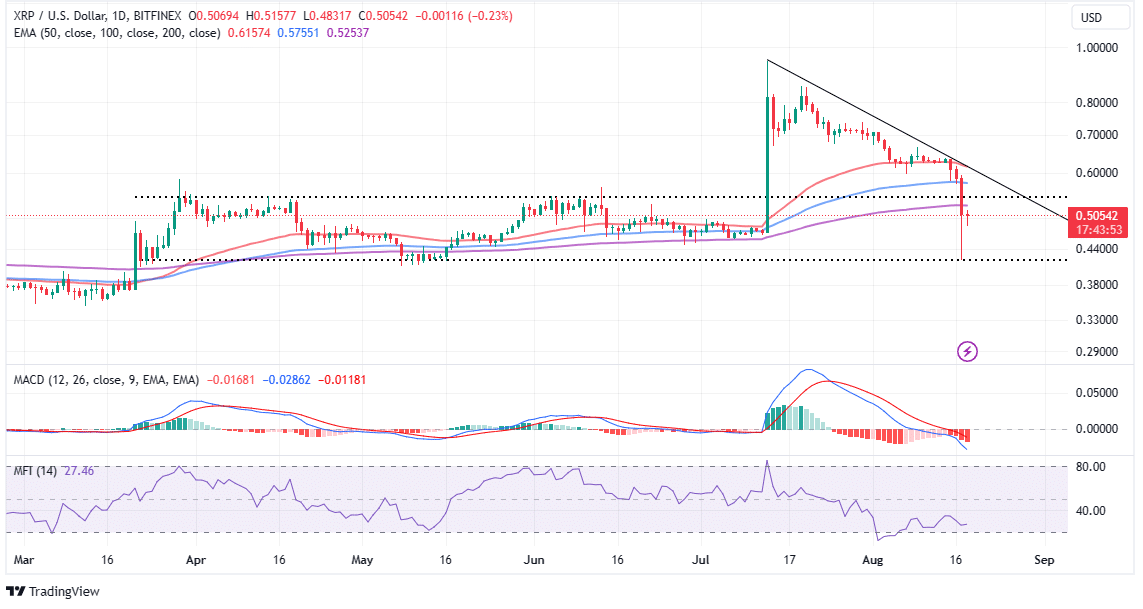

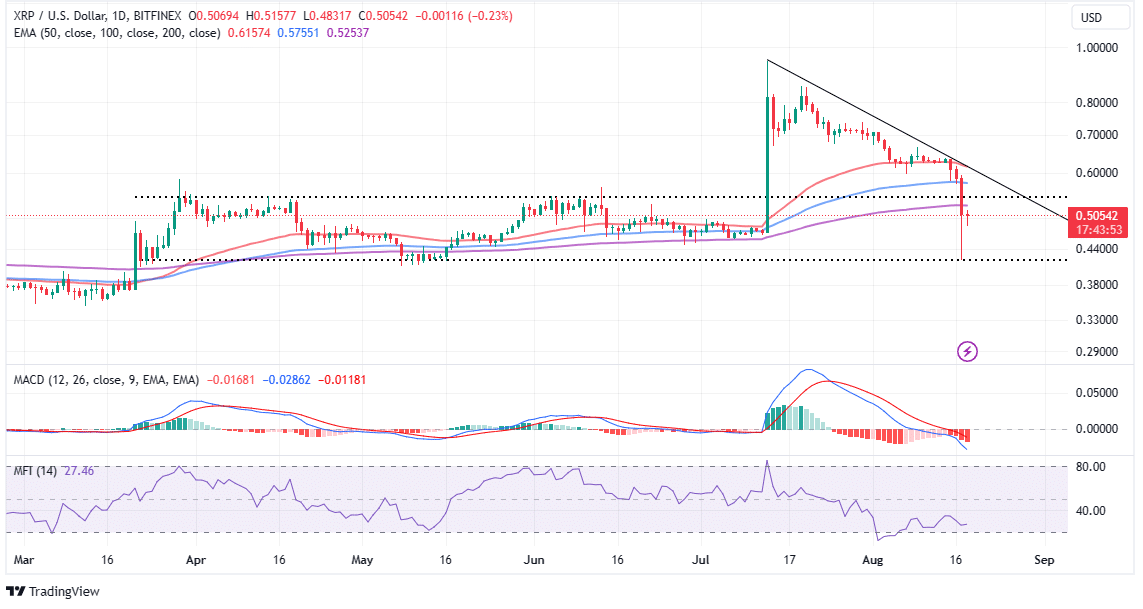

The path with the least resistance holds to the south bolstered by increased short positions with attributes to negative sentiment. A sell signal from the Moving Average Convergence Divergence (MACD) manifested with the MACD line in blue crossing below the signal line in red.

A net negative flow of funds into XRP markets has also contributed to the selling pressure. Based on the Money Flow Index (MFI), the outflow volume of funds from XRP markets is currently in full force, which further dampens all attempts to resume the uptrend to $1.

Trading below all the major moving averages, starting with the 50-day EMA (red), the 100-day EMA (blue), and the 200-day EMA (purple), implies that bears have intensified their grip and are likely to push for more losses below the support at $0.42.

Court Permits SEC’s Appeal Request

Investors in XRP may also have overacted to the request by the Securities and Exchange Commission (SEC) to appeal part of the ruling in the lawsuit against Ripple. The interlocutory motion wants the court to rethink its ruling that programmatic sales of XRP on third-party platforms are not securities, unlike direct sales to institutions.

Judge Analisa Torres granted the SEC’s request and has given the agency an August 18 deadline to file the appeal motion. Ripple has until September 1 to file its opposing motion but with the possibility of an extension to September 8.

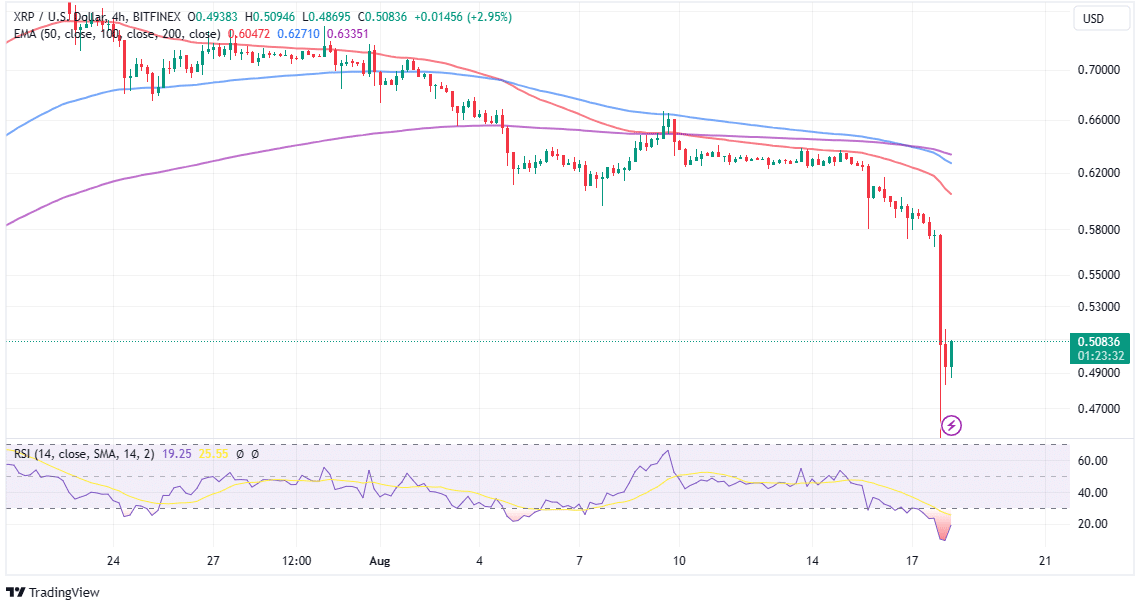

Considering the Relative Strength Index (RSI) is extremely oversold, a recovery might ensue anytime from now. The four-hour chart shows the RSI at 18.26 after climbing from the sub-10.00 level.

Traders willing to bet on new long positions in XRP may want to wait until the price deals with the first hurdle at $0.51, which would validate a rebound, targeting highs at $0.62. The uptrend would be validated with the RSI crossing above the signal line in yellow.

Related Articles

- Breaking: Shibarium Restarts Block Production, SHIB And BONE Rebounds

- Crypto Price Today: Pepe Coin, XRP, And SEI, All Continues Track On Red Lines

- Coinbase-backed Crypto Mixer Tornado Cash Loses Lawsuit Over US Sanctions

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- Breaking: Michael Saylor’s Strategy Makes 100th Bitcoin Purchase, Buys 592 BTC as Market Struggles

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?