XRP Price Could Drop Below $2 as Market Sentiment Dips to “Anxiety” Stage

Highlights

- XRP price could tumble amid a drop in sentiment from "denial" to "anxiety" phase.

- Analyst predicts a fall below $2, with $1.91 and $1.73 as key support levels.

- Trader interest drops after the death cross formation after a recent crypto market crash.

A bearish technical chart pattern formation could begin to take effect, triggering a drop in XRP price below $2. Amid the extreme fear sentiment in the crypto market, long-term holders and whales have shifted to the anxiety phase, according to an analyst.

Key Indicator Signals Dip in Long-Term Holders’ Sentiment from “Denial” to “Anxiety” Phase

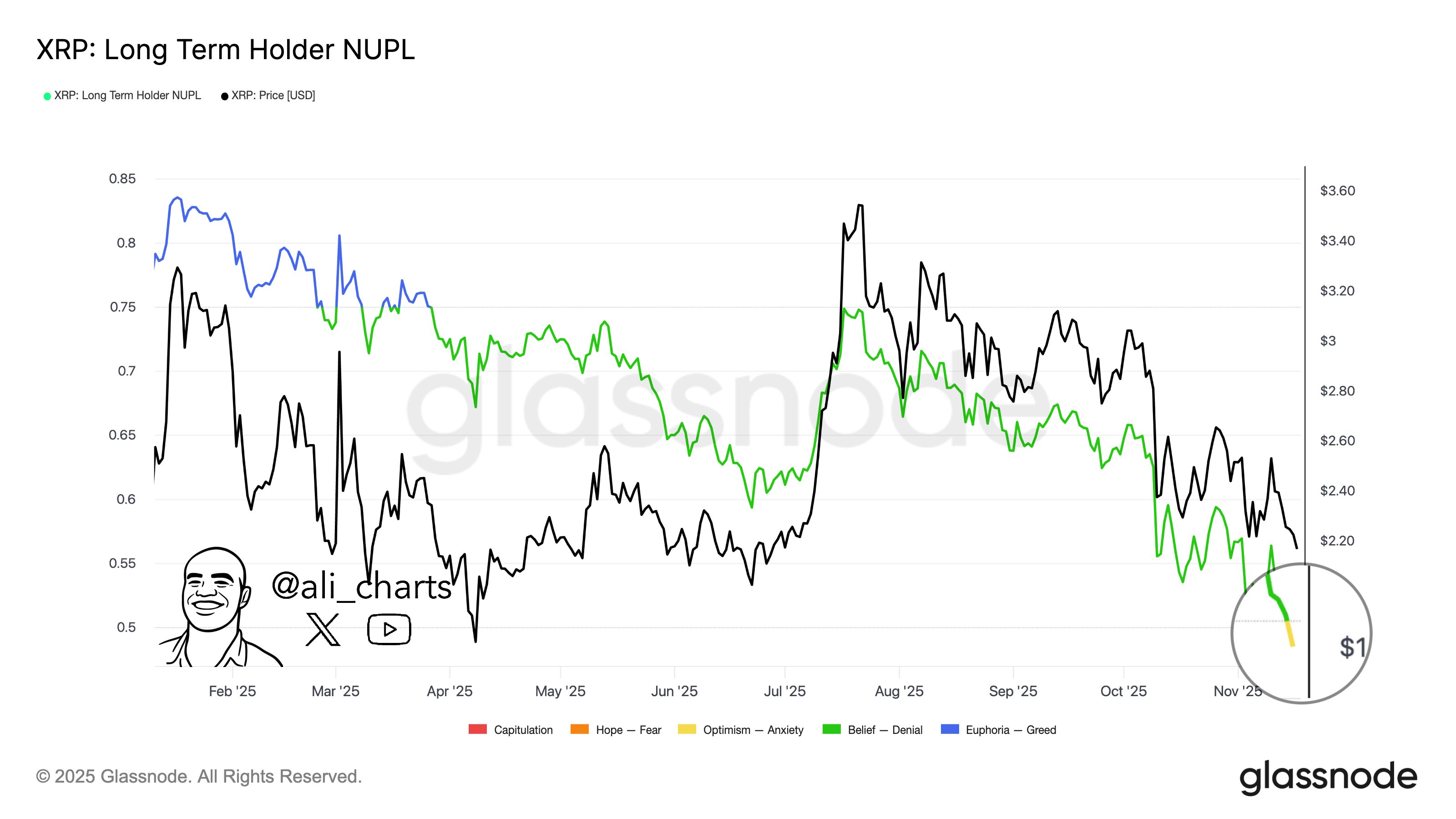

Glassnode’s XRP Long Term Holder NUPL data indicates that investors are leaning bearish amid heightened uncertainty and volatility in the crypto market.

XRP Long Term Holder NUPL shows “euphoria” in long-term holders ended in mid-2025 itself, which followed massive selloffs by whales. The sentiment has now dropped from “denial” to “anxiety” during the recent crypto market crash.

Meanwhile, on-chain platform Santiment revealed that retail investors holding less than 100 XRP are dumping. It is a sign of a potential rebound during bull markets, but the current crypto market sentiment is bearish.

Notably, XRP supply in profit has dropped to 58.5%, the lowest since November last year when the price was at $0.53. Additionally, 41.5% of the supply sits at a loss despite four times higher trading volumes.

Analyst Predicts XRP Price Fall Below $2

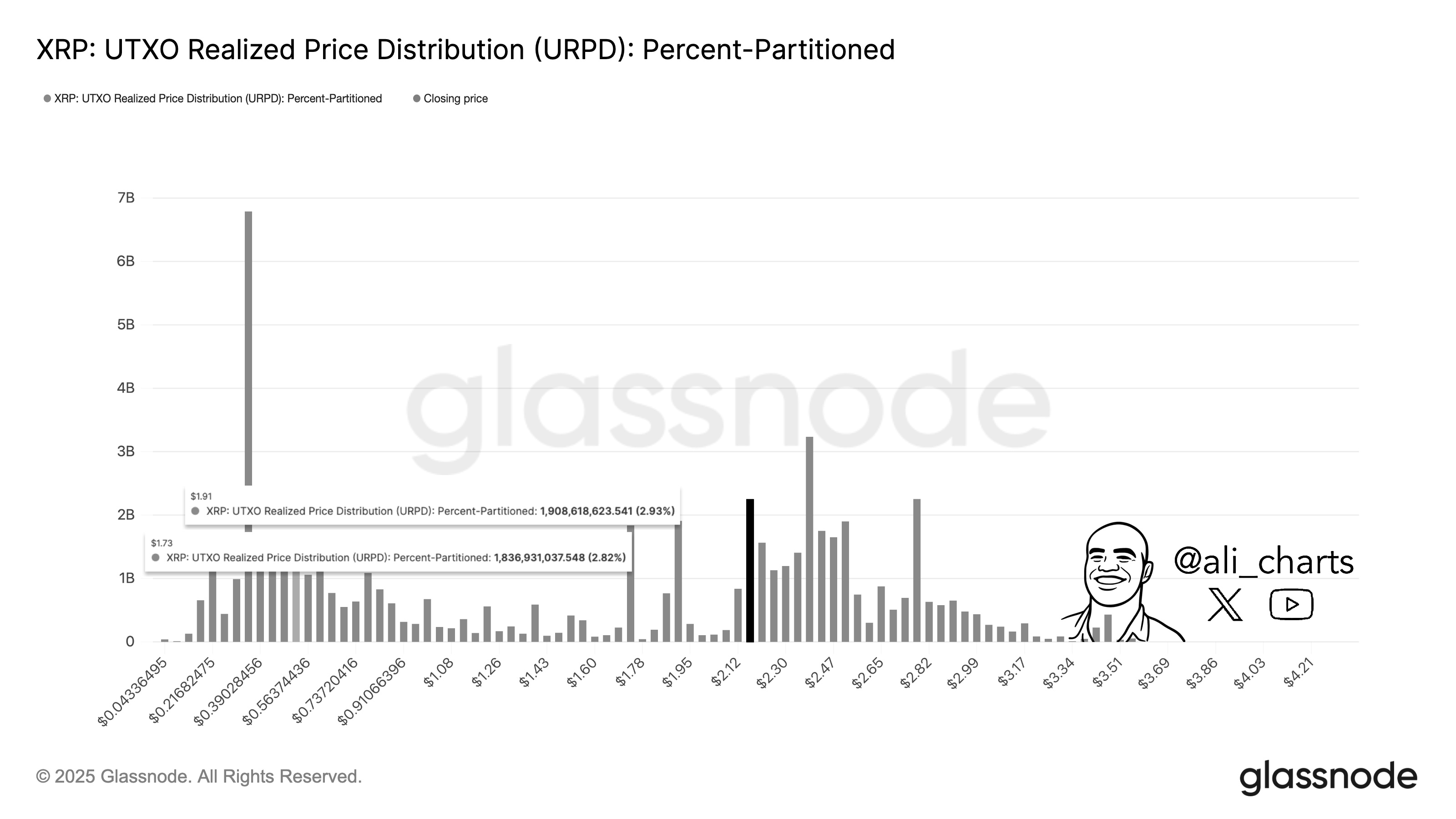

With bulls failing to hold XRP price above key support levels, crypto analyst Ali Martinez predicts a drop below $2 if the Ripple coin drops below $2.15 support.

He shared the UTXO Realized Price Distribution metric that revealed $1.91 and $1.73 are the next key levels to watch in case of further distributions.

At present, crypto traders are closely awaiting key events, including Nvidia earnings, FOMC minutes release, and Nonfarm payroll jobs data, for clues on market direction in the coming weeks. If XRP bulls hold $2.15 level this week, a move to $2.40-$2.70 becomes more likely.

Meanwhile, crypto analyst CasiTrades predicted that XRP could decline further from its current level, noting that the macro structure points to $2.03. She also raised the possibility of a drop below $2, with the altcoin falling to the macro target at $1.65, which is the .618 fib level.

🚨 XRP’s Macro Structure Still Points Directly to $2.03! 🚨

XRP is still likely making its way down toward the macro .5 fib support at $2.03, and the way price is moving fits that expectation. This move was never going to be a straight drop. Wave 2’s are corrective! The… pic.twitter.com/EnKgZg4JfU

— CasiTrades 🔥 (@CasiTrades) November 18, 2025

XRP Price Action Slows After Death Cross

XRP price fell 1.7% over the past 24 hours, currently trading at $2.14. The 24-hour low and high are $2.13 and $2.24, respectively. Furthermore, trading volume plunged 35% over the last 24 hours, indicating a decline in interest among traders.

At the time of writing, the price is below the 50-DMA, 100-DMA, and 200-DMA. Also, the formation of a death cross pattern last week triggered a 15% drop in XRP price. Additionally, the relative strength index (RSI) has dropped to 38.44, indicating weakness.

The derivatives market shows mixed sentiment in the last few hours, as per CoinGlass data. Total XRP futures open interest dropped more than 1.50% to $3.77 billion in the last 24 hours. However, 4-hour XRP futures open interest climbed 0.75%, rising 0.07% on CME and 2.40% on Binance.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs