XRP Whale Moves $95M Ahead Of Trump Inauguration, Rally To $4 Imminent?

Highlights

- XRP surges over 560% since Nov 2024, breaking $3 mark for first time in 7 years, market cap exceeds $180B.

- XRP poised for breakout to $4 after bullish flag pattern; analysts set long-term target at $15.

- 30M XRP moved from Upbit to unknown wallet; potential market impact as ETF approval looms.

A substantial transfer of 30,000,000 XRP, worth approximately $95.5 million, was recorded on January 19, 2025. This transaction was made from the South Korean exchange Upbit to an unidentified wallet, raising speculation about potential market activity. Analysts predict that XRP may experience a significant price surge, with a potential breakout to $4.

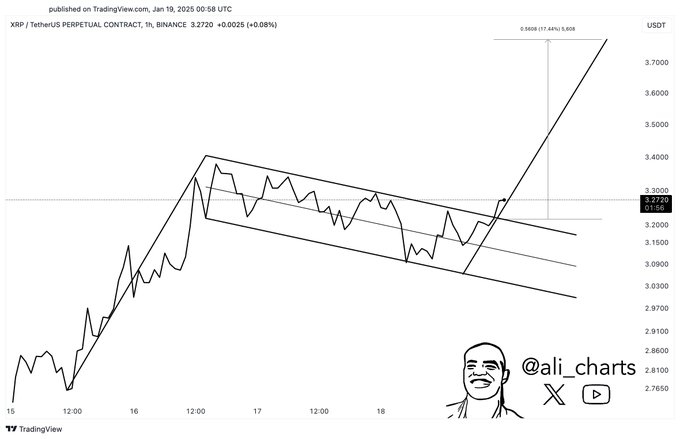

XRP Price Breaks Out of Bullish Chart Patterns

Crypto analysts are closely monitoring XRP’s price movements, citing a bullish flag pattern as a possible indicator of further gains. This chart pattern, characterized by a sharp upward movement (flagpole) followed by a consolidation period (flag), suggests the continuation of XRP’s upward trajectory.

According to Ali Martinez, a market analyst, the price of XRP has broken out from this bullish flag and may rise to $4. XRP broke the $3 mark for the first time since 2018, peaks at $3.40, then dropped to $3.16.

According to analysts, if XRP continues to trade above $3.40 and breaks through this level again, it could signal that the expected increase has begun. On the flip side, a drop below the $2.91 level may open the way for testing the $2.59 support level.

Symmetrical Triangle Breakout Signals Long-Term Growth

On a larger scale, analysts are pointing to the fact that XRP price is trading out of a symmetrical triangle that has been in place for years. This pattern started right after the XRP reached its ATH of $3.80 in December 2017, which is a bullish pattern.

As per Martinez, the long-awaited breakout was initiated by XRP’s recent rally from November 2024, indicating that the price may rise even more. He has set a price target of $15 that is five times of the current price and this could be the long term target. According to Martinez, the fact that XRP broke the $3 mark for the first time in seven years supports the idea that it should keep rising.

Nonetheless, this positive outlook has attracted criticism. Some skeptics like the crypto commentator Tribal Trader has questioned the possibility of hitting $15 citing the market cap bar. At $15 per coin, XRP’s market capitalization would be over $860 billion, more than double that of Ethereum right now. Martinez retaliated that with a market capitalization of $180 billion, XRP already has a market capitalization greater than the financial behemoth, BlackRock.

Optimism Builds as XRP ETF Approval Looms

XRP investors’ confidence has been boosted further by the possibility of the U.S. approving XRP exchange-traded funds (ETFs). This optimism comes after Ripple emerging victorious in a lawsuit against the U.S. Securities and Exchange Commission (SEC) in 2024.

Even though the SEC has moved to appeal the decision, experts are positive that with a crypto-friendly chairman expected to join the SEC soon, Ripple will find better luck. If the regulatory climate becomes more favorable for cryptocurrencies, then it could also mean the approval of XRP ETFs, which could in turn push the price even higher.

Transaction volumes for XRP have been on the rise in the past few weeks, which is a sign of interest from investors. The cryptocurrency has appreciated by more than 560% since November 2024 and the market capitalization has more than doubled in this time. Market analysts are keen on the $3.40 price level as a crucial marker of whether XRP will break through to $4 or higher.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise