XRP’s Open Interest Surges Above $3 Billion, Will Price Follow?

Highlights

- XRP's open interest has surged above $3 billion, providing a bullish outlook for the altcoin.

- Crypto analyst Ali Martinez predicts that Ripple's native crypto could rebound to as high as $2.60.

- Crypto analyst Egrag Crypto stated that XRP could either drop to $0.65 or rally to $17.

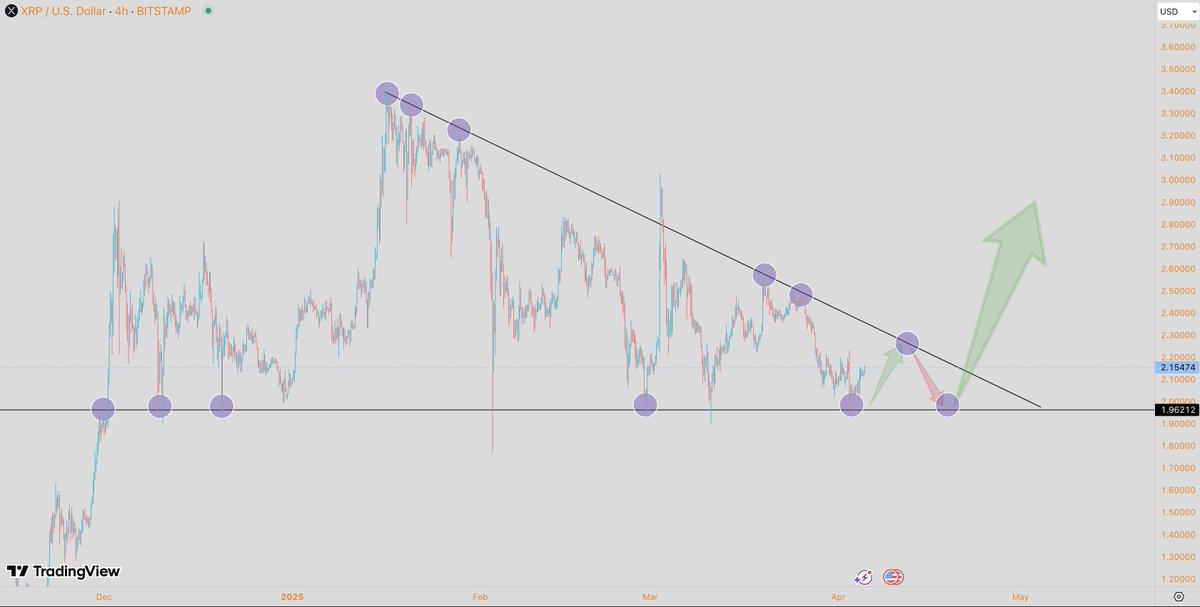

XRP’s interest has surged in the last 24 hours, providing a bullish outlook for the altcoin. Based on this, Ripple’s native crypto is eyeing a rebound, with crypto analyst Ali Martinez predicting that the XRP price could rebound to as high as $2.60 if it holds the $2 support.

XRP’s Open Interest Surges Above $3 Billion

CoinGlass data shows that XRP’s open interest has surged in the last 24 hours, rising to as high as $3.61 billion, indicating huge interest in the altcoin at the moment. This provides a bullish outlook for the altcoin, seeing as traders are heavily betting on it.

Crypto analyst Ali Martinez also suggested that Ripple’s native crypto could rebound soon. In an X post, he stated that if XRP can stay above the key $2 level, a 30% move toward the channel’s upper boundary at $2.60 could be next.

Crypto analyst CasiTrades’s prediction also showed that the altcoin could surge to $2.70 if it breaks above $2.24. This could eventually pave the way for Ripple’s native crypto to rally to a new all-time high (ATH).

However, there is still the possibility that the altcoin could also drop to new lows. A CoinGape market analysis revealed that Ripple’s price is at a crossroads, as a wedge pattern signals a 70% crash or 700% surge.

Crypto analyst Rex also predicted that XRP could soon witness a bullish reversal. He stated that a breakout is coming and that this is the most obvious play of the cycle. His accompanying chart showed that XRP could rally to as high as $2.9.

Two Paths For Ripple’s Native Crypto

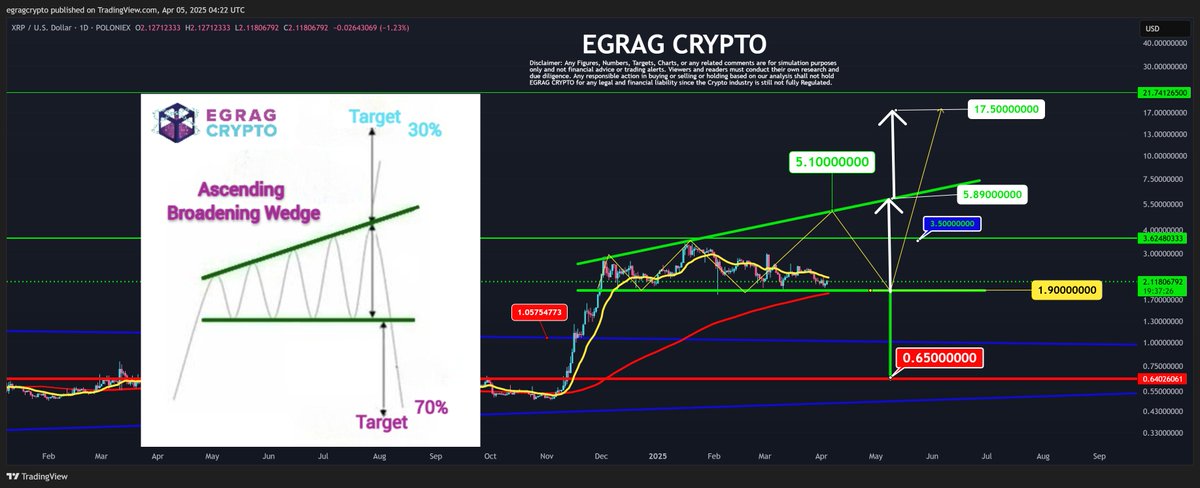

Crypto analyst Egrag Crypto stated that the XRP price could drop to $0.65 or rally to $17. This is based on an Ascending Broadening Wedge, which is currently forming for the altcoin. The analyst remarked that XRP first needs to close above $3.50 for a solid start.

He claimed that if the altcoin hits the $5 range but doesn’t close above it convincingly, this formation has a higher chance of playing out. Egrag Crypto asserted that XRP must retest $1.90 after being rejected from the $5 range.

Once that happens, the altcoin will need another attempt to close above $5, ideally hitting $6 and closing above that level. The analyst affirmed that XRP will likely blast to double digits within two to three weeks if that happens.

The target move for this Ascending Broadening Wedge is a potential $17.50. This aligns with another prediction in which he stated that the XRP price could rally to double digits by the July 21 cycle peak.

However, Egrag Crypto warned that there is still a 70% chance that XRP breaks to the downside and only a 30% chance for an upside breakout. If the altcoin breaks down, the analyst claims the measured move would take Ripple’s native crypto back to $0.65.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs