Just-In: Yearn Finance Suffers Flash Loan Exploit, Is Aave Also Impacted?

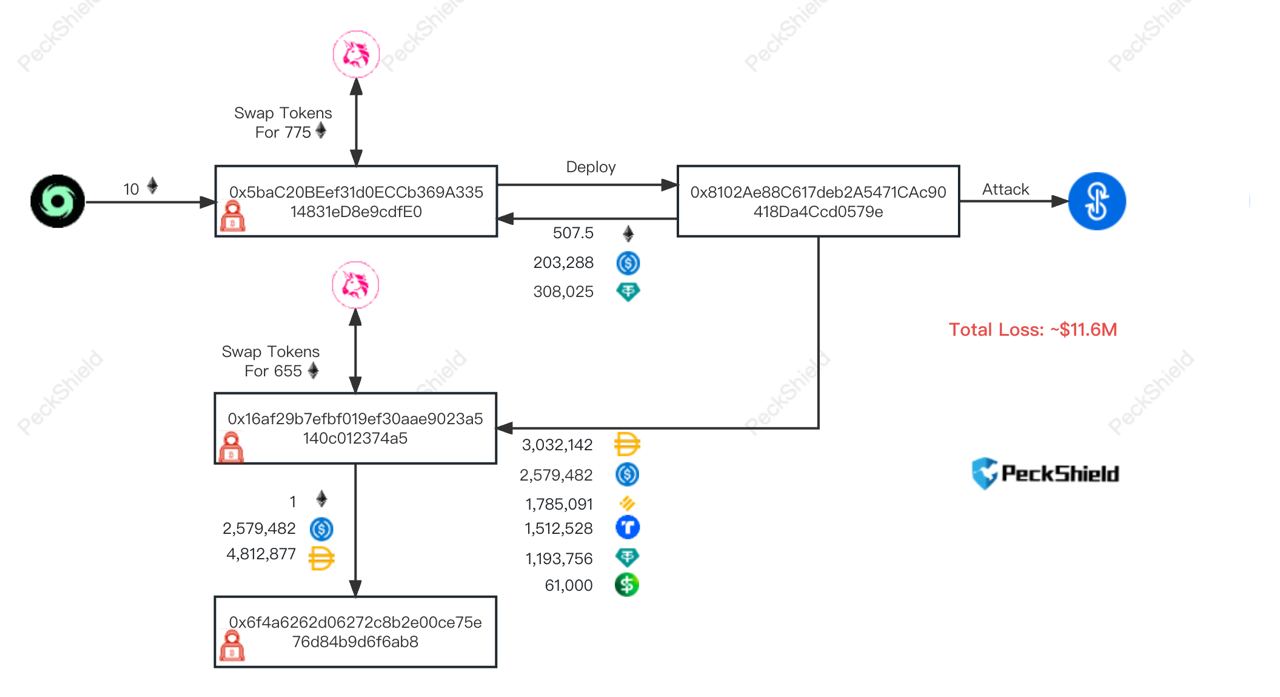

DeFi platform Yearn Finance has suffers a flash loan attack, with millions of funds withdrawn by the hacker. The exploit is concentrated on Aave V1 liquid protocol, blockchain security firm PeckShield reported on Thursday. Yearn security team is aware of the issue and working on a fix.

PeckShield in a subsequent tweet revealed that the root cause is likely due to the misconfigured yUSDT, which is exploited to mint huge yUSDT (approx. 1,252,660,242,212,927.5) from just $10K USDT. The huge yUSDT is then cashed out by swapping to other stablecoins. However, it needs to be confirmed if Aave has any role in the hack.

Also Read: Ethereum (ETH) Withdrawn After Shanghai (Shapella) Upgrade: Details

Beosin Alert noted that the total loss in the Yearn Finance hack is nearly $11,539,783. The blockchain security platform also reported the wallets having the most stolen funds from Yearn Finance. It also confirmed withdrawals of 996k USDC, 570k DAI, and 241k USDT from Aave Lending Pool Core V1.

Hackers grabbed nearly $11.6 million worth of stablecoins, including 61K USDP, 1.5 million TUSD, 1.8 million BUSD, 1.2 million USDT, 2.58 million USDC, and 3 million DAI. The hackers transferred 1.5 million TUSD to AAVE, and borrowed 634 ETH from AAVE. They then swapped some stablecoins for 600 ETH, with 1,000 ETH already transferred into Tornado Cash.

Aave Not Impacted By Yearn Finance Hack

Crypto researcher Samczsun claimed that Yearn Finance’s version of USDT, called yUSDT, has been broken since it was deployed around three years ago. He said it was “misconfigured to use the Fulcrum iUSDC token instead of the Fulcrum iUSDT token.”

Aave team confirmed that the Aave V1 protocol was used but is not impacted by the hack. Aave CEO Stani Kulechov took to Twitter to confirm this.

We are aware of this transaction, and it did not have an impact on Aave V2 and Aave V3.

We are now confirming whether there is any impact on Aave V1, the oldest version of the protocol which has been frozen. We're monitoring the situation closely to ensure no further concerns. https://t.co/uM9wtLNJMl

— Aave (@AaveAave) April 13, 2023

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs