Zcash (ZEC) Extends Rally Above $200 as Privacy Narrative Gains Reflexive Momentum

Highlights

- Zcash jumps over $200, overcoming broader market declines amid price recovery for privacy-tokens.

- According to Santiment and Grayscale, Zcash has a compliant privacy model and an institutional attractiveness.

- Ex-Coinbase engineer believes that reflexivity drives renewed investor confidence as the Zcash network develops in strength.

Zcash (ZEC) now trades above $200. The rally reflects a reflexive surge in investor belief, reinforcing Zcash’s comeback as the leading compliance-ready privacy cryptocurrency.

Zcash Defies Market Downturn

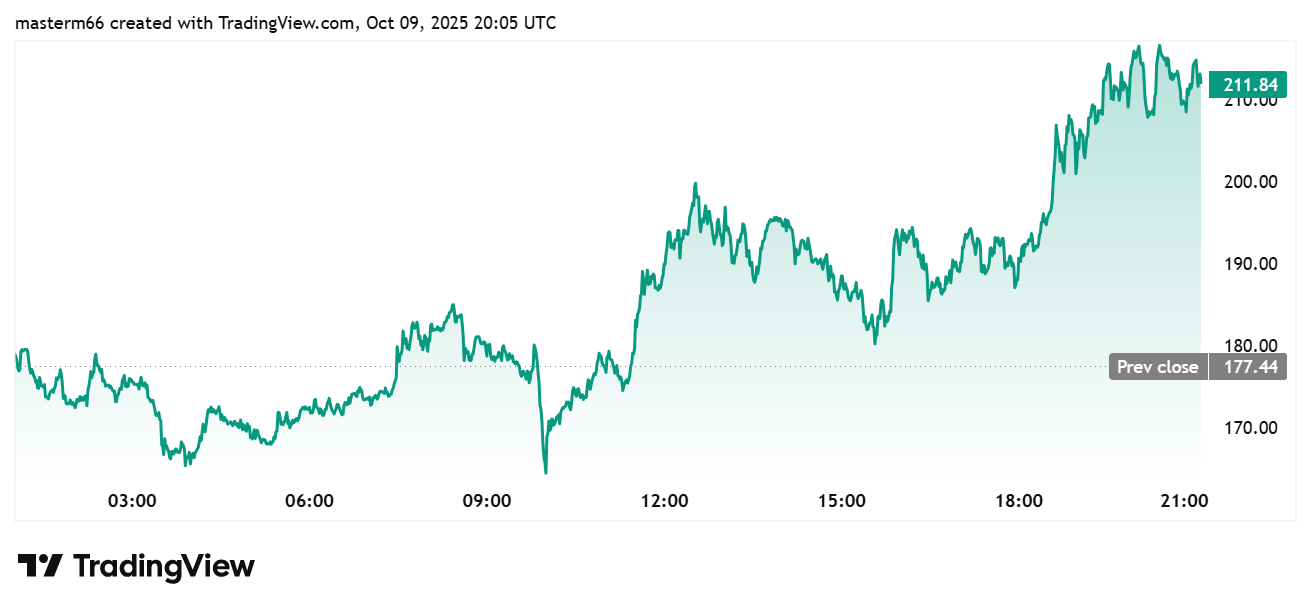

The rally by ZEC marks one of the most decisive privacy-sector rebounds lately. ZEC price climbed nearly 20% in 24 hours and more than 75% this week, trading around $212, as shown by TradingView data.

The surge reflects a renewed global focus on financial privacy at a time when central banks and regulators push for greater transaction visibility. The renewed interest in financial freedom and regulatory alignment have rekindled attention in Zcash as an investment. There is the optional privacy with institutional flexibility on the network.

ZEC Rises as Other Cryptocurrencies Struggle

In a recent Bybit x Santiment report, it was shown that ZEC price is on the rise, with privacy tokens faring better than other tokens in the crypto market. It attributes this trend to rising concerns about surveillance, particularly as CBDCs advance worldwide.

This comes at a time when Bitcoin price and most major altcoins are on the decline. Santiment describes Zcash’s system as “a flexible model that allows users to choose between public and shielded transactions,” a rare trait in a space often divided between total transparency and full anonymity.

The report also notes increased Zcash usage across Asia and Latin America, regions where privacy-preserving options are gaining traction as safeguards against financial monitoring.

Grayscale Notes Zcash’s Compliance Edge

Zcash’s design gives users the ability to share view keys. This is a selective-transparency tool enabling cooperation with auditors and regulators without revealing sensitive wallet data. This feature is now being re-evaluated as regulators look for privacy-preserving yet accountable technologies.

Grayscale underscored this advantage in a recent post. The asset manager reminded investors that its ZCSH Trust remains the only way for U.S. brokerage clients to gain exposure to ZEC. The firm highlighted Zcash’s Bitcoin-based foundation and its encryption layer, which shields user assets while maintaining verifiable integrity.

Mert Links Zcash’s Growth to Reflexive Investor Confidence Loop

Adding a psychological dimension, Mert (@0xMert_) a former Coinbase engineer, describes privacy coins like Zcash as major beneficiaries of reflexivity. Mert stated that it is the feedback loop between investor belief and market value.

He argues that as more people speculate on privacy, Zcash’s shielded pools will expand and reinforce the network’s core strength. “Privacy systems like Zcash will benefit disproportionately,” Mert wrote, “as the financialization of the internet accelerates the reflexive loop.”

A Reflexive Thesis on Why Privacy Is About to Take Off

Reflexivity is the idea that investors’ beliefs shape the market, and then the market shapes the investors’ beliefs.

For example, people buy because they think the price will go up, but if enough people do this, the price…

— mert | helius.dev (@0xMert_) October 8, 2025

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Will Bitcoin, ETH, XRP, Solana Rebound to Max Pain Price amid Short Liquidations Today?

- 3 Top Reasons XRP Price Will Skyrocket by End of Feb 2026

- Metaplanet CEO Simon Gerovich Defends Bitcoin Strategy Amid Anonymous Allegations

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans