$15B Bitcoin Options Expire on Deribit in 2025’s Largest Quarterly Expiry

Highlights

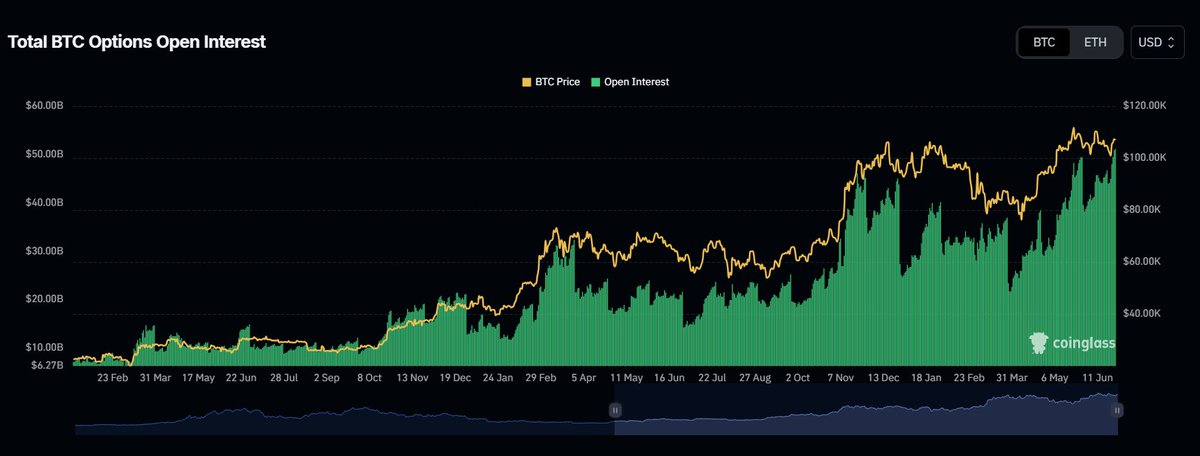

- Deribit saw $15B in Bitcoin options clear, with $40B in open interest, marking the largest expiry of 2025.

- Bitcoin held steady near $106,800 during Deribit’s record expiry, reflecting investor optimism and speculation.

- Ethereum's options expiry saw 939K contracts settle, with max-pain at $2,200, indicating balanced market sentiment.

Crypto derivatives exchange Deribit has experienced a record-setting expiry event on June 27, with over $15 billion in Bitcoin options clearing. This marked the largest quarterly expiry of the year, as Bitcoin options open interest exceeded $40 billion on the platform.

As a result, Bitcoin maintained steady levels near $106,800, while Ethereum showed signs of consolidation, highlighting both the strength of Bitcoin and the ongoing stability in altcoins during the expiry.

Bitcoin Options Expiry Hit 2025 Highest

On the day of the expiry, Deribit set a new record for Bitcoin options open interest, surpassing $40 billion. The exchange accounted for nearly 90% of the total open interest across all platforms, reflecting its dominance in the crypto options market. According to data, the total open interest across all venues briefly exceeded $45 billion, with Deribit leading the charge.

In total, 139,000 BTC options contracts, worth about $15 billion, expired. This event saw the put–call ratio settling at 0.75, signalling more bullish bets than hedges. The max-pain level, the price point where options buyers lose the most, was pinned at $102,000.

These expirations could have far-reaching effects, as they often bring volatility and price movement. The expiry also coincided with a cooling trend observed in the Bitcoin market, as pointed out by CryptoQuant, which highlighted that Bitcoin was near its all-time high but showing no signs of overheating. The report noted that with almost no Bitcoin left on exchanges, a supply shock could be on the horizon.

Expiry Event Signals Investor Optimism

The quarterly Bitcoin expiry saw investors get optimistic given the bulls stance in the market. The 0.75 putcall ratio indicates an investor inclination to place themselves in a position that wagers on a price rise rather than hedges against a possibility of decline. This expiry event was hoovering around a max-pain price of $102,000 and drove the Bitcoin movements on the market.

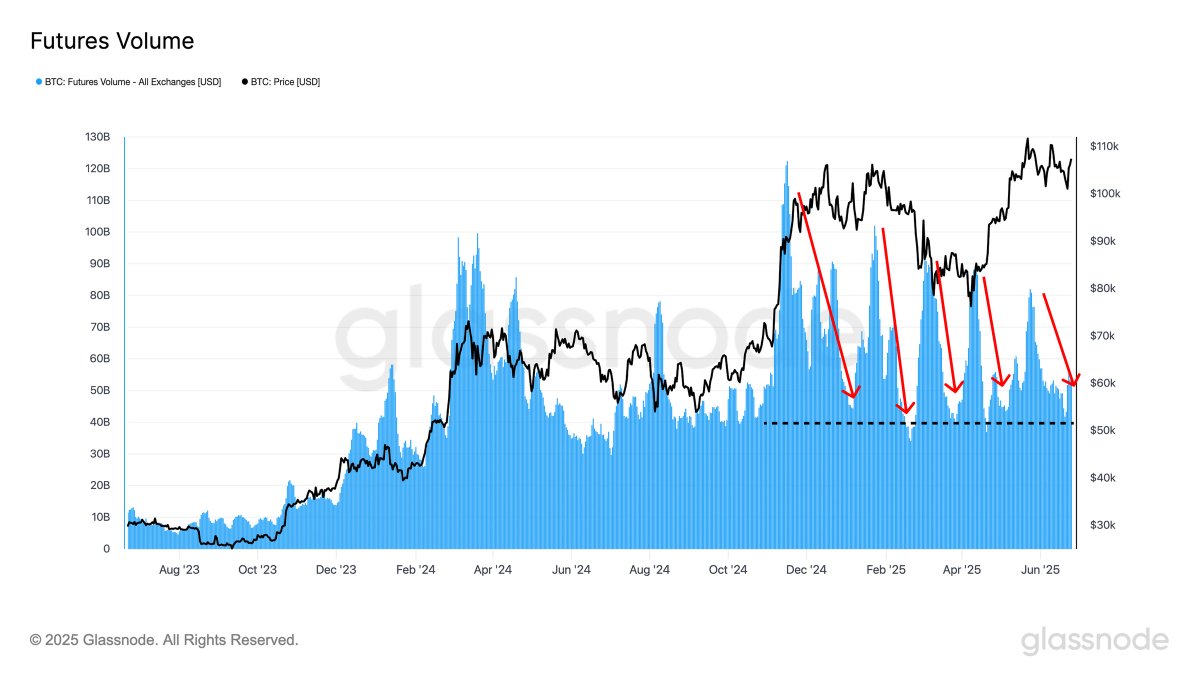

Nevertheless, the Bitcoin price did not fall, with the price stable at about $106,800, and the futures volume also high, as per Glassnode. This implies that the last price changes may have been more associated with leveraged speculation rather than natural demand. Most traders were anticipating the possibility of any price movement that might come after the expiry that might be determined by large investors who might alter their positions.

In conjunction with the expiry of Bitcoin, Ethereum options contracts also expired, with 939,000 ETH contracts settling at a notional value of 2.29 billion. Ethereum had a putcall ratio of 0.52 indicating more balanced opinion, and max-pain was pegged on ETH at $2,200.

- Why Is The Crypto Market Up Today? Bitcoin, XRP Lead Recovery

- ‘Cardano Didn’t Go Down,’ Charles Hoskinson Pushes Back On Network FUD

- ‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

- Eric Trump Says Now Is a Great Time to Buy Bitcoin Amid Crypto Crash

- Dogecoin, Cardano, Shiba Inu Eye Wider Adoption as Coinbase Announces Perpetual-Style Futures

- Here’s Why XRP Price Will Hit $3 This Week

- Zcash Price Soars 10% as OKX Eyes ZEC Relisting

- WLFI Price Soars 17%: What’s Fueling the Surge?

- Dogecoin Price Eyes $0.2 Rally Ahead of Grayscale’s NYSE ETF Debut on November 24

- Crypto Market Eyes Major Rebound as Fed Rate Cut Chances Rise to 71%

- Dogecoin Price Finds Support: Can the 21Shares & Grayscale DOGE ETFs Spark a Surge?