BREAKING: 21Shares SUI and Polkadot ETFs Gain DTCC Listing

Highlights

- DTCC lists 21Shares SUI and Polkadot ETFs, signaling approval by the SEC soon.

- Polkadot and SUI ETFs are due for final SEC decision in November and December.

- Bloomberg senior ETF analyst Eric Balchunas said "crypto ETF approval season has officially arrived."

21Shares SUI and Polkadot ETFs were listed on the DTCC website. The listing indicates progress towards approval of the exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) nears. Experts confirm the decision on ETF approvals lies with the commission, and the DTCC listings do not indicate regulatory approval.

DTCC Lists 21Shares SUI and Polkadot ETFs

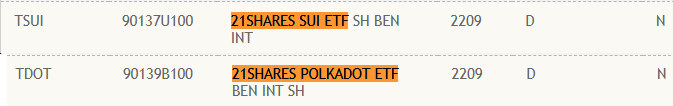

Two crypto ETFs appeared on the DTCC’s website: 21Shares SUI ETF (TSUI) and 21Shares Polkadot ETF (TDOT). The listing sparks buzz in the crypto community as it signals a potential approval of these ETFs by the SEC soon.

Polkadot and SUI ETFs have 90% and 60% odds of approval by the SEC, according to Bloomberg ETF analysts. The final deadline for the SEC to approve or deny 21Shares Polkadot and SUI is in November and December, respectively. Notably, the commission has asked all ETF issuers to withdraw 19b-4 forms in compliance with the General Listing Standards for crypto ETFs.

Notably, DTCC adds securities to the NSCC security eligibility list in preparation for the launch of a new ETF to the market, but still requires SEC approval before they can begin trading. Bloomberg’s senior ETF analyst Eric Balchunas reacted to an SEC announcement and claimed the crypto ETF approval season has arrived.

Crypto ETF approval season has officially arrived! https://t.co/85h74ZZ7LS

— Eric Balchunas (@EricBalchunas) September 30, 2025

As CoinGape reported earlier, Fidelity’s Solana ETF (FSOL), Canary’s XRP ETF (XRPC), and Canary’s Hedera ETF (HBR) were listed on the DTCC’s website.

SUI and DOT Price Action Amid the Announcement

Traders reacted immediately to 21Shares SUI and DOT ETFs’ listing on DTCC, causing prices to rebound from the latest fall. This came after the US JOLTS jobs data came in slightly higher than expectations, signaling a resilient labor market in the United States. However, this has not impacted the market estimates over two additional Fed rate cuts this year.

SUI price bounced 4% from the 24-hour low of $3.16 to hit an intraday high of $3.31. The price is currently trading at $3.23, with a 12% drop in trading volume over the last 24 hours amid the US government shutdown jitters.

Meanwhile, Polkadot rebounded 2% in the past 24 hours, with the price currently trading at $3.90. The 24-hour low and high were $3.81 and $3.94, respectively. Furthermore, the trading volume has decreased by 24% in the last 24 hours, indicating a decline in interest among traders.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale