BLUR Token Skyrockets 105% in a Week Following Massive Accumulation by 25 Whales

The Blur token’s second airdrop, coupled with its recent addition to the Binance exchange, has significantly piqued interest in the cryptocurrency market, especially among major investors. This enthusiasm is further heightened by Tieshun Roquerre’s Ethereum Layer 2 initiative, Blast, which witnessed an astonishing 20,000% increase in Total Value Locked (TVL). On-chain analytics show a considerable shift, with around 25 whale investors acquiring BLUR tokens post-airdrop, leading to an impressive 105% increase in the token’s value in just one week.

Whales Jumped To Grab Their Share of Blur

Almost 25 whales accumulated BLUR tokens and staked mostly purchased tokens as the Blur NFT marketplace introduced staking, reported Spot on Chain on November 24. Whales purchased 60.8 million BLUR tokens worth more than $32 million and staked 59.6 million BLUR tokens.

In the past 6 hours, two whales accumulated and staked 6.79 million BLUR tokens. Whale 0x13d withdrew 3.75 million BLUR ($2.01M) from OKX crypto exchange and whale 0x602 withdrew 3.04M ($1.56M) from Upbit.

The move came as Blast, the L2 network launched by Blur team surpassed $300 million in TVL in just 4 days.

Scopescan reported a total of $204 million BLUR, including $87 million from airdrops, are staked and only $88 million are unstaked. Currently, 339 million BLUR tokens are staked at an average price of $0.342, with average return of 78%.

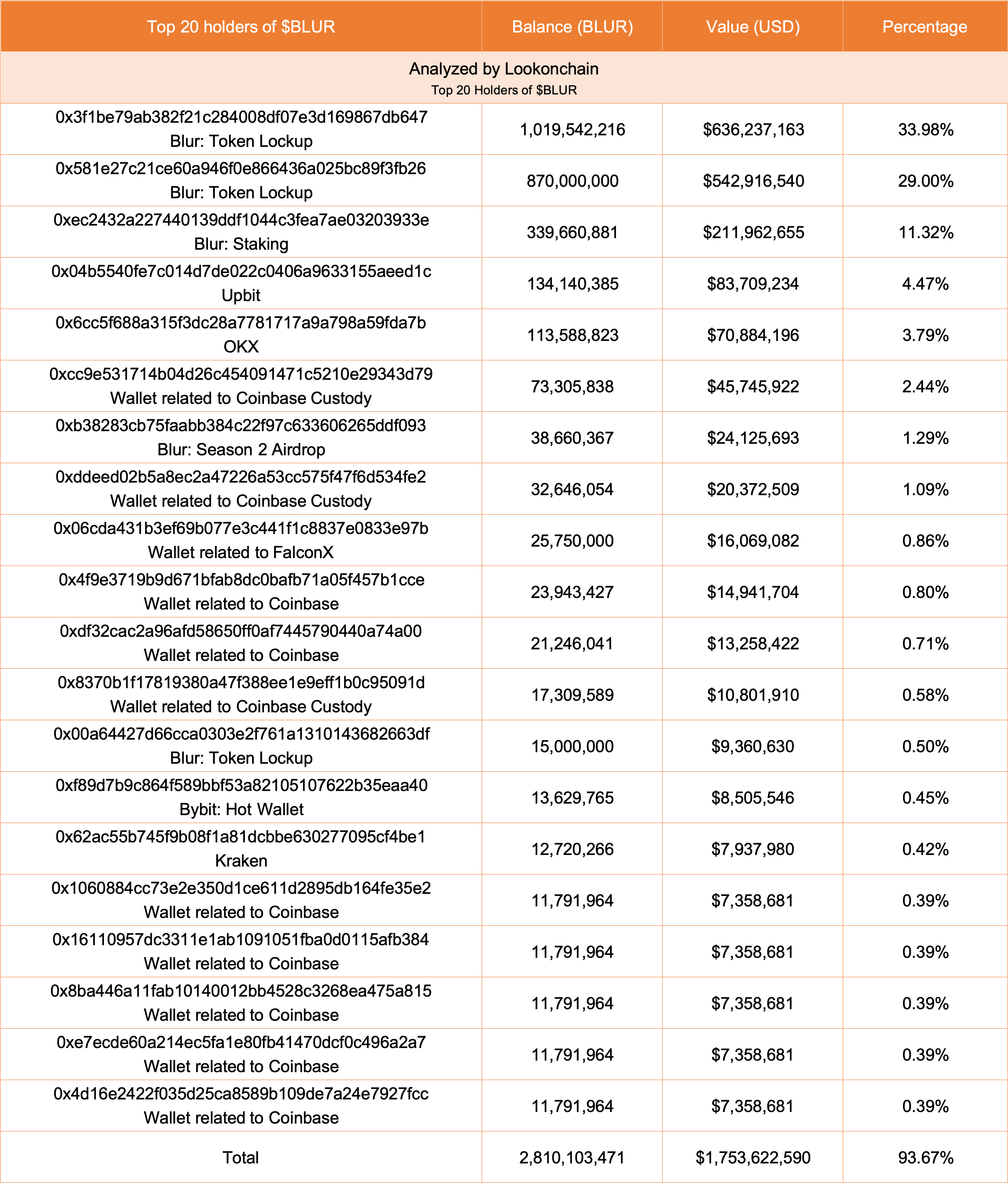

Lookonchain revealed the top 20 BLUR holders account for 2.81 billion tokens worth $1.75 billion, which is nearly 94% of the total supply.

A total of 337.6 million BLUR staked accounts for 11.25% of the total supply and 30.64% of the circulating supply. Traders are keeping an eye on the trend as Blur witnessing nearly 100% upside after the Binance listing.

Also Read: Hong Kong SFC Wary of Binance’s License Amid Regulatory Pressures

BLUR Price Up 30%

BLUR price rallied 20% after the world’s largest exchange Binance listed BLUR, making the total rally in a day to 30%. The price currently trades at $0.62, with a 24-hour high of $0.638.

Furthermore, trading volume has increased just 6% in the past 24 hours, indicating massive buying by just whales. Thus, BLUR price can see volatility in the coming days. Moreover, top addresses holding BLUR may sell their tokens in response to Binance’s listing.

Also Read: Crypto Market Braces For $6.5 Bln Bitcoin And Ethereum Monthly Expiry, What’s Ahead?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs