5 On-Chain Indicators Signals Bitcoin Entering Bull Market Cycle

Bitcoin price trades strongly above the $20,000 psychological level and shows signs of another upside move above $21K. Five on-chain indicators also signal that Bitcoin has entered an early bull market cycle.

The crypto market recovered slightly after the U.S. DOJ enforcement action against Russian crypto exchange Bitzlato. Crypto Twitter blames DOJ for creating much hype surrounding small news that caused panic selling across the crypto market.

Five On-Chain Indicators Indicate More Upside in Bitcoin Price

According to on-chain data by CryptoQuant, Bitcoin price has entered the early bull market cycle and is likely to move higher with promising momentum in the next few days.

Bitcoin movements from spot to derivative exchanges have increased as investors started taking risks. Traders generally transfer their coins to derivative exchanges to increase their market upside exposure. It helps them make more profits during a market recovery.

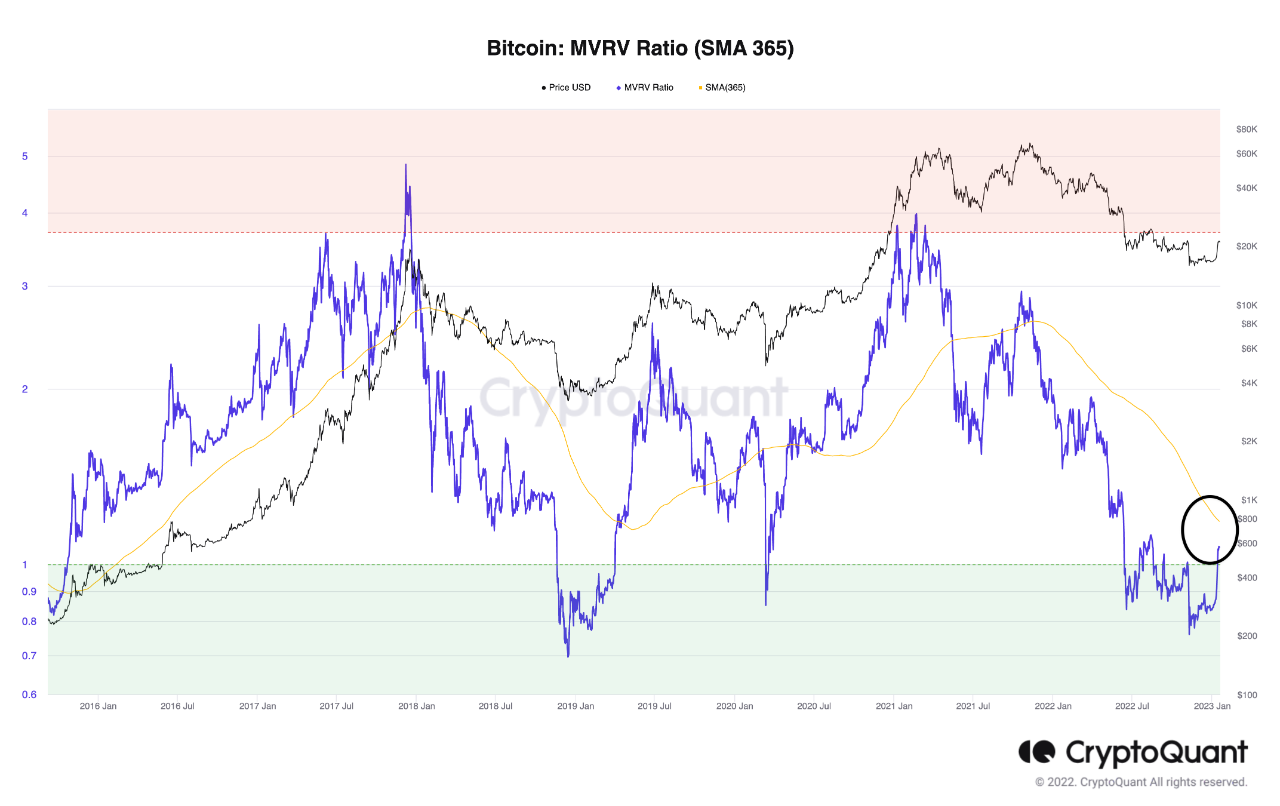

The MVRV Ratio indicates if the Bitcoin price is undervalued or overvalued. It is derived from Bitcoin’s market capitalization (market price) divided by its actual market capitalization. Currently, MVRV is 1.07 and moving near the 365-day moving average (orange line). Thus, it indicates Bitcoin is about to start a new uptrend.

Third indicator, the Net Unrealized Profit/Loss shows the average profit margin of Bitcoin holders. It is also near the 365-day moving average and indicates an early bull market cycle.

Puell Multiple is the ratio of the daily dollar worth of newly issued bitcoins to their one-year moving average. At present, the indicator shows a shift to a positive trend as Bitcoin price holds strongly above its 365-day moving average.

CryptoQuant’s P&L Index indicator combines the MVRV ratio, Net Unrealized Profit/Loss, and LTH/STH SOPR into a single Bitcoin value indicator. The P&L Index points to an early Bitcoin bull market cycle as the index (dark purple line) looks to cross the 365-day moving average (light purple line)

Also Read: Bitcoin Price Really Bottomed? Use These To Confirm Market Bottom

BTC Price Await Upside Momentum

Bitcoin (BTC) price fell nearly 2% in the last 24 hours, with the price currently trading at $20,774. The 24-hour low and high are $20,541 and $21,564, respectively. Furthermore, the trading volume has increased by 21% in the last 24 hours, indicating an increase in interest.

Traders should keep an eye on the US dollar index (DXY). A fall in the DXY below 102 at current market conditions will confirm a rally in Bitcoin price.

Also Read: Binance Linked With Exchange Accused Of Money Laundering

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs