$7B Virtu Financial Holds $63M XRP as Whales Accelerate Daily Sell-Off

Highlights

- The SEC filing of Virtu Financial indicates that it owns $63 million XRP.

- Glassnode data indicates that the long-term holders are selling approximately $260 million per day.

- Coinbase records almost $24 million XRP inflows, which suggests an increasing sell pressure.

Virtu Financial, a $7 billion Wall Street firm, has revealed $63 million in XRP holdings. In contrast, on-chain data shows that whales are offloading over $260 million worth of the token every day.

Virtu Financial Joins Wall Street’s Growing XRP Adoption

According to a new SEC filing highlighted by Bill Morgan, a notable XRP advocate, the firm has added XRP to its balance sheet. It listed the token alongside Bitcoin and Ethereum as of September 30, 2025.

A new filing with the SEC yesterday shows that the company, Virtu Financial, Inc in addition to Bitcoin and Ethereum holds a substantial amount of XRP on its balance sheet.

Because @Marc_Fagel always does it when I do these posts I checked up on the company. Seems to be… pic.twitter.com/fMeL1TzYVX

— bill morgan (@Belisarius2020) October 31, 2025

The move positions Virtu among the few major Wall Street institutions directly holding the token. A similar development was seen earlier when Canary XRP ETF filing removed an SEC delay clause. This is another proof of growing confidence around XRP-linked financial products.

Virtu Financial provides liquidity in equities, ETFs, fixed income, currencies, and, for the first time, in digital assets. The fact that the Ripple-linked token has been added to the company’s balance sheet indicates that conventional companies are increasing their exposure to blockchain-based tokens. This follows the recent decision by the U.S. to clarify the regulatory status of the Ripple-associated token.

Long-Term XRP Holders Take Profits

However, on-chain data from Glassnode paints a contrasting market picture. It noted that since early August, XRP price has fallen from $3.30 to around $2.40, a 27% decline.

Since early August, XRP price has dropped from $3.3 to $2.4 (-27% 🔽).

At the same time, long-term holders who accumulated before Nov 2024 ramped up their spending by ~580%, from $38M/day to $260M/day (7D-SMA)A clear sign of seasoned traders exiting and adding pressure to… pic.twitter.com/q5h02AsdrJ

— glassnode (@glassnode) October 31, 2025

During the same period, long-term token holders who accumulated before November 2024 increased their spending activity by roughly 580%. Glassnode estimates this activity rose from $38 million to $260 million per day based on a seven-day moving average.

The data suggests that seasoned investors are taking profits after last year’s rally. The trend could be an indication of token redistribution by whales who had purchased XRP in previous market cycles.

Coinbase Inflows Suggests XRP Sell Pressure

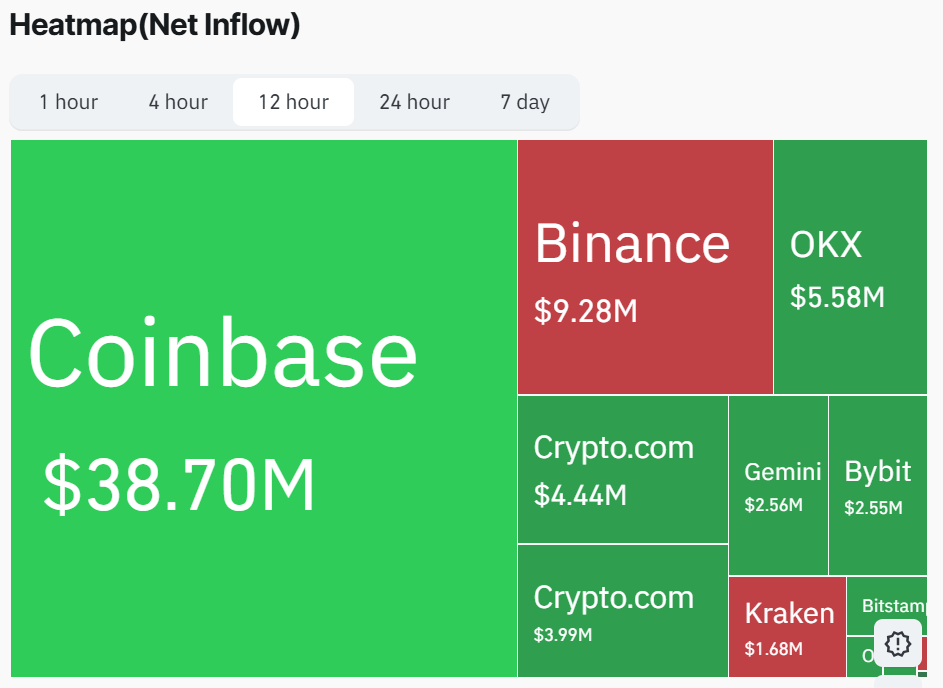

Institutional buying offers a longer-term assurance while whale selling causes pressure on price recovery in the short-term. Data from Coinglass shows that within the last 12 hours, Coinbase has registered a total of $23.93 million in net XRP inflows.

This represents a recent peak in USD-to-XRP conversions. But has coincided with a rise in the token’s price. Similarly, Ripple-backed Evernorth has grown its XRP treasury to $1 billion. These underscores deepening institutional involvement in the token.

At the time of writing, the Ripple-linked price is trading at $2.51. It climbed 3.17% in the past 24 hours and maintains a 21.22% year-to-date increase.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs