Actual Reason Behind Today’s Bitcoin (BTC) Price Rally Amid US CPI Release

Bitcoin price finally breakout above the key $18K level on Thursday, for the first time in the last two months. Traders anticipate a slowdown in rate hikes by the U.S. Federal Reserve as inflation eases in 2023.

The BTC price rises over 5% in the last 24 hours as Wall Street economists expect a drop in December’s Consumer Price Index (CPI). However, the actual reason behind the rally is the technical breakout. Also, a fall in the U.S. dollar index (DXY) below 103 after many months.

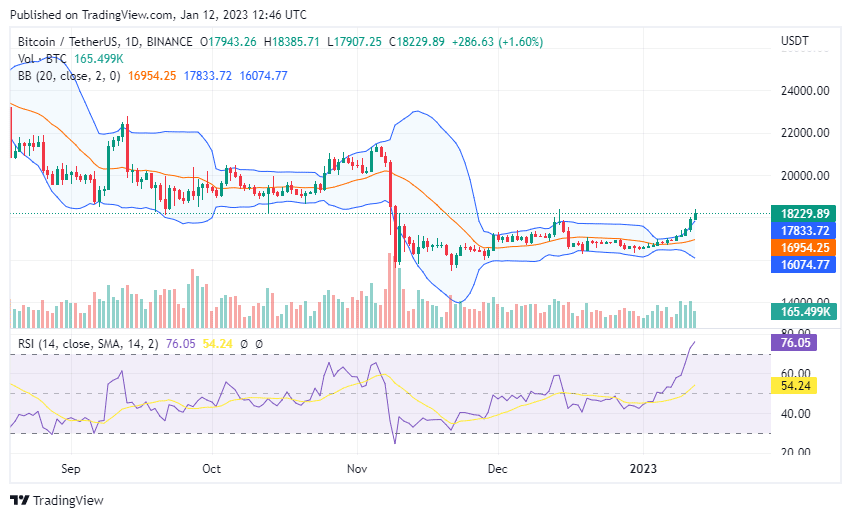

As reported earlier, the Bollinger Bands indicator was forming narrow bands in the weekly timeframe. Thus, traders kept away from trading due to decreased volatility. Also, it caused the Bitcoin price to hold above $16.5K and rise above $17,500 in the last few days.

As expected, the end of the Bollinger Bands Squeeze saw Bitcoin price moving 5% higher in the last 24 hours. Moreover, indicates the BTC price will continue to move higher and hit $19K soon.

The RSI reaches the overbought zone and moves around 76. Therefore, the Bitcoin price shows strength and should continue to move higher in the next few weeks. The Exponential Moving Average also hints at a bullish price trend in the coming weeks as the 20-EMA looks to cross above the 50-EMA.

At the time of writing, the BTC price is trading at $18,252. The 24-hour low and high are $17,337 and $18,268, respectively.

Bitcoin Price After December’s CPI Release

Wall Street banks expected a drop in the CPI for December as energy prices in December contributed the most to the slowdown. Gasoline costs declined nearly 12% from November to December.

Major banks such as Bank of America, JPMorgan, Morgan Stanley, and Goldman Sachs expect the CPI data to come at 6.5%.

Crypto analyst Michael van de Poppe believes the CPI will most likely drop further, but the expectations of a massive drop as suggested by other experts are low. He expects the CPI can come in at 6.6% or 6.7%. Thereafter, the crypto market can witness a correction, before continuing the rally.

Also Read: Will Bitcoin Rally After the CPI Release?

- Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report

- XRP Community Day: Ripple CEO on XRP as the ‘North Star,’ CLARITY Act and Trillion-Dollar Crypto Company

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- U.S. Jobs Report: January Nonfarm Payrolls Rise To 130k, Bitcoin Falls

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates