Anchor Protocol Holders Strike Down Proposal To Cut Yield Rate

A proposal to reduce yield rates on the Terra-based Anchor Protocol (ANC) was overwhelmingly voted against by ANC token holders on Saturday. The cut was proposed by Polychain Capital and Arca Prop, and sought to trim rates by up to 50% to make the protocol more sustainable.

ANC currently offers a yield of nearly 20% per annum on USDTerra (UST) deposits. The Polychain proposal seeks to progressively lower yield rates on higher deposit amounts, bringing it as low as 10% on deposits of above 500,000 UST.

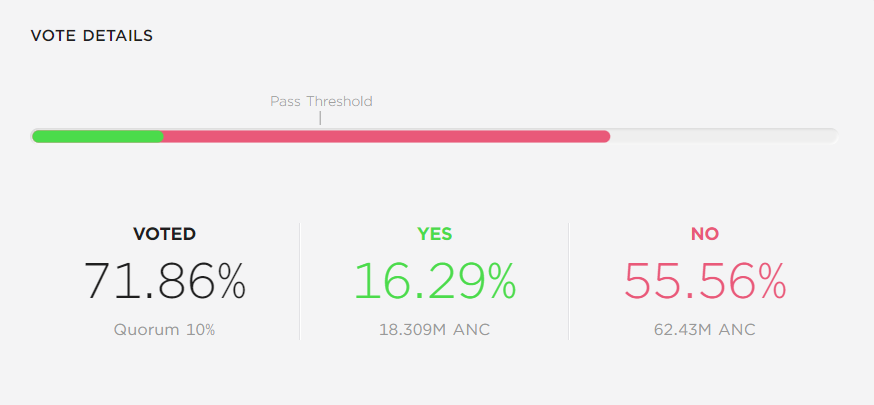

Voting on the proposal will close on March 16. But so far, nearly 72% of ANC token holders have voted, with 55% of them against the proposal.

Reaction to the proposal was also largely negative on Twitter, with users speculating that the move would overcomplicate the code and possibly even break the platform.

Anchor Protocol offers market-beating yields

ANC, which is built by the creators of Terra, currently offers depositors the highest stablecoin yield in the market, at nearly 20%. By comparison, yields on top stablecoins including Tether, USD Coin and Binance USD go up to 12%.

While the relatively large yield has seen a surge in deposits through February, it has also raised questions over sustainability, given that total deposits are nearly four times as much as total borrowers on ANC.

ANC funds this high yield through interest payments from UST borrowers, as well as a yield reserve. But this reserve has been dwindling in recent weeks, spurring more capital raising efforts from the community.

ANC, LUNA holders still spooked

Even as ANC token holders voted against the proposed rate cut, the prices of ANC and Terra’s native token LUNA reflected some uncertainty. LUNA, which can be used to stake on the protocol, was down 4.4% over the past 24 hours, coming further away from the closely watched $100 level, while ANC sank 11% to $3.42.

Both token prices had skyrocketed over the past month on growing adoption of Anchor Protocol. LUNA is now the largest DeFi token by market capitalization, which has nearly doubled in value over the past 30 days to $34.6 billion.

ANC is also the fourth-largest DeFi platform by total value locked ($15.4 billion), according to data from DeFi Llama.

- Crypto Market Crash: Here’s Why Bitcoin, ETH, XRP, SOL, ADA Are Falling Sharply

- Missouri Joins Bitcoin Reserve Push as U.S. States Race to Accumulate BTC

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible