Is Another BTC Price Crash On Its Way As Predicted By JP Morgan?

Bitcoin price may be headed for another price crash as per financial giant JP Morgan. The prediction comes in the wake of the upcoming Grayscale Bitcoin Trust (GBTC) unlock, a half-yearly event believed to have a volatile impact on Bitcoin price.

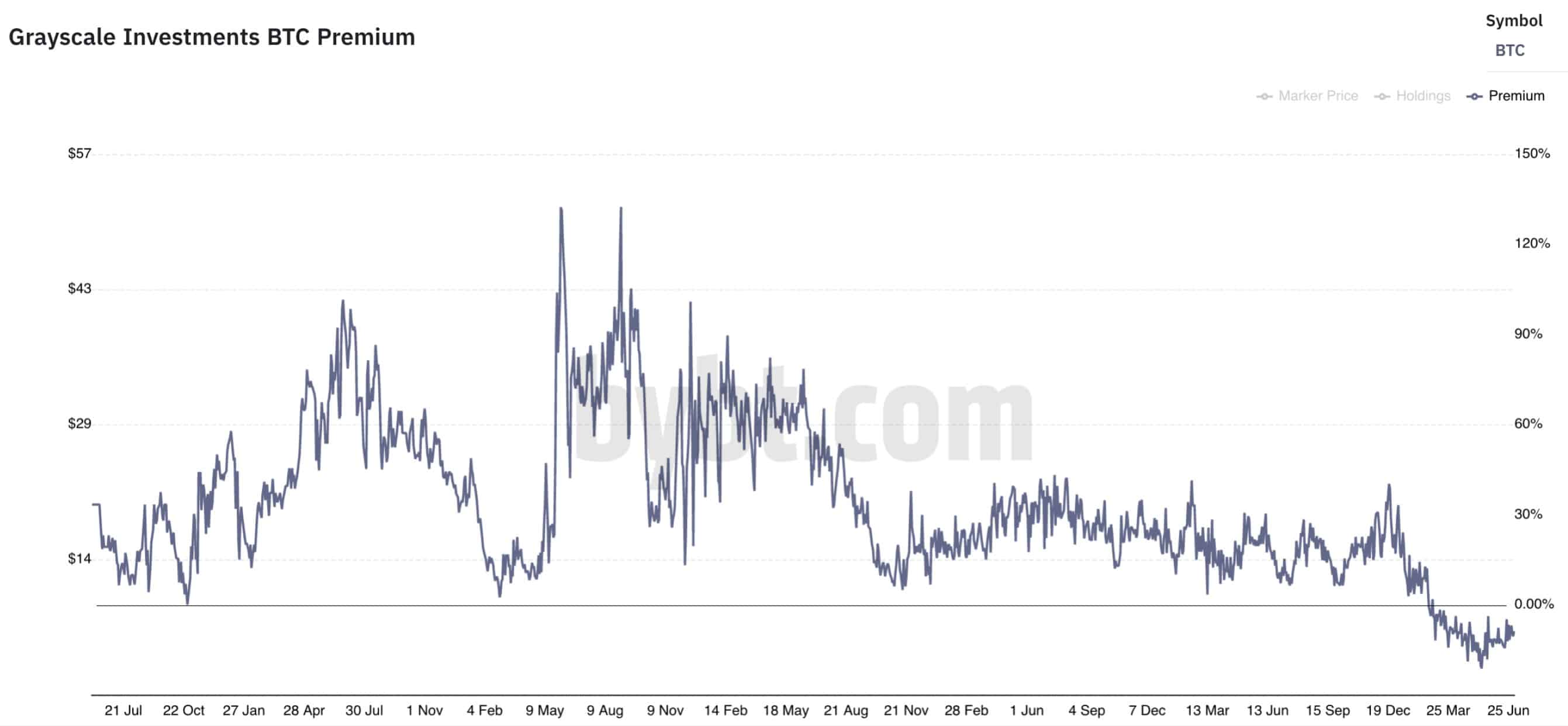

Grayscale Bitcoin trust allows accredited investors to add BTC to the Trust holdings and offers share against it. Being a lucrative investment tool these share often trade at a premium price offering great profitability to the holders. Shareholders can only sell their holdings after 6 months for cash and the upcoming unlock is one such event. The upcoming unlock on July 18 would see GBTC stocks worth 41852.26 BTC getting sold. This will be the largest single-day unlocking of the GBTC shares so far in history.

Financial giant JP Morgan believes the GBTC share unlock can pose a bearish outlook for the Bitcoin market. This is primarily because the unlock event leading to the selling of a significant amount of GBTC shares brings down the premium significantly making spot BTC costlier than the GBTC shares, thus a bearish short-term outlook.

Analyst Predict Bitcoin Bullish Case for GBTC Unlock

Willy Woo, a popular Bitcoin analyst however beleive the unlock phase would have a neutral long-term impact despite a bearish short-term outcome. Talking about the bull case of the upcoming unlock, Woo explained, traders can buy bitcoin at a spot price and put it in the Grayscale trust, receive GBTC shares against it and then short the Bitcoin futures market to hedge the risk.

1) Derivatives

Playing the carry trade:

a) buy BTC spot, put it into Grayscale

b) receive GBTC shares

c) short BTC futures (to hedge risk)

d) earn yield from shorting BTC

e) earn the GBTC premiumUnlocking:

f) sell GBTC shares for USD

g) unhedge shorts(g) is BULLISH

— Willy Woo (@woonomic) July 6, 2021

Traders can earn yield from their short position in the run-up to the unlock phase and sell their GBTC share at the time of unlocking.

Another important factor to note here is that GBTC premium is currently negative and analysts predict shareholders won’t sell their holdings at a discounted rate. This could in turn help in narrowing down the GBTC discount.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs