ASTER Token Defies Crypto Market Consolidation With 14% Upside, Expert See Next Stop at $3

Highlights

- ASTER token's second phase of rally begins following the recent bounce back $2.

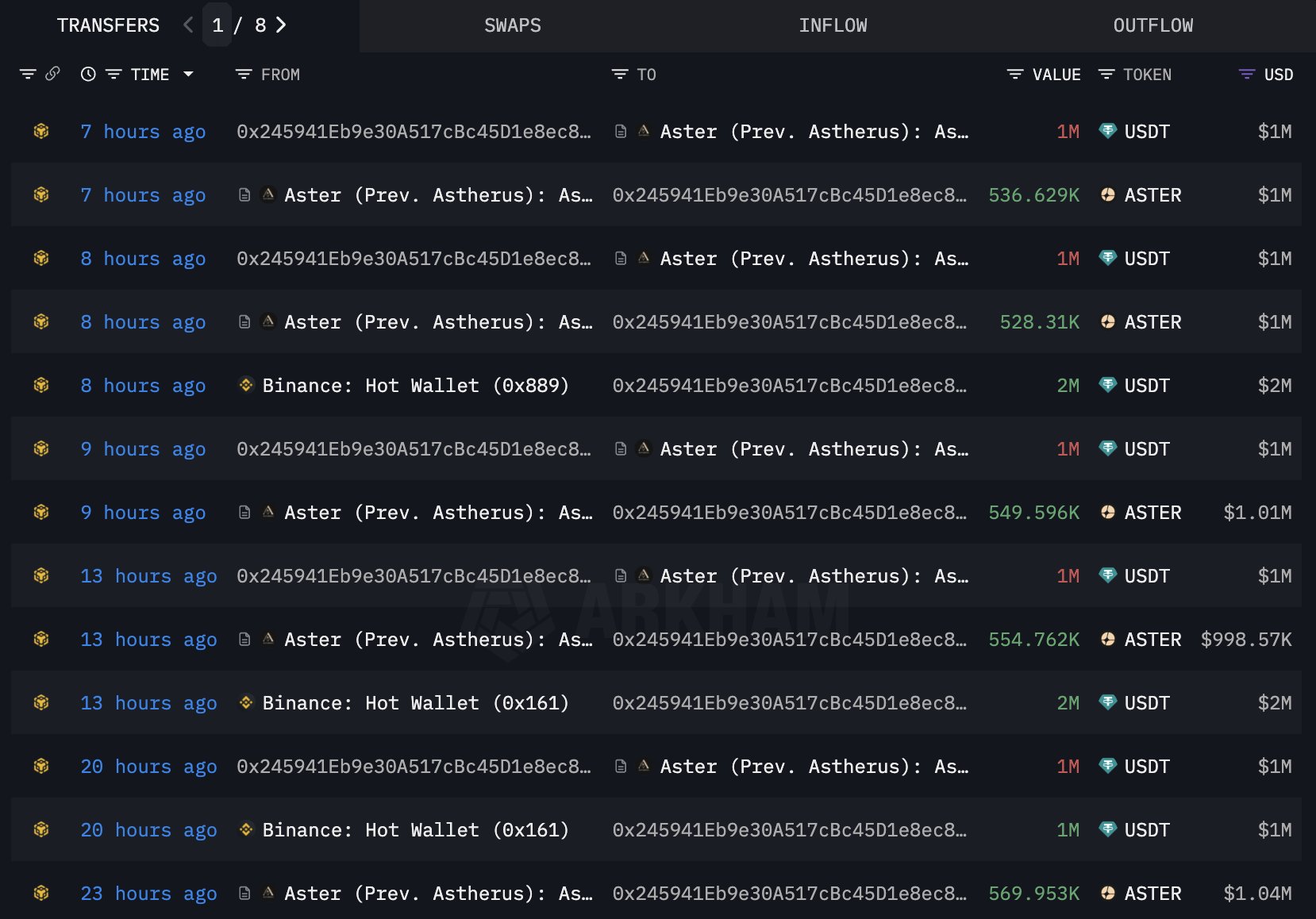

- Whale activity intensifies, with one large investor purchasing 2.74 million ASTER worth $5 million.

- ASTER dominates Perpetual Protocol trading, leading September’s $1.226 trillion total volume.

Despite the broader crypto market consolidation, ASTER token is outperforming with 14% gains in the last 24 hours, shooting past $2 and eyeing fresh all-time highs. This is a strong bounce-back for the DEX altcoin after hitting the lows of $1.5 on October 1. Market analysts are hopeful that the altcoin rally can continue further, all the way to $3.

ASTER Token Shows Breakout From Bull-Flag Pattern

Crypto analyst Lark Davis says the ASTER token is currently breaking out of a bull-flag pattern, a technical setup that often precedes further upside. Davis identified $2.40 as the first key resistance to watch; if ASTER price clears that level, he sees the next Fibonacci target around $2.96.

Furthermore, the Aster blockchain’s native token continues to draw strong institutional interest. A large investor has purchased 2.74 million ASTER tokens for approximately $5 million USDT at an average price of $1.825 over the past 24 hours.

The whale still holds $1 million USDT on Aster DEX, suggesting possible further accumulation. Following the latest purchase, the investor’s total holdings have reached 3.07 million ASTER, currently valued at $5.86 million.

This strong whale demand shows that big players have continued with ASTER accumulation amid recent rumors of a possible Binance listing. Any such development could provide a major liquidity boost, thereby driving the ASTER price higher to fresh all-time highs.

Leading Perpetual Protocol Trading Volume Topping $1 Trillion in September

Perpetual Protocol recorded its highest-ever monthly trading volume in September, surpassing $1 trillion for the first time. Total activity for the month reached $1.226 trillion, with ASTER emerging as the leading contributor, posting $493.61 billion in trading volume.

The BNB Chain-focused ASTER, backed by YZi Labs, rapidly climbed to the top position in Perpetual swap trading, registering more than $420 billion in trading activity. Meanwhile, long-standing Layer 1 platform Hyperliquid slipped to second place with $282.5 billion in volume, dropping by 29% from August’s $398 billion.

In a related development, Aster announced plans to launch its own ZK-based Layer 1 network, dubbed Aster Chain, to further support its growing Perpetual trading ecosystem. This could further contribute to the ASTER token price surge moving ahead.

On the other hand, the broader crypto market has entered consolidation after a strong upside earlier this week. BTC price has now approached closer to its all-time highs at $124,000, while Ethereum (ETH), XRP, and Solana (SOL), are all flat.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs