Binance’s Bitcoin Trading Volume Drop Weakens BTC Price Rally

Binance, the world’s largest crypto exchange, dominates the crypto market due to the massive trading volumes it records on the exchange. However, Bitcoin spot and derivatives trading volumes on Binance are declining in the last few months.

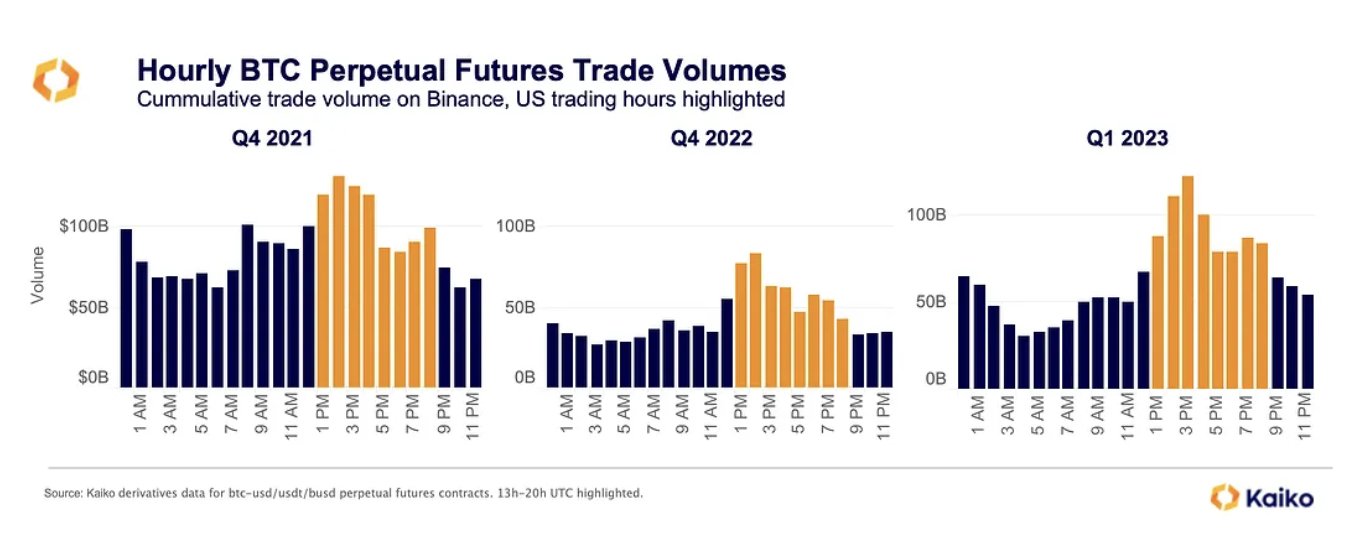

Over the past few years, Binance recorded higher derivatives trading volume in the U.S. hours in comparison to other hours. However, the volumes are dropping during the U.S. hours since the CFTC lawsuit in March, reported Kaiko on April 13.

Bitcoin derivatives trading volume data for BTC-USD, BTC-USDT, and BTC-BUSD perpetual futures contracts indicated trading volume usually rises between 13:00 and 20:00 UTC. The Q1 2023 data was compared with Q4 2021 and Q4 2022 figures, with Binance’s Bitcoin trading volumes almost doubled in U.S. hours.

“However, not charted, we noticed a drop in volumes during U.S. hours since the CFTC lawsuit,” noted Kaiko.

Will Binance’s Trading Volume Drop Impact Bitcoin Price?

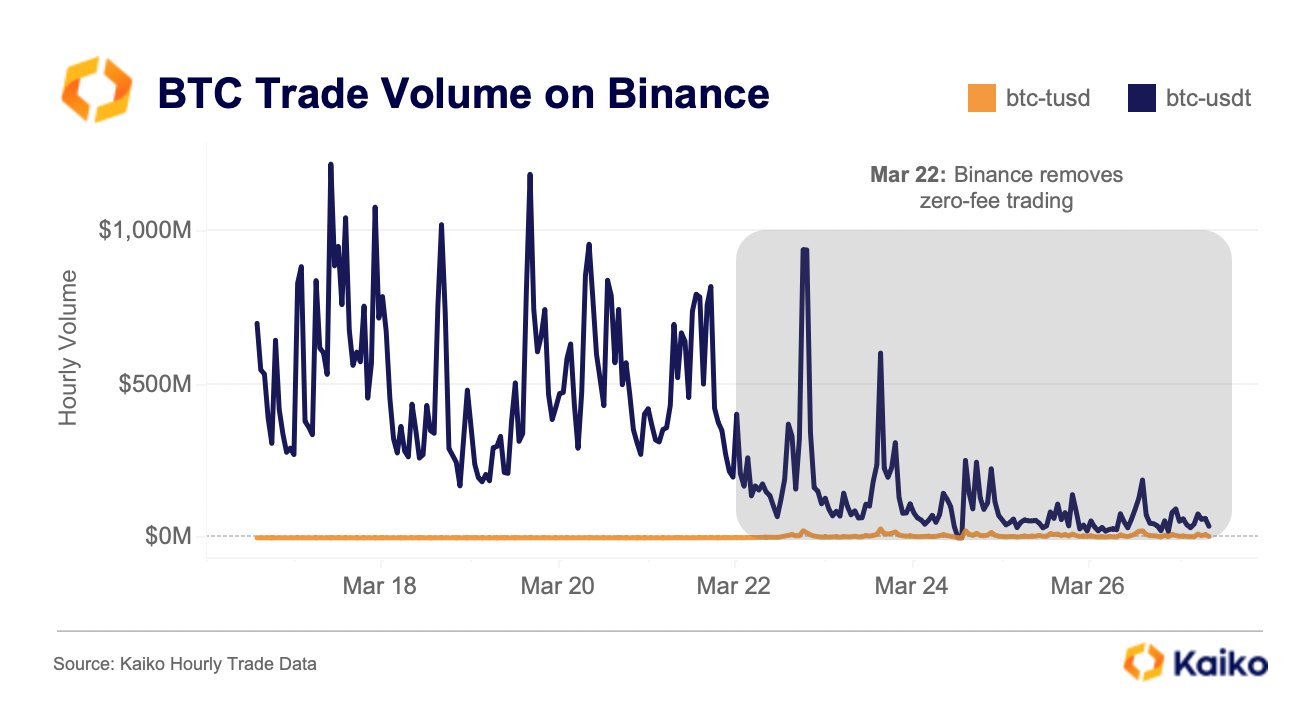

Bitcoin trading volume for the BTC-USDT pair fell 90% on crypto exchange Binance after it ended the zero-fee Bitcoin trading for all trading pairs except TrueUSD (TUSD). While the daily trading volume on BTC-TUSD pair has increased to $170 million, it’s still relatively lower.

Binance made major changes to its zero-fee Bitcoin trading program and BUSD zero-maker fee promotion as part of removing Binance USD (BUSD) after the crackdown by U.S. regulators.

Binance‘s market share dropped to 54% from 70% two weeks ago, the lowest level since November 5, after the CFTC lawsuit and ending some zero-fee trading. Kaiko earlier clarified that CFTC had no impact on Binance’s trading volumes, but today it agreed that it does have some impact.

While Bitcoin has jumped over $30,000, the upcoming price rally is likely to be restrictive. The BTC price is currently trading at $30,255, up 1% in the last 24 hours. Meanwhile, the ETH price has hit $2,000 after the Shanghai upgrade due to massive shorts liquidation.

Also Read: London Stock Exchange To Offer Bitcoin Futures And Options Trading

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold vs. Bitcoin: Can Gold Outperform BTC Amid US–Iran Conflict?

- Bitcoin Faces $1.8B in Panic Selling as U.S.-Iran Airstrikes Escalate; Will BTC Crash Below $60k?

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs