Bitcoin All Exchange Inflows Hit 1-Year High, Massive BTC Shorts Coming In

The world’s largest cryptocurrency Bitcoin (BTC) continues its downward fall at an unprecedented rate. As of press time, Bitcoin is down another 8% slipping under $31,000 for the first time since July 2021.

On-chain data shows that Bitcoin whales have been depositing the BTC on the exchanges in massive numbers. As per data from CryptoQuant, the all-exchange inflows of Bitcoin have touched a 1-year high. Similarly, the spot exchange inflows have touched a two-year high.

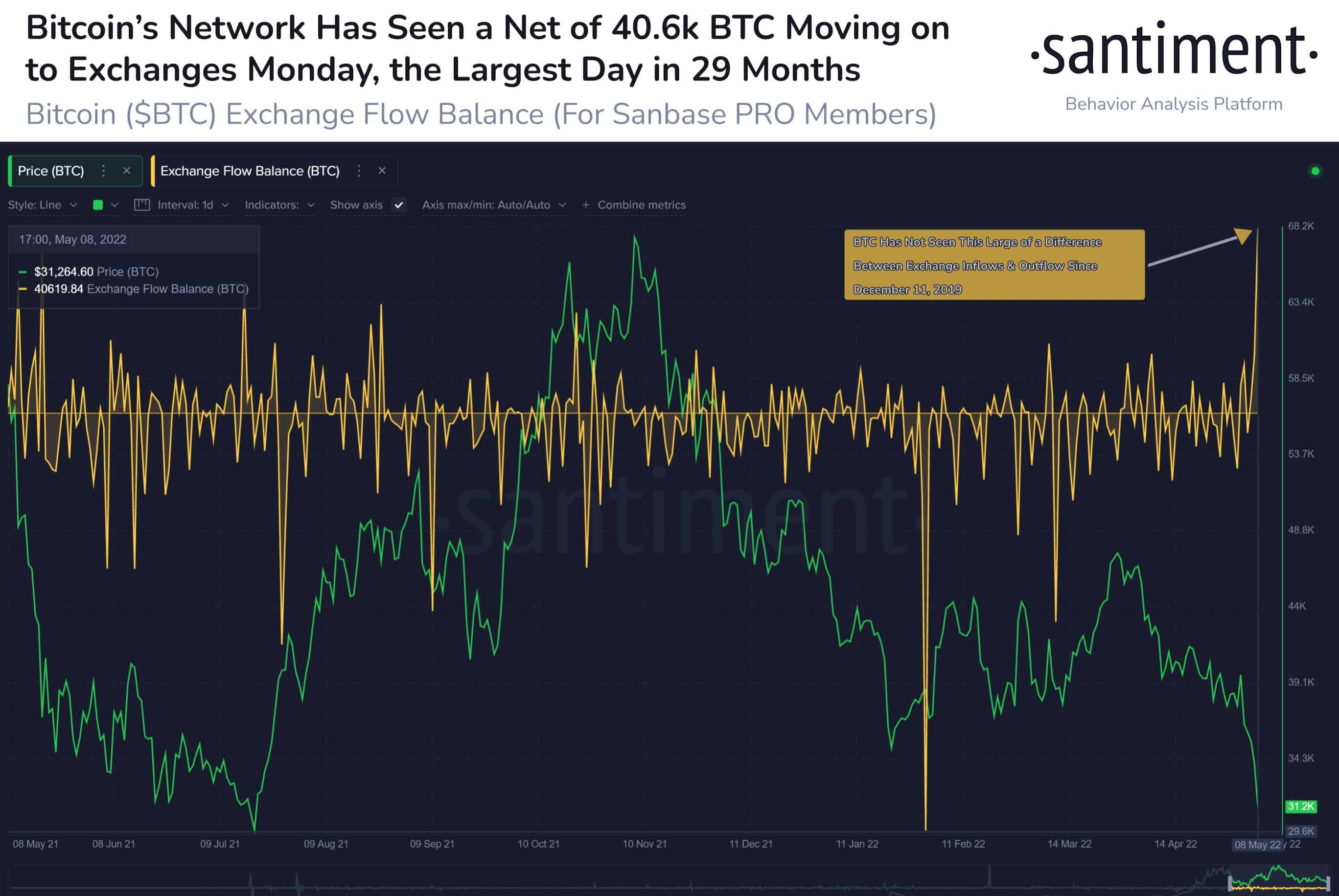

On-chain data from Santiment further shows that more than 40K Bitcoins moved to the exchanges on Monday, the largest single-day inflow after December 2019. Santiment notes:

“As Monday has crossed into its final trading hour (UTC time), a landmark in net Bitcoin moving to exchanges has occurred. Today’s net sum of ~40,620 $BTC in exchange inflow is the largest spike since Dec, 2019. This marks maximal crowd polarization”.

Massive Bitcoin Shorts Coming In

On-chain data provider Santiment reports that the “Funding rate data indicates a massive amount of shorts are coming in after Bitcoin fell below $30k for the first time in about a year”.

📺 Funding rate data indicates a massive amount of shorts are coming in after #Bitcoin fell below $30k for the first time in about a year. Our latest video covers this, trader pain, weak hands exiting, and plenty more as we figure out what's next! 📊 https://t.co/KOeItPxg44 pic.twitter.com/afHkpbB5V6

— Santiment (@santimentfeed) May 10, 2022

It means that the carnage on the crypto street won’t be stopping anytime soon, and investors are in for additional pain. On the other hand, the U.S. equity market is showing up no signs of reversal and continues to head downwards.

Nasdaq Composite (INDEXNASDAQ: .IXIC) was down 4.29% losing more than 500 points in a single day. Dow Jones tanked 2% and the S&P 500 tanked 3.2% on Monday.

As of press time, the broader cryptocurrency is down by 10% currently at $1.4 trillion. Terra’s LUNA remains the biggest loser with all the drama that surrounds the UST stablecoin losing its dollar peg.

However, during this market crunch, El Salvador announced its highest-ever one-time purchase of Bitcoins. The Latin American country purchased 500 Bitcoins valued at $15,372,000.

El Salvador just bought the dip! 🇸🇻

500 coins at an average USD price of ~$30,744 🥳#Bitcoin

— Nayib Bukele (@nayibbukele) May 9, 2022

With its recent purchase, El Salvador holds more than 2,300 Bitcoin in its kitty.

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- Will Crypto Market Crash as U.S.–Iran War Reportedly Imminent?

- Bitcoin Quantum Threat: CryptoQuant’s CEO Flags Risk of Losing Satoshi’s 1M BTC Stash to Hackers

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand