Bitcoin Bounces 6% As Grayscale Breaks ETF Barrier in US Court Win

Grayscale Investments LLC has achieved a significant legal victory. The company, backed by a federal court, can now launch the first-ever Bitcoin exchange-traded fund (ETF) in the United States, marking a potential influx of investment from the general public. Following this announcement, Bitcoin’s price witnessed a notable surge, increasing by 6%.

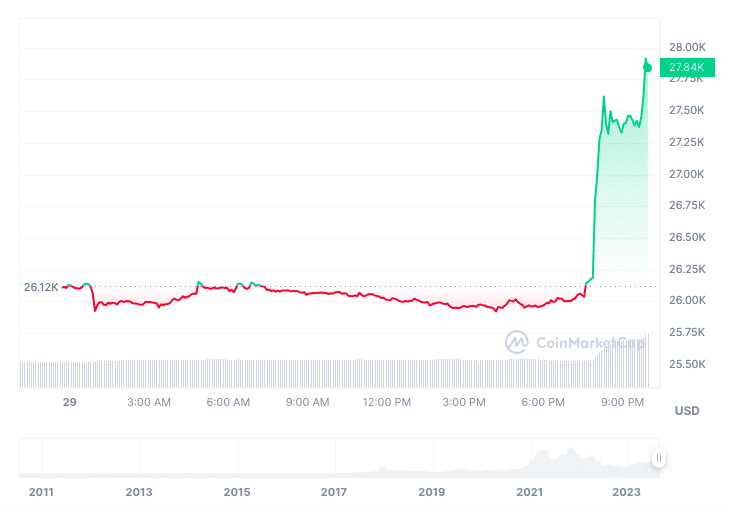

Bitcoin, the dominant digital asset, experienced a 5.31% hike within the last 24 hours, bringing its bitcoin price to $27,506.05. With a 24-hour trading volume that surpassed $17.5 billion, the cryptocurrency remains a global favourite. According to CoinMarketCap, Bitcoin retains its number-one position with an imposing market capitalization of roughly $535.6 billion.

BTC/USD price chart, Source: CoinMarketCap

Grayscale Vs SEC: A Tug of War

The battle between Grayscale and the US Securities and Exchange Commission (SEC) peaked when a three-judge appeals panel in Washington overruled the SEC’s decision to halt the ETF. Judge Neomi Rao commented on the ruling;

“The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products.”

This verdict came after several delays, with the crypto community awaiting the final decision. Grayscale’s pursuit of an ETF was primarily driven by the limitations of its trust’s closed-end structure. Currently, this structure doesn’t permit investors to redeem shares during a price drop, often resulting in the trust trading at significantly discounted rates compared to its underlying Bitcoin assets. With the ETF, Grayscale can create and redeem shares in tandem with fluctuating demand. The move to an ETF could unlock an approximate value of $5.7 billion from Grayscale’s $16.2 billion trust.

A Glimpse into the Past

The US SEC’s initial rejection in June 2022 was rooted in concerns surrounding Bitcoin’s trading on unregulated markets, leading to potential fraud risks. Grayscale responded with a lawsuit, arguing discrimination by the SEC, especially given the approval of similar Bitcoin futures ETFs.

In conclusion, the recent court decision is a testament to cryptocurrency’s ever-evolving landscape in the mainstream financial world. With Grayscale’s groundbreaking achievement, we may be on the brink of even more innovations in the crypto sphere.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs