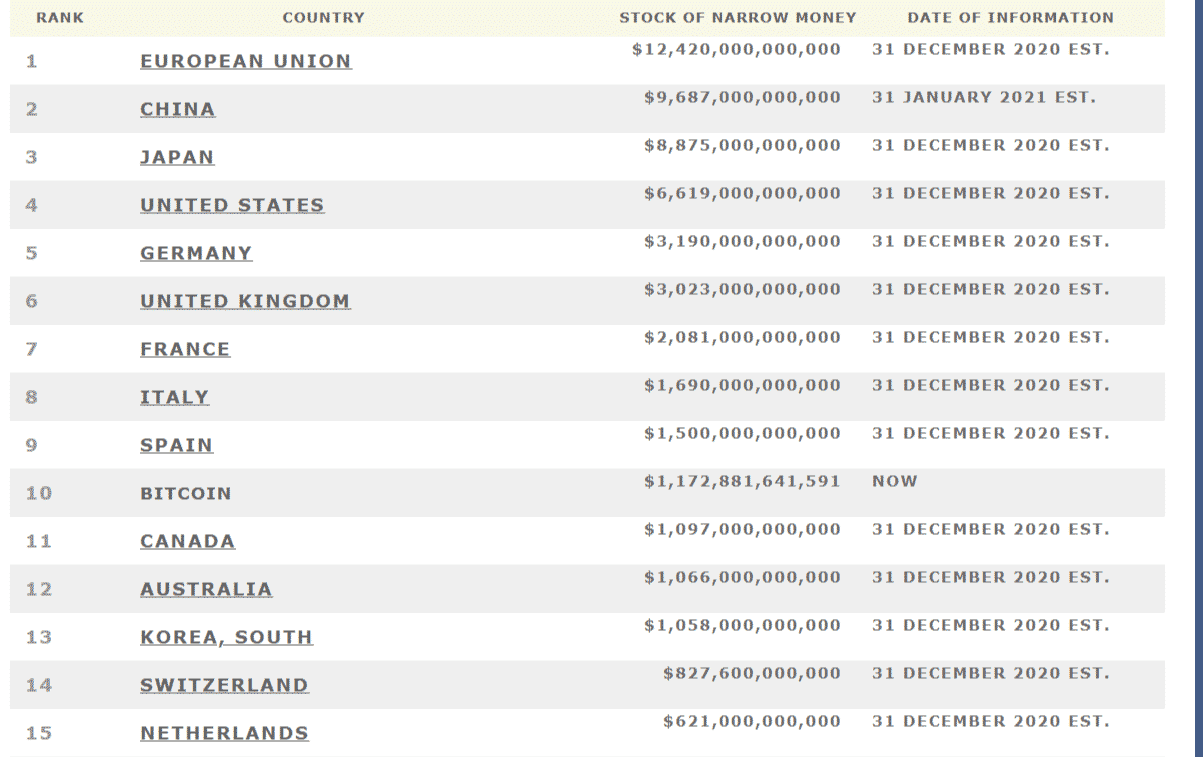

Bitcoin Breaks Into Top-10 Largest Global Currency Leaving behind Canadian (CAD) and Australian Dollar (AUD)

Bitcoin ($BTC) price today registered a new ATH of $63,861 after a month-long consolidation phase. The rising price of Bitcoin along with its market cap has made it top-10 list of largest currencies by M1 Market Supply, leaving behind the likes of the Canadian Dollar (CAD) and Australian Dollar (AUD) to make it to the top-10 list of global currencies.

At $64,000 price Bitcoin would overtake British Pound to become the 6th largest currency in the world. The rapid rise of Bitcoin this bull season has sent Wall Street investors and fund managers rushing to add Bitcoin to their portfolio. On the other hand, Fortune-500 companies such as MicroStrategy and Tesla have started using Bitcoin as a Treasury Hedge.

The rapid growth and adoption of Bitcoin have also made regulators around the world realize the growing influence of Bitcoin as the future of finance forcing policymakers to change their regressive approach owing to the growing demand.

Current Bitcoin Demand Only Tip of IceBerg

The rush among wall street giants such as Goldman Sachs, Morgan Stanley, JP Morgan, BlackRock, and many others to add Bitcoin to their offerings over the past 3-4 months might seem overwhelming, but it is nothing compared to the actual demand that would come over the next few years with better regulations. One of the key tools that would act as a catalyst for expanding the Bitcoin market would be the approval of Bitcoin ETFs in the US.

A total of 9 Bitcoin ETF application has been filed before the US SEC for approval over the past few months, the latest coming from crypto fund manager Galaxy Digital. A Bitcoin-based exchange-traded fund would allow investors to invest in Funds that would track the price of the top cryptocurrency. The first Bitcoin ETF launched by Purpose group in North America has already turned into a big success, amassing over $1 billion worth of BTC within two months of its launch.

The limited 21 million supply and the Bitcoin block reward halving in the month of May last year also played a key part in the ongoing bull run. As more people and investors start realizing the value of the diminishing market supply more people would rush to gain Bitcoin exposure.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

Buy $GGs

Buy $GGs