Bitcoin (BTC) And Crypto Market Make V-Shape Recovery After SEC Lawsuits

In a strong recovery, Bitcoin (BTC) and the broader cryptocurrency market are up by 4% almost recovering all of the early week losses. As of press time, the Bitcoin (BTC) price is up by 4.59% and is currently trading at $26,920 adding $21 billion to its market cap in the last 24 hours.

On Tuesday, June 6, the broader cryptocurrency market entered a steep correction following the SEC lawsuit on Binance. A day later, the SEC targeted another major crypto trading giant Coinbase in a similar lawsuit accusing the exchange of securities laws violations.

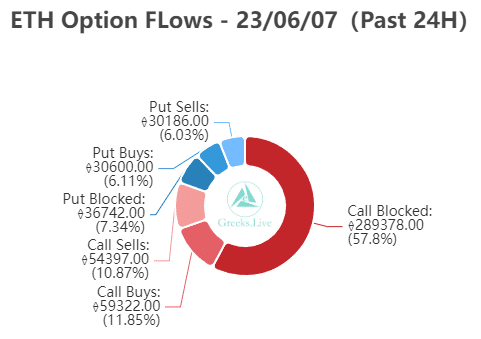

However, it seems for now that investors have chosen to look past the regulatory developments. Wiping the negative impact of SEC’s yesterday’s complaints, BTC and ETH have registered a V-shaped recovery in the market. As of press time, ETH is up by 3.64% and is currently trading at $1,878. The latest report from Greeks.live shows:

“The V-reverse market drove options volume sharply higher, with daily volume up over 400%, while short-term IV rose slightly. Of particular interest was the 290k ETH block calls traded yesterday, accounting for 57% of the day’s volume, with a notional value of $540 million, consisting mainly of nearly 100,000 sets of calendar spreads, with the strike price of this Whale Bid lower compared to last month”.

As per the Giant Whale’s assessment of the current market, Greeks.live notes that it will be difficult to get back above $2,000 and this V-shaped recovery doesn’t change the fact that the bearish sentiments are overwhelming.

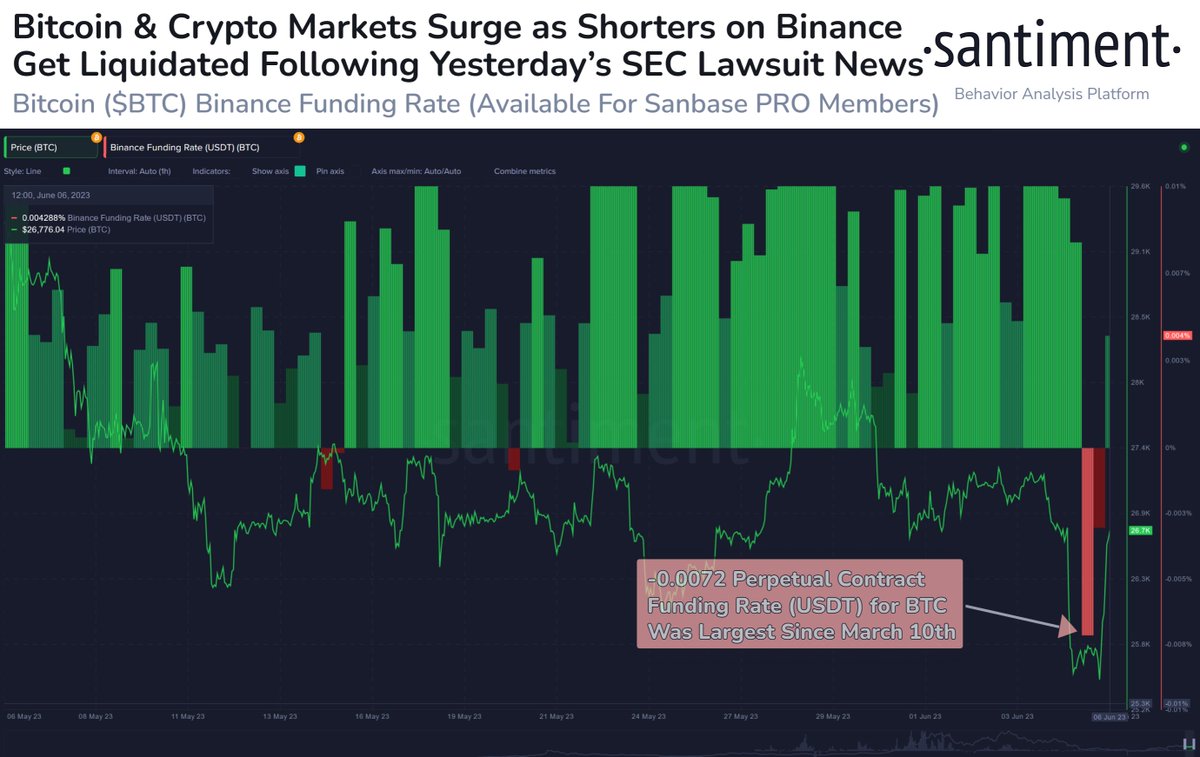

Bitcoin Shorters Liquidated, Buy the Dip Sentiment Rising

On-chain data from Binance shows that shorters got liquidated amid the strong recovery in the market. It noted: “Traders had many #liquidated #shorts today after showing some over-eagerness to bet against markets. The largest shorts in 3 months acted as rocket fuel as $BTC jumped back above $27k. We saw a similar price bounce when traders shorted on March 10th”.

Santiment also reported that buy-the-dip sentiment in the market picked up as crypto prices plummeted this week earlier.

📈 As there was increased crowd #buythedip interest as #crypto prices plummeted yesterday, it was shortly after the crowd gave up when prices began to soar. Avoiding the mainstream hype is a typical strategy that contrarian traders can take advantage of. https://t.co/GBNy8U3aW3 pic.twitter.com/El2RfI6N7u

— Santiment (@santimentfeed) June 6, 2023

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?