Bitcoin (BTC) Could Dip To $59K Flashing A Buy Signal, Here’s Why

Highlights

- Bitcoin faces a potential dip to $59K due to sell signals, sparking market speculation.

- Analysts suggest the current Bitcoin downturn may signal a lucrative buying opportunity for investors.

- Market experts predict Bitcoin price fluctuation between $56K to $70K, with a bullish long-term outlook.

The Bitcoin price has slumped over 4% today amid a selloff in the broader cryptocurrency market, sparking discussions over the future trajectory of the flagship crypto. Amid the recent crash, a prominent crypto market analyst warned over a potential dip in BTC price to $59,000.

However, according to several other market experts, this dip may present a lucrative buying opportunity for the market participants. So, let’s take a closer look at the analysts’ predictions to understand the current market trend.

Analyst Predicts Bitcoin Price Dip To $59K

The recent decline in the Bitcoin price has weighed on the investors’ sentiment globally. Given the recent crypto market crash, many are speculating over the potential scenario of the broader market in the coming days.

Amid this, a prominent analyst Ali Martinez shared an important BTC analysis. According to Ali Martinez, Bitcoin faces two significant sell signals: a death cross between the 50 and 100 SMA, and a red 9 candlestick from the TD Sequential. Notably, Martinez’s analysis suggests that if Bitcoin falls below $63,300, it could plummet to $61,000 or even $59,000, sparking speculation over a potential breach of the $60,000 mark.

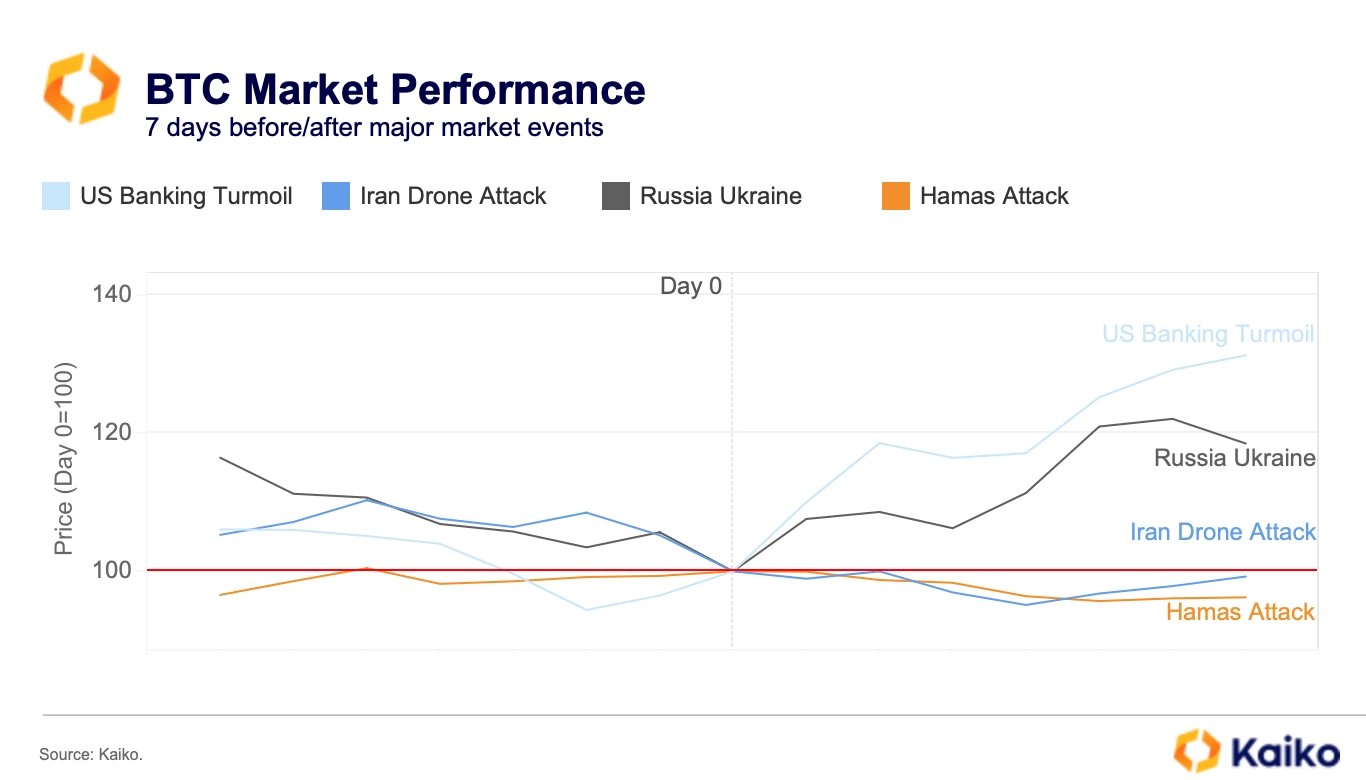

Simultaneously, Kaiko, an on-chain analytical firm, also shared a bearish sentiment, attributing Bitcoin’s recent 6% drop in April to geopolitical turmoils. While traditional safe-haven assets like gold and the US Dollar rallied, Bitcoin failed to capitalize on market turbulence, fueling concerns over its resilience amidst global uncertainty.

Also Read: CryptoQuant CEO Slams DoJ For Charges Against Samourai Wallet Founders

Is The Recent Dip Flashing A Buying Signal?

Amid discussions surrounding a potential downturn in Bitcoin’s price below the $60,000 mark, market experts are heralding it as a buy signal for savvy investors. Despite short-term volatility projections after the recent Bitcoin Halving event, long-term forecasts paint a promising picture of BTC’s trajectory.

For context, Spot On Chain’s analysis, powered by Google Cloud’s Vertex AI, forecasts BTC prices fluctuating between $56k to $70k throughout May, June, and July 2024, with a 48% chance of dipping below $60k. However, looking further ahead, they anticipate significant movement in the second half of 2024, with a 63% likelihood of hitting $100K and a 42% probability of surpassing $150k in the first half of 2025.

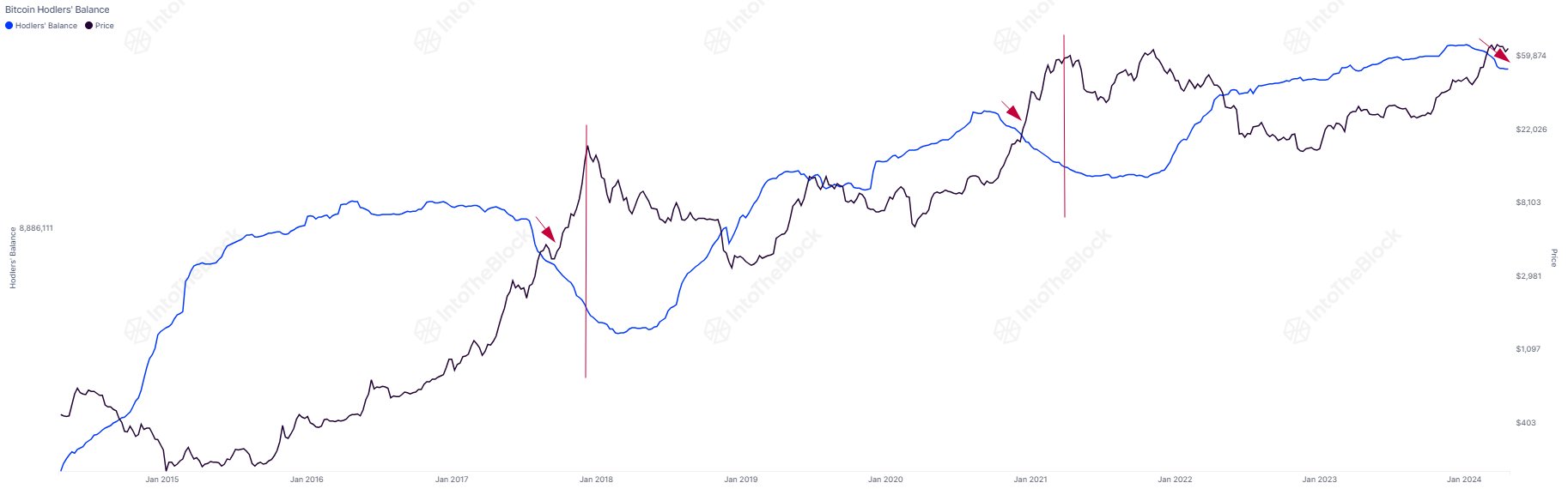

Echoing this sentiment, IntoTheBlock notes that seasoned Bitcoin holders have begun selling off their holdings, a trend typically observed at the onset and peak of bull markets. Meanwhile, despite initial concerns, they reassure investors that this behavior aligns with historical market cycles and stress that ample time remains compared to previous cycles.

What’s Next?

CryptoQuant data reveals a negative turn in the Bitcoin Coinbase Premium Gap, suggesting significant selling pressure from US investors on Coinbase. Notably, as of April 24, the gap stood at -33.81.

While this sentiment may signal a bearish trend, it presents a potential buying opportunity for investors eyeing Bitcoin at a discounted price. Besides, considering the optimistic long-term outlook for Bitcoin, this dip could serve as a strategic entry point for investors aiming to capitalize on future growth.

As of writing, the Bitcoin price was down 4.39% and traded at $63,486.12, while its trading volume soared 35.40% to $32.42 billion. The flagship crypto has touched a high of $66,730.43 in the last 24 hours, reflecting the highly volatile scenario in the cryptocurrency market.

Also Read: XRP Whales Shift 150M Coins As Price Dips To $0.52, What’s Next?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- ZachXBT Names Axiom Exchange in Alleged Employee Crypto Insider Trading Investigation

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs