Bitcoin (BTC) Social Dominance Hits Yearly High Ahead Of Key Event

The discussions on Bitcoin (BTC) appear to have risen drastically in the recent past. The last time such a high ratio of discussions was recorded in June last year. However, people remain skeptical of the Bitcoin price before the U.S. June CPI data on July 13. Currently, the BTC price is extremely volatile as it continues to move around the $20,000 level.

Discussions on Bitcoin (BTC) Reaches Yearly High

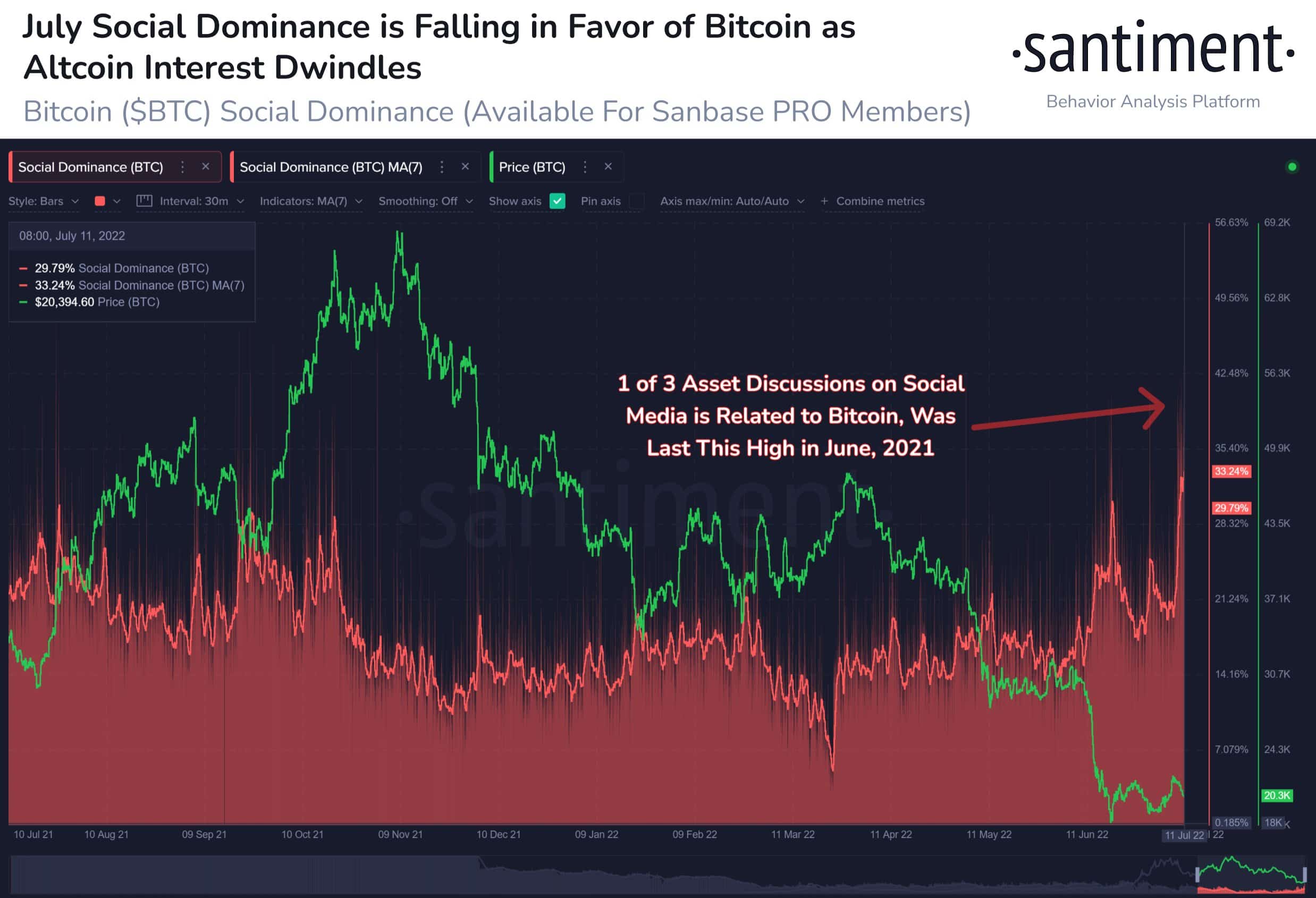

According to Santiment, Bitcoin’s Social Dominance metric has jumped yearly high. As the Bitcoin price has slipped below the 20,000 level, interest in Bitcoin (BTC) is rising and discussions over other crypto topics have faded. Historically, this has been considered a good sign for Bitcoin as well as the crypto market.

“The ratio of discussions related to Bitcoin vs. all crypto topics has risen swiftly on social media. BTC‘s social dominance is now at its highest point since June 2021. Historically, focus coming back to BTC is a good sign for crypto bulls.”

Altcoins including Ethereum, Solana, Cardano, and XRP have failed to show significant price movements amid pressure due to the liquidity crisis and bankruptcy filing by Three Arrows and Voyager Digital. Whereas, Dogecoin and Shiba Inu have shown some strength as a result of whales buying and latest developments.

The U.S. June CPI data is scheduled to be released tomorrow, July 13. The White House press secretary Karine Jean-Pierre expects the inflation data to be “highly elevated” due to an increase in gasoline and food prices. However, the falling energy prices in July indicate improvement in the following months.

Rising inflation may force the Fed to raise the interest rate by another 75 bps as the June CPI data will be important amid rising recession fear.

BTC and Ethereum Discussion Surges Before the CPI Data

Crypto prices jumped last week as sentiments improved a little. Bitcoin (BTC) prices soar higher over the $22,000 level on July 8. However, crypto prices are volatile and retracing as the CPI report date approaches.

Discussions on Bitcoin and Ethereum have risen with reports predicting prices to fall below key support levels. According to the MLIV Pulse survey, 60% of the individuals surveyed think BTC could fall to $10,000, while 40% say BTC price will eventually rally to reach $30,000.

Bitcoin price is currently trading at $19,900, down 4% in the last 24 hours. Ethereum (ETH) is at $1068, down over 6% in a day.

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?