Bitcoin (BTC) Tanks Another 4%, Here’s Why Starters Should Avoid “Buy The Dips”

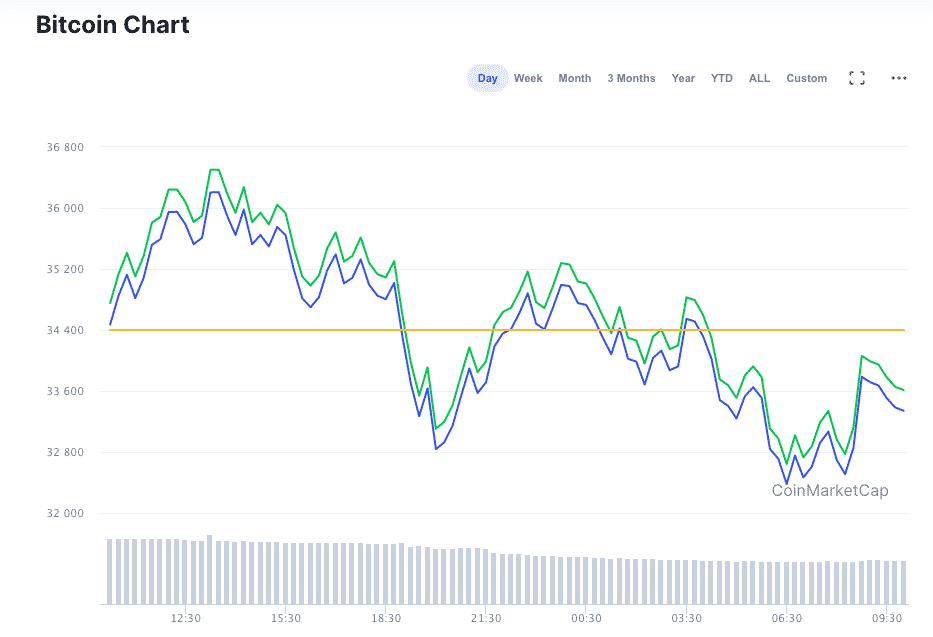

As CoinGape predicted yesterday, Bitcoin (BTC) has finally entered another correction with exchange inflows and outflows showing no improvement over the previous day. At press time, Bitcoin (BTC) has corrected another 4% and is trading below $33,500 levels. If we see the Bitcoin daily chart, the BTC price corrected nearly 10% for the second time in a span of just 24-hours.

Interestingly, Bitcoin has been showing similar behavior in the past as well! This goes on to explain why shorters should avoid the popular saying “buy the dips” every time Bitcoin drops. On-chain data provider Santiment explains that “avoid ‘buying the dips’ when the crowd consensus is to ‘buy the dips'”. Interestingly, being cautious and fearful can be good at times as an investor.

So what exactly should you be looking for to stay safe when #Bitcoin has the kind of drop it saw this weekend? For starters, as strange as it sounds, avoid "buying the dip" when the crowd consensus is to "buy the dip". This indicates a lack of fear that pic.twitter.com/oJBifA6vUm

— Santiment (@santimentfeed) January 12, 2021

This is especially true for starters who are new to the game and who haven’t tasted the sour taste of Bitcoin volatility in the past. Bitcoin (BTC) inherently has been a volatile asset class and we must respect that! If we look at the long-term, Bitcoin (BTC) continues to surge above and beyond every time it enters a sharp correction.

On Tuesday, January 12, another $410 million in long positions for the Bitcoin (BTC) futures contracts were liquidated on Binance, the largest daily value liquidation to date.

Yesterday, a total of $410M (!) in $BTC long positions in futures contracts were liquidated on Binance – marking the largest daily value to date.#Bitcoin

Chart: https://t.co/iG1CakH6kv pic.twitter.com/RZA4ulLoLB

— glassnode (@glassnode) January 12, 2021

It looks like the bulls have finally exhausted after weeks of continued institutional participation. It looks like the dust isn’t settled yet as BTC forms another bearish head-and-shoulder pattern on charts. This fresh flow of big capital can only take the BTC price back to $40,000 and above.

#bitcoin could be about to complete a bearish head and shoulder pattern. Need a billionaire to announce their mega BTC buy for more bull energy. pic.twitter.com/BeIsZkhPpb

— Lark Davis (@TheCryptoLark) January 12, 2021

While Bitcoin price has corrected recently, its on-chain fundamentals like hash-rate and miner activity remain at an all-time high. The selling pressure from miners, who resorted to profit-booking, is pushing the price down at the moment.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs