Bitcoin (BTC) Technical Set Up Supports Tactical Shorts, What’s ahead?

Last week, the world’s largest cryptocurrency made a strong move to $25,000, however, it facing strong resistance at those levels. As of press time, BTC is trading 1% down at $24,615 and a market cap of $475 billion.

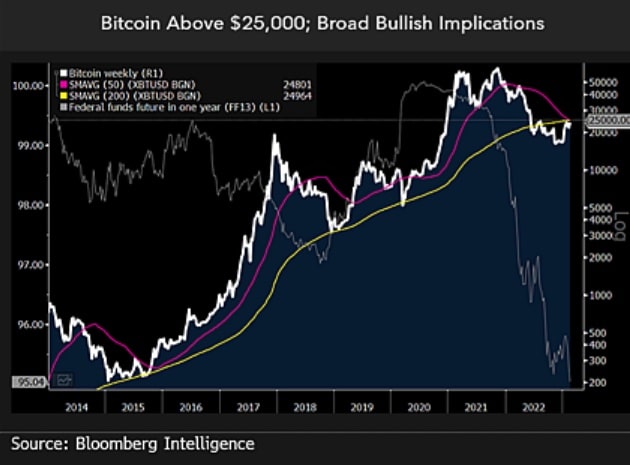

Bloomberg’s senior commodity strategist Mike McGlone explains how the current technical setup for Bitcoin supports tactical shorts. During the entire Fed tightening season, Bitcoin’s 50-week moving average has never crossed under its 200-week moving average. However, the possibility of that happening now has come closer.

However, if the BTC price manages to swing above $25,000, it would signal a divergent strength against the Fed’s decisions. The CPI data for January 2023 continues to suggest that inflation remains sticky and that Fed could continue to raise interest rates going ahead. In his latest tweet, Mike McGlone wrote:

Hollow Rally or Enduring Recovery? Bitcoin $25,000 vs. the Fed – Cryptos have never faced a US recession, Fed tightening and the Bitcoin 50-week moving average below the 200-wk. My long-term bias is quite bullish, but the 1Q bounce to good resistance may favor tactical shorts.

Bitcoin, Crypto and Stock Markets

Bitcoin and the broader cryptocurrency market rallied with the impetus provided by the surge on Wall Street. In fact, the crypto market has managed to outpace the traditional markets in 2023.

Since the beginning of 2023, the S&P 500 is up by 6% while the Nasdaq 100 is up by 13%. On the other hand, the MVIS CryptoCompare Digital Assets 100 Index of leading tokens is up 40%.

On the other hand, Hong Kong is planning to relax rules and allow retail traders to trade larger cryptocurrencies like Bitcoin and Ethereum. This would lead to increased liquidity in the crypto space going ahead. The retail backing has so far helped BTC surge by over 50% since the start of 2023. JPMorgan Chase & Co. strategist Nikolaos Panigirtzoglou said:

“This positive retail impulse year-to-date is naturally more dominant in crypto given the absence of institutional investors at the moment”.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs