Bitcoin Bull Cathie Wood’s Ark Invest Extends Coinbase And Robinhood Selling Spree

Bitcoin bull Cathie Wood’s asset management firm Ark Invest extends Coinbase (COIN) and Robinhood Markets (HOOD) selling spree as crypto shares take a hit despite a rally across the crypto market. Bitcoin surpassed $45.5K on Tuesday for the first time in last 2 years as investors consider a spot Bitcoin ETF approval by the US SEC.

Negative sentiment today is causing Coinbase and other crypto shares to open much lower. Interestingly, Cathie Wood was on the mark again with another accurate prediction.

Ark Invest Sells Coinbase and Robinhood Shares

On Jan 2, Cathie Wood’s Ark Invest sold a total of 3,360 Coinbase shares worth over $580K and 23,606 Robinhood shares worth nearly $300K, as per trades seen by CoinGape.

ARK Innovation ETF (ARKK) sold 2,944 Coinbase shares, ARK Next Generation Internet ETF (ARKW) offloaded 329 COIN shares, and ARK Fintech Innovation ETF (ARKF) sold 87 COIN stocks.

Ark Invest funds look to continue to offload COIN shares worth millions this month as part of its active fund management strategy, extending its selloff run of the last year.

Coinbase (COIN) price fell 9.80% on Tuesday, closing at $156.88. The price is falling by 7.35% in the pre-market hours on Wednesday.

In addition, ARK Next Generation Internet ETF (ARKW) sold 23,606 Robinhood Markets (HOOD) shares. Ark Invest offloaded 121,100 HOOD shares last time on December 19 after HOOD shares closed 10.4% higher at $13.17.

HOOD price also closed 2.90% lower at $12.37 on Tuesday and appears to open further lower on Wednesday as it trades almost 6% down in premarket hours today.

Also Read: Binance Announces New Solana (SOL), BNB, NFP, SEI & Other Crypto Margin Pairs

Ark Invest 21Shares Spot Bitcoin ETF Approval

Ark Invest sold 2.25 million Grayscale Bitcoin Trust (GBTC) shares worth $81 million last week. ARKW parked funds in ARK 21Shares Active Bitcoin Futures Strategy ETF (ARKA) and ProShares Bitcoin Strategy ETF (BITO) in preparation for its ARKB spot Bitcoin ETF approval.

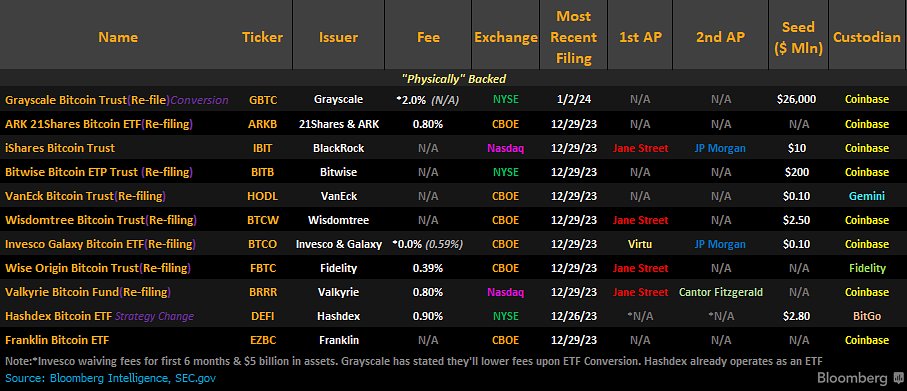

The spot Bitcoin ETF issuers expect to hear soon from the U.S. SEC on potential approval, with the approval window opening between Jan 5-10, 2024.

Notably, 11 issuers including Ark 21Shares have updated their spot Bitcoin ETF with APs, fees, and other changes and await the SEC’s decision.

Also Read: Crypto In Crosshairs As EU Regulators To Probe Banks-NBFIs Links

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act