Bitcoin, Crypto Market to Remain Range-Bound After FOMC Meeting, Matrixport Predicts

Highlights

- Matrixport predicts a range-bound Bitcoin and crypto market in December after FOMC meeting.

- Fading implied volatility would cause Bitcoin price to consolidate despite Fed rate cut.

- BTC options data shows BTC stuck under $100,000 until March next year.

- Mixed reactions in the market Bitcoin move in line with 2-month descending trendline.

Bitcoin trades above $92,000 ahead of the key FOMC Meeting, with the broader crypto market expecting a further rebound to officially mark a recovery. Matrixport predicts a range-bound market despite another 25bps Fed rate cut.

Global investors will also closely watch Fed Chair Jerome Powell’s post-meeting remarks on the 2026 monetary policy outlook following the end of quantitative tightening (QT).

Why Bitcoin Price and Crypto Market Set to Consolidate After FOMC?

Today’s FOMC meeting marks the final major catalyst for further upside in Bitcoin price and the crypto market. Matrixport predicts Bitcoin will trade in a range-bound manner through December.

Analyst Markus Thielen added that the odds of a Bitcoin breakout and upside momentum post-FOMC into year-end will diminish without spot Bitcoin ETF inflows and other catalysts.

Traders remain cautious ahead of the Fed rate decision, Powell’s press conference on monetary outlook, and the FOMC economic projections. Markets expect last week’s end of quantitative tightening (QT) to further improve financial conditions and liquidity in the markets, including the crypto market.

However, Matrixport claims adjustments towards a fall in Bitcoin price back to $88,000 level are already underway. Deribit’s BTC options data shows traders see BTC could remain stuck under $100,000 until March next year.

FED to Cut Rates by Another 25 Basis Points

The CME FedWatch tool shows more than 87% odds of another 25 bps Fed rate cut by the central bank today, bringing the target range to 3.50%-3.75%.

The Wall Street Journal’s Nick Timiraos said the market will watch “Powell stitch together enough consensus to minimize dissents to the same two that opposed the 25 bps cut last time.”

However, the key focus is on Fed rate cuts next year as FOMC officials remain divided on today’s rate-cut odds. Also, a rate hike by the Bank of Japan could cause Bitcoin and the broader crypto market to crash amid Yen carry trade unwind jitters.

Analysts Expectation on Bitcoin Price

BTC price has surged by 3% in the past 24 hours, currently trading at $92,732. The 24-hour low and high are $89,977 and $94,601, respectively. Furthermore, a 13% increase in trading volume over the past 24 hours indicates interest among traders.

However, Bitcoin is still trading below the 50-MA and 200-MA on the daily chart. As analysts pointed out earlier, $93K-$94K is the major resistance zone.

Analyst PlanC noted that a descending trendline breakout above $93,000 could trigger a rally towards $100K. However, a strong rejection at this trendline would signal the continuation of the two-month downtrend and lower lows.

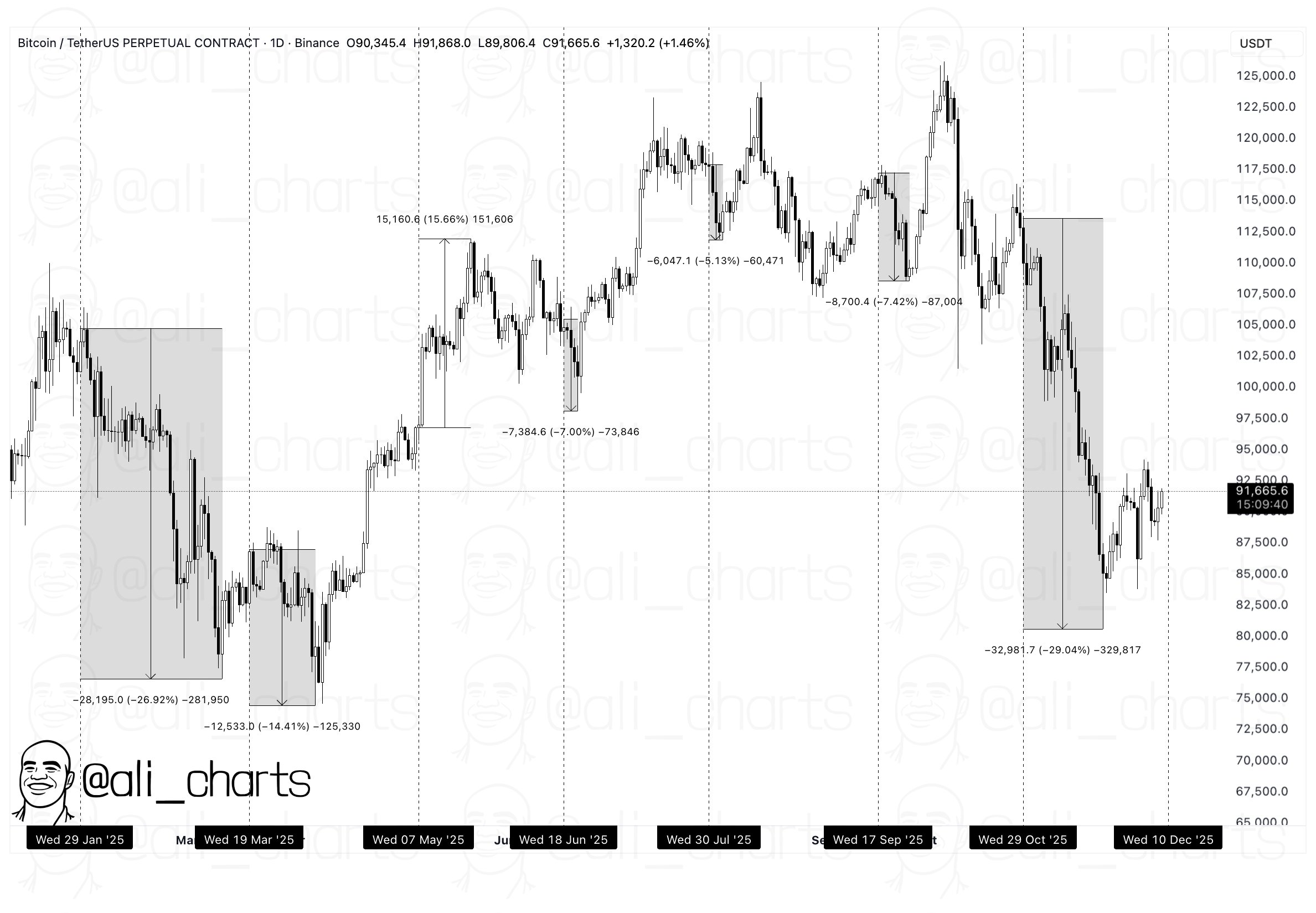

Crypto analyst Ali Martinez highlights Bitcoin price corrections in the last 6 out of 7 FOMC meetings. He added that only one FOMC in May has triggered a short-term rally.

Meanwhile, analyst Crypto Tony claims BTC could go down again below $90K. “FOMC today so really can be a wicky day. Anything less than 50 BPS and we dump IMO,” he added.

CoinGlass data shows buying in derivatives markets in the last few hours. At the time of writing, the total BTC futures open interest jumped 0.76% to $59.10 billion in the past 4 hours. The 24-hour BTC futures OI on CME and Binance climbed more than 4% and 2%, respectively.

Also Read: Best Crypto Tools for Research and Analysis in 2025

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs