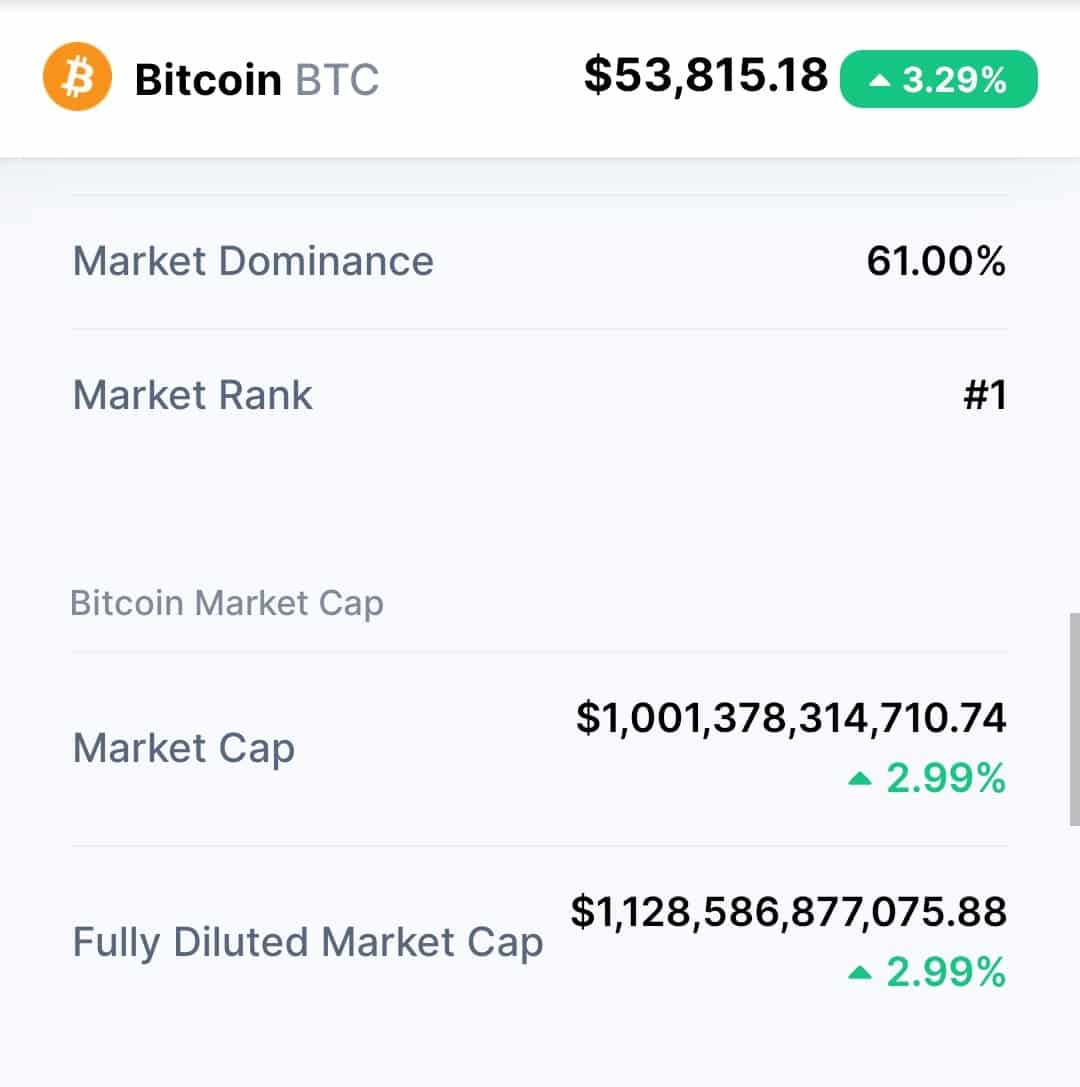

Bitcoin Marketcap Breaches $1 Trillion With New ATH of $53,756

Bitcoin breached the $53,000 price to register a new all-time high of $53,756 and also breached the $1 trillion market cap during the process. The top cryptocurrency has been on a dream run since the last quarter of 2020 and has added nearly $40k to its price since the bull run began towards the end of October 2020.

The mammoth price rise has been aided with booming mainstream adoption by retail and institutions alike. While the 2017 bull run brought bitcoin the mainstream attention, the current bull run has seen Bitcoin gain widespread mainstream adoption from traditional financial institutions as well as fortune 500 companies.

BREAKING: Bitcoin just reached a $1 trillion market cap for the first time in history.

— Pomp ???? (@APompliano) February 19, 2021

Bitcoin price is slated to touch the 6-figure mark by the end of this year with price prediction varying from $100,000 to $220,000. Many analysts believe bitcoin is currently in a supercycle rather than just another bull run. The fact that Bitcoin has not only rose by 2.5X it’s 2017 high, unlike earlier the top cryptocurrency has maintained its gains. The previous bull runs came in bursts and lasted anywhere from few weeks to a couple of months, however, the current bull run is already in its 5th month.

On-Chain Metrics Suggest Another Impressive Price Rally

The top cryptocurrency has posted a new all-time-high every week since the start of February and on-chain metrics such as funding rate and stablecoin inflow are bullish enough for another price rally that could send bitcoin to $60,000 anytime soon.

More like 2013 than 2017???? pic.twitter.com/H5hzBEYHKN

— PlanB (@100trillionUSD) February 18, 2021

The institutional influx added with consumer tech companies such as Twitter and Uber planning to integrate bitcoin is big bullish news along with continuous buying from MicroStrategy, Grayscale, and Paypal. The shortage of bitcoin due to its fixed cap added with rising demand is fueling its price further.

The top cryptocurrency’s growing institutional demand could also see the launch of the first regulated Bitcoin ETF product in the US market this year as Bitcoin is now a trillion-dollar asset. The success of the North American bitcoin ETF called The Purpose Bitcoin ETF (BTCC) on debut could also propel American investors to agree to the ETF.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- BitMine’s Tom Lee Bets on ‘March Turnaround’ to Spark Crypto Market Recovery

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

Buy $GGs

Buy $GGs