Bitcoin Price Analysis: Which Way For BTC As It Consolidates Above $56,500?

Bitcoin (BTC) is trading above $56,000 with a bullish bias amid decreasing price volatility as market participants wait to see the direction the big crypto is likely to take before the year ends. If Bitcoin price moves up, it is likely to confirm the Santa Claus rally thesis that some analysts believe will taken BTC to new record highs before the year ends. However, if BTC continues the recent correction it may drop to lower levels as we go into the new year.

Bitcoin Price Holds Above The 50 SMA

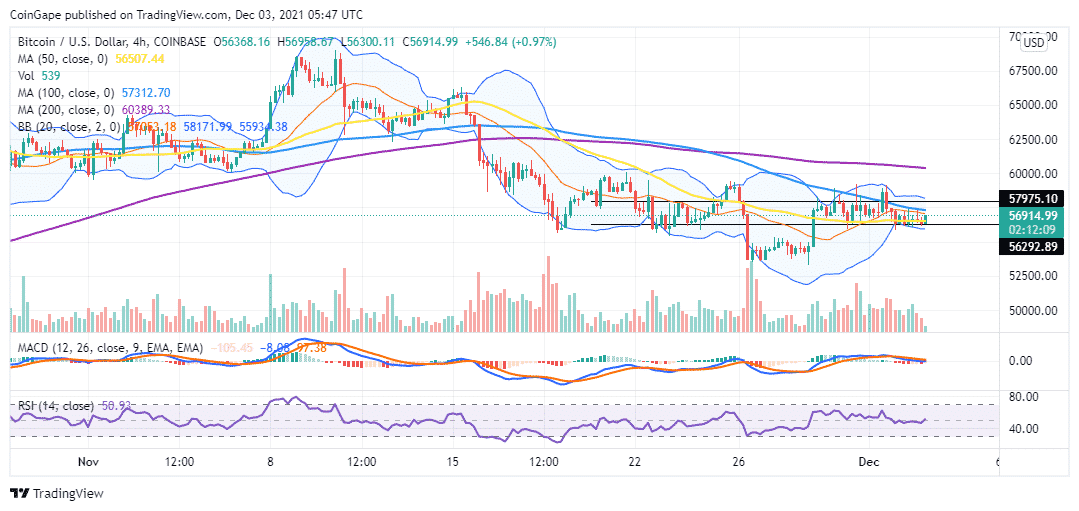

BTC/USD has displayed a sideways price action since rising above the 50-period Simple Movign Average (SMA) on November 28 as seen on the four-hour chart. Since then, Bitcoin has successfully closed above the 50 SMA, expect for few sessions.

At the time of writing, Bitcoin price trades at $56,914 with a bullish bias amid decreasing price volatility suggesting market consolidation. This is accentuated by the sideways price action, the flattening moving averages and the squeezing of the Bollinger Bands (BB). Note that the more the Bollinger Bands move towards each other, the more the price volatility decreases and Bitcoin price may break out in either direction.

The position of the Relative Strength Index (RSI) at 50.26 and the position of the Movign Average Convergence Divergence (MACD) at the zero line validate BTC’s consolidation.

BTC/USD Four-Hour Chart

Which Way BTC?

A bullish break out will be confirmed if Bitcoin overcomes the immediate resistance at $57,300 embraced by the 100 SMA. If this happens, the price of the pioneer cryptocurrency will rise to tag the $57,975 resistance after which a move towards the $60,000 crucial level will be the next logical move.

However, Bitcoin will favours the bears, if it loses the $56,504 support embraced by the 50 SMA and drop towards the $56,292 support floor. A further drop below this point will trigger massive sell orders that are likely to take Bitcoin towards the November 28 intraday low at $53,292.

At the moment, investors need to be patient as we wait to see the direction is likely to take.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs