Bitcoin: BitMEX Liquidations Now Over $1.4 Billion, Causes Wild Swings in Price

Bitcoin [BTC] price is extremely volatile at the moment, with the charts going haywire. In the last 4-hours it has seen a downfall of $1950 from %$5800 to $3850. Nevertheless, heavy buying action followed as the price re-coupes its losses above $5500.

While its easy to attach ‘buying action’ as an explanation, the entire move in the last few hours was not organic, even by Bitcoin’s standards.

BitMEX Prevents Log-ins

According to datamish, in the last 4-hours over $478 million long orders have been liquidated on BitMEX. The long squeeze of orders is identified as the leading cause of bears at the moment, with spot exchanges looking to buy.

In the last four hours, the liquidation on Bitfinex was of 3,356 Bitcoins, around $15 million dollars.The open interest on Binance as well dropped by more than $20 million during the same time pointing at liquidations.

On a daily scale the total liquidations on BitMEX is around $1.44 billion, by far the largest.

Leading derivatives and crypto trader, Jacob Canfield tweeted on the price action,

Market is NOT SAFE to trade right now. Bitmex price just went from 3600 to 4400 to 3600 and prevented all logins. Coinbase just went to $5500.

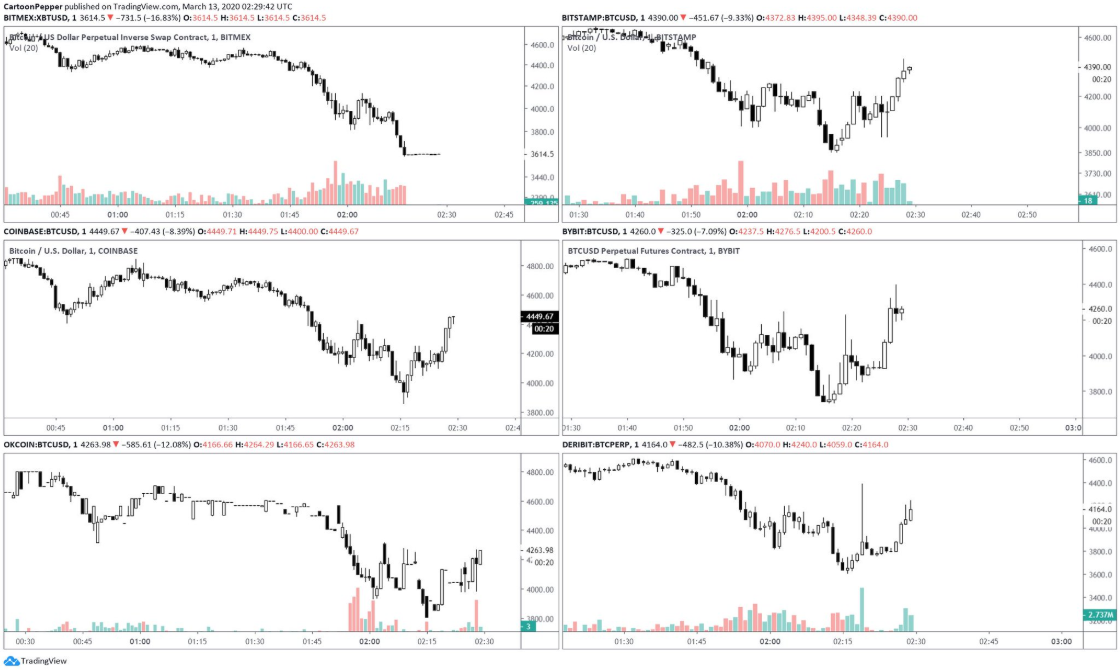

In the 5-min chart below, notice how the price of Bitcoin has stalled off due to inactivity, while Coinbase sees a rise of over $1500 is less than 15 minutes.

Prominent crypto trader, Salsatekila identifies BitMEX as the black sheep causing all the selling pressure at the moment. Reportedly, it went down for nearly 15 minutes after dropping to $3600. The spot buyers, on the other hand, were ready the buy into the panic. He tweeted,

Bitmex (top left) goes down and buyers come in across the board?

Bitcoin Basis, i.e. the difference between the the spot exchange and futures is still over $800 on BitMEX. While the price of Bitcoin [BTC] on Coinbase is $5600, it is fluctuating between $4700 and $4800 on BitMEX.

Moreover, the XBT (used for trading contracts on BitMEX) index on Kraken exchange is closer to the spot exchange prices with only a $100 BTC basis. The massive scale of BitMEX seems to have been causing all the hysteria in the price.

Last but not the least, while the buys on spot exchange does bring hope for investment, normalcy must return to market before any sound judgement can be made.

Do you think the price is out of the waters or it was a dead cat bounce? Please share your views with us.

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans