Bitcoin Price Struggles Amid Record Low Miner Reserves, What’s Next?

Highlights

- Bitcoin's price faces challenges with record-low miner reserves suggesting a potential correction.

- Analysts speculate on Bitcoin's consolidation to $42,000 before rallying pre-halving.

- Santiment reports declining Bitcoin wallets amid SEC's approval of 11 Spot ETFs.

Recent shifts in BTC miner reserves spark Bitcoin price speculation, with experts foreseeing a possible correction to $42,000 before a halving rally. Meanwhile, miners seem to be fortifying their balance sheets in preparation for April’s halving event, hinting at impending market shifts.

Notably, as Bitcoin’s price hovers around $43,000, concerns about miner selling pressure and outflows persist, influencing market sentiment and investor decisions.

Miner Reserves Decline Weighs On Bitcoin Price

According to a recent Bloomberg report, Bitcoin miners have been reducing their reserves in anticipation of the upcoming halving event in April. The reduction in miner reserves, coupled with increased selling activity, suggests a strategic move by miners to optimize their financial positions amidst impending revenue declines.

Bitcoin miner reserves have decreased by 8,400 tokens since 2024’s start, signaling increased token sales. Notably, now the miner reserves stood at 1.8 million, its lowest level since June 2021. This move reflects miners’ proactive stance amidst the impending reduction in transaction verification rewards.

Meanwhile, Matthew Sigel, head of digital-asset research at VanEck, highlights the significance of miners’ actions in the current market landscape. He notes that miners are preemptively selling their holdings to mitigate potential margin pressures post-halving, emphasizing the importance of scale in navigating future challenges.

Notably, this strategic shift among miners underscores the evolving dynamics of the Bitcoin ecosystem and its broader implications for market stability and investor sentiment. In addition, it seems that the recent surge in Spot Bitcoin ETFs in the United States has further influenced miner behavior and market dynamics.

Bitfinex’s Alpha market report reveals a substantial outflow of Bitcoin from miner wallets to exchanges following the launch of Bitcoin ETFs, signaling heightened market activity and investor interest. This influx of Bitcoin to exchanges reflects a complex interplay of factors, including miners’ liquidity needs and broader market sentiment surrounding ETF adoption and regulatory developments.

Also Read: Dogecoin Whale Dumps 100 Mln DOGE To Robinhood, Price Dip Ahead?

Other Factors That Could Impact The Price

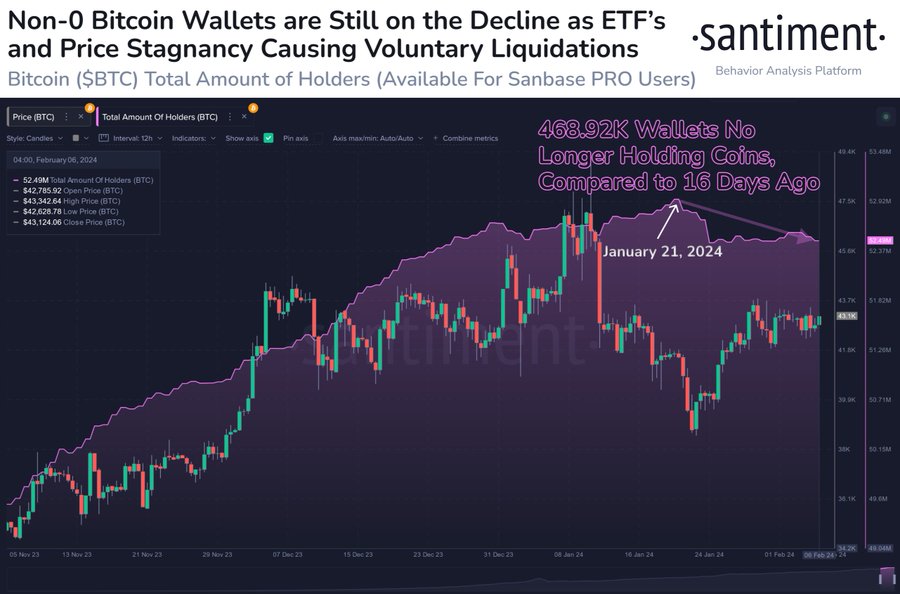

Recent data from Santiment on the X platform reveals a decline in Bitcoin wallets holding more than 0 coins. This trend persists nearly four weeks after the SEC’s approval of 11 Spot ETFs for crypto, raising speculations among the crypto market enthusiasts.

Meanwhile, the Santiment report said that this decline may stem from crowd FUD and diversification into alternative investments, signaling dynamic shifts in the crypto market sentiment and investment strategies. On the other hand, top crypto analyst Michael van de Poppe suggests Bitcoin could consolidate, potentially correcting to $42,000 before rallying towards the $48-50K mark pre-halving.

However, the updates come amid a time when the Bitcoin Futures Open Interest soared notably over the last 24 hours, suggesting a bullish sentiment in the market. Meanwhile, Bitcoin OI surged 1.17% over the last 24 hours to 419.93K BTC or $18.05 billion. Notably, the CME exchange topped the list, with a 4.65% surge in Bitcoin Open Interest to 106.09K BTC or $4.55 billion.

Despite a surge in Bitcoin OI, the BTC price traded near the flatline over the last 24 hours at $42,918.68. Notably, over the last 24 hours, the Bitcoin price has touched a high of $43,344.15 and a low of $42,625.90.

Also Read: South Korea to Bring Strict Digital Assets Act With Life Imprisonment for Violators

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?