Bitcoin Price Prediction As Speculation For Spot ETF Soars, Is BTC Invalidating The Bearish Fractal?

Bitcoin (BTC) price rallied to $35,000 for the first time in 2023 as investors reacted to speculation around the potential greenlighting of a spot exchange-traded fund (ETF) in the United States. The bellwether crypto has sustained the uptrend since early last week when it reclaimed support above $28,000 swiftly stepping above the resistance turned support at $30,000.

Investors have come to appreciate the fake news that rocked the crypto space about the Securities and Exchange Commission (SEC) greenlighting BlackRock’s Bitcoin spot ETF proposal and the appearance of the company’s ETF price tricker on a list maintained by Depository Trust and Clearing Corporation (DTCC).

Institutional investors jumped on Bitcoin during the Asian business hours on Tuesday sending the futures open interest (IO) to historical highs on the Chicago Mercantile Exchange (CME). Retail investors hoping on the trend are increasing exposure to BTC and building momentum for the ongoing rally above $30,000. Up 8.7% in the last 24 hours, Bitcoin price is trading at $33,837, according to live market updates by CoinGape.

What Does A Spot BTC ETF Approval Mean For Bitcoin Price?

Bitcoin price has climbed considerably and is almost hitting its yearly high of $31,000 riding on the bullish wave created by fake news about approving a spot ETF. Hence, the actual approval could invalidate all bearish sentiments and act as the springboard for the early stages of the bull market ahead of the 2024 halving.

A BTC spot ETF would open an influx of money from traditional investors, who prefer to buy shares of the product through a conventional stockbroker, thus avoiding the process of purchasing the digital asset directly on exchanges and subsequently the complexities associated with storing the coins in crypto wallets.

The approval would also validate Bitcoin as a mature asset—a status that crypto enthusiasts have long been waiting for. It is the expected influx of money from institutional investors in the traditional market that will act as the catalyst for a massive rally and coupled with the halving, they could usher in the 2024/2025 bull run.

A research report by JP Morgan released last Wednesday speculated that multiple spot ETFs would be approved, especially after the SEC decided not to appeal a recent court ruling in the Grayscale case.

Grayscale is the largest digital asset manager and operates the Grayscale Bitcoin Trust (GBTC), which it had sought to convert into a spot ETF. According to the report, the exact timing of the approval is uncertain but could happen within months.

Can Bitcoin Price Invalidate The Bearish Fractal?

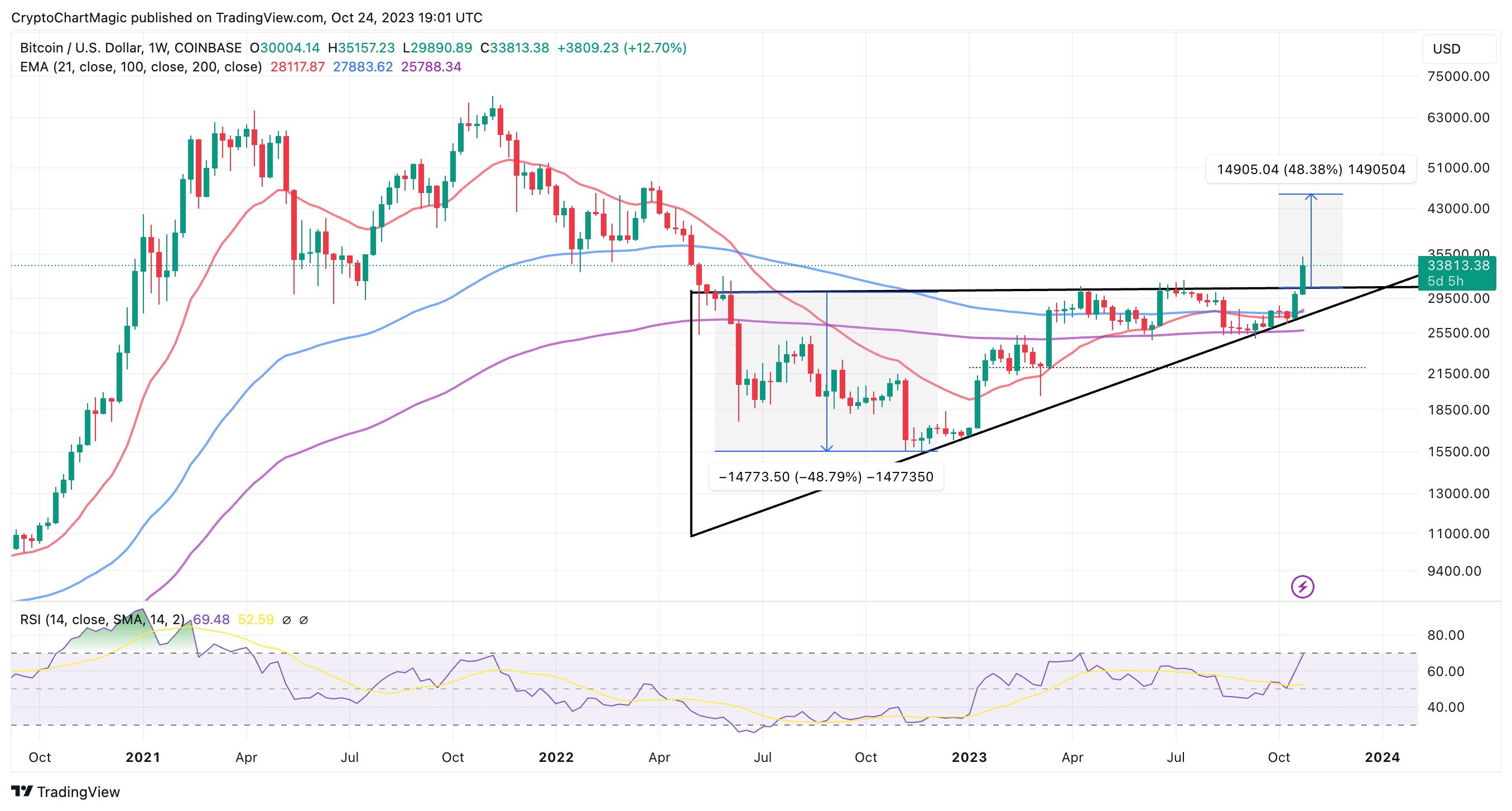

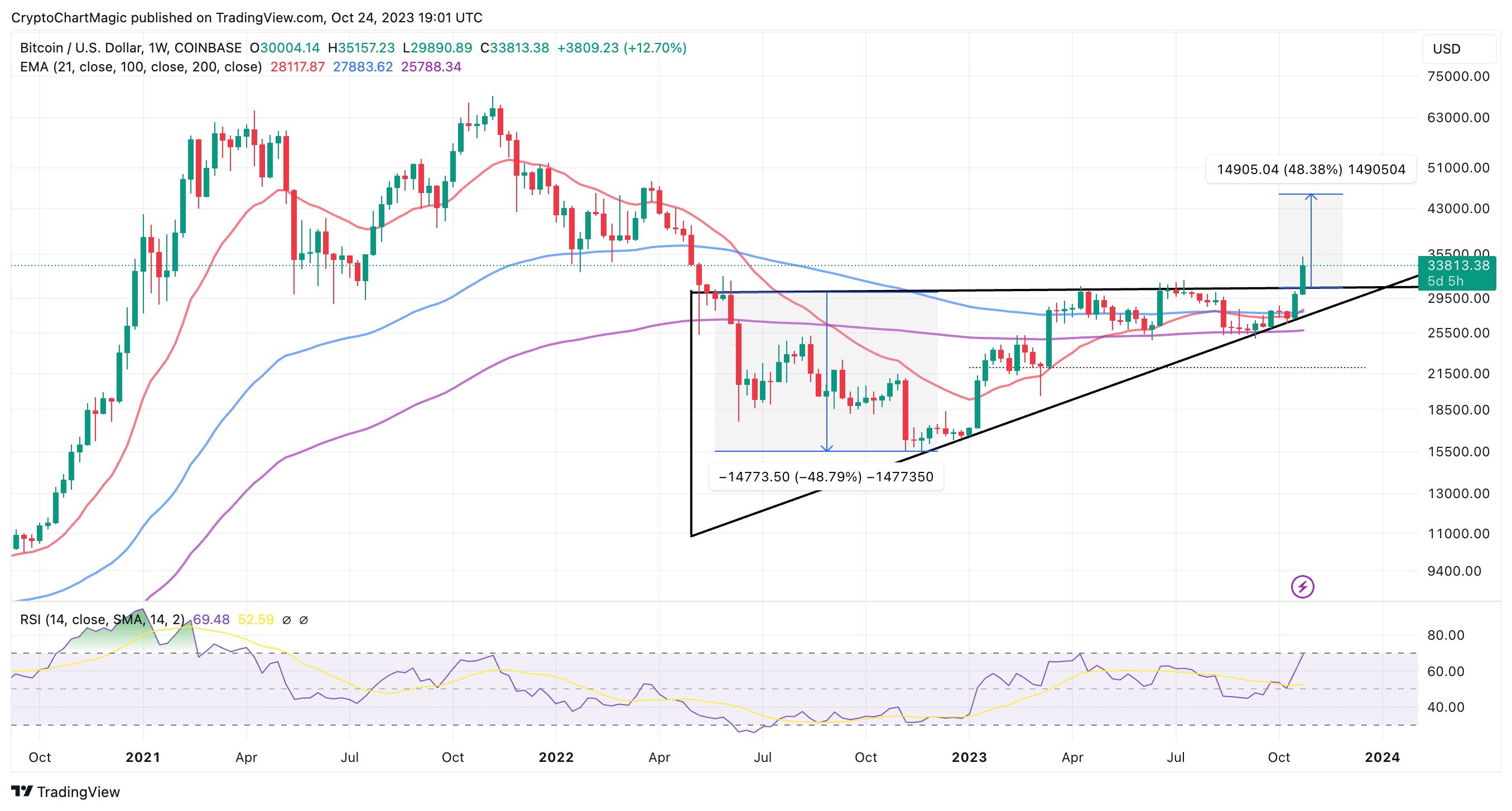

Bitcoin price is trading above a key bullish pattern — the ascending triangle illustrated on the chart below. The path with the least resistance sustained the rally to $35,000, although profit booking is the biggest stumbling block with BTC trading at $33,813 at the time of writing.

Traders backing the uptrend could be reading from the Moving Average Convergence Divergence (MACD) indicator, which sent a buy signal last Monday, October 16.

The bullish outlook is also validated by a golden cross pattern formed when the 21-week Exponential Moving Average (EMA) (red) crossed above the longer-term 100-week EMA (blue).

According to technical insight shared by analyst and trader Rekt Capital, “A clean break of the ~$31,000 highs is the final step to fully invalidating the Bearish Bitcoin Fractal.”

A clean break of the ~$31,000 highs is the final step to fully invalidating the Bearish Bitcoin Fractal$BTC #Crypto #Bitcoin pic.twitter.com/gT5IXSoSQG

— Rekt Capital (@rektcapital) October 23, 2023

In another post on X (Twitter), Rent Capital shared what he termed “the Bearish Fractal invalidation criteria” but it is worth mentioning that a pullback below $30,000 is still on the cards, especially if resistance at $31,000 fails to budge.

At Range High resistance after breaking its multi-month Lower High

Reclaim red as support and/or Weekly Close beyond would likely confirm a breakout beyond the Range High

Until then, there is scope for a pullback into the high ~$27k for a retest$BTC #Crypto #Bitcoin pic.twitter.com/UHHMxBloTC

— Rekt Capital (@rektcapital) October 23, 2023

Bulls have the upper hand and are focused on pushing for gains above $35,000. A break and hold above this crucial level could validate the rally and open the door for the double-top pattern’s breakout target at $45,771 and subsequently above $50,000.

Related Articles

- Crypto Exchange HashKey Launches RWA Issuance for Institutions Amid Tokenization Boom

- Just-In: Ethereum Foundation Begins Staking 70,000 ETH, Futures Open Interest Bounces

- 8 Best White Label RWA Tokenization Platform Development Companies

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

Claim Card

Claim Card