Bitcoin Price Risks Massive Fall As Central Banks Sparks Bearish Sentiment?

Bitcoin’s bullish momentum is waning as central banks across the globe plans to continue raising interest rates this year and discuss a possible ban on crypto during the G20 meeting in India. This puts intense pressure on Bitcoin price, causing price and sentiment to slip from “greed” to “neutral.”

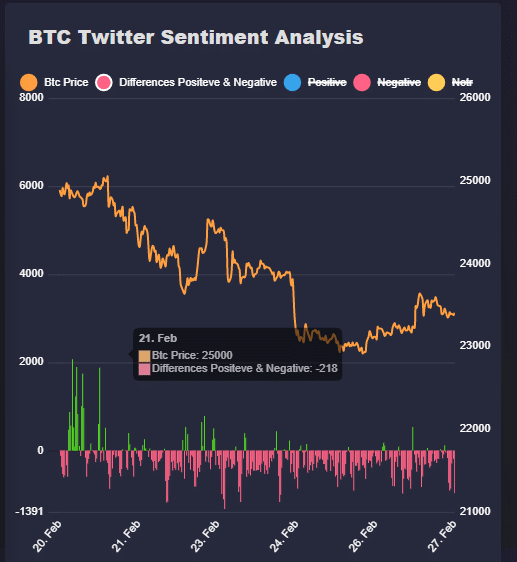

The Crypto Market Fear and Greed Index fell from 60 “greed” to 51 “neutral” within just 3 days after the U.S. Core PCE inflation came in at 0.6% MoM, against market estimates of 0.4%. The inflation data along with a monthly expiry on February 24 caused BTC price pullback to $22,861, just higher above the massive liquidation level of $22,000.

Major central banks including the U.S. Federal Reserve, the Central European Bank, and the Bank of England plan aggressive rate hikes in March and the coming months. The ECB President Christine Lagarde confirmed a 50 bps rate hike in an effort to return the inflation target to 2%. The Bank of England has also confirmed a 50 bps rate hike next month due to higher energy prices and supply bottlenecks.

The US Dollar Index (DXY) has jumped over 105 from below 103 in just a few days, sparking speculation of a major price dip in Bitcoin price. While the DXY and other data show volatility, the sentiment has already turned negative as crypto market trading volume has declined across crypto exchanges.

Also Read: Ethereum Shanghai Upgrade, Developers Reveal Key Details Ahead Of Sepolia Upgrade

Bitcoin Price Retest Coming

Bitcoin price falling to support level can witness two expected events. First, whales and institutional investors can once again accumulate from $21.7K for longs. Second, derivates traders are likely to make a more bullish mark.

Popular crypto analyst Michael van de Poppe predicts a rejection at the crucial $23.8K level would indicate another test of the support level. If that sweep happens and we reclaim the level upward, then a rebound to $25K is inevitable and longs are triggered.

BTC price is currently trading at $23,428, moving sideways in the last few days. The 24-hour low and high are $23,165 and $23,654, respectively.

Also Read: Solana Releases Report On Mainnet Beta Outage, Is SOL Price Dump Next?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs