Bitcoin Price To $65k Or $55k After US PCE Data? IMF Asks Fed To Delay Rate Cuts

Highlights

- BTC witnessing massive volatility and uncertainly amid the US PCE inflation data and quarterly options expiry.

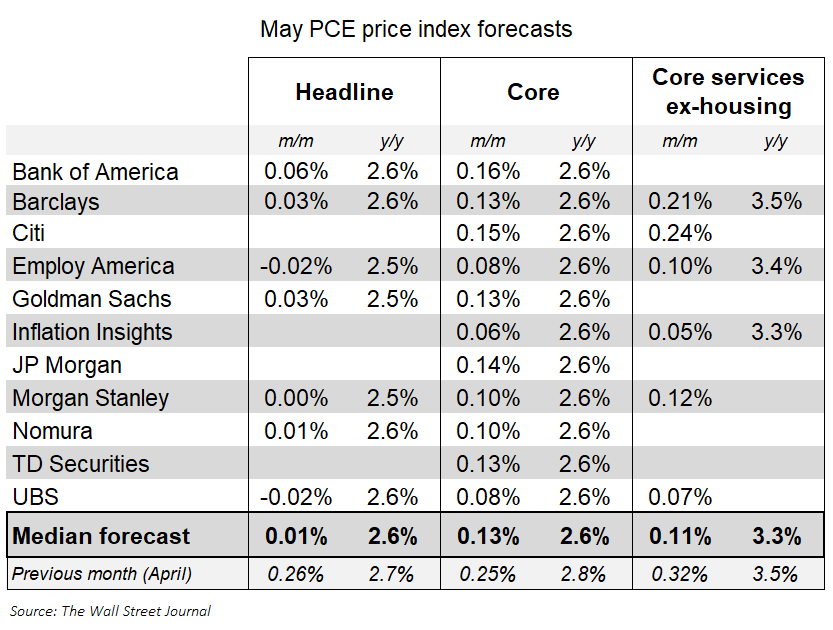

- JPMorgan, Goldman Sachs, and Morgan Stanley estimate cooling PCE inflation.

- IMF Managing Director Kristalina Georgieva urges the Fed to keep rate unchanged until the year end.

- Markus Thielen BTC price risks falling to $55k.

- Options traders are buying BTC and open interests rose in the last 24 hours.

Bitcoin price trades below the current short-term average BTC realized price of $62.6k, a key support level during the bull market. Traders are expecting massive volatility to continue after the US PCE inflation data and quarterly options expiry. Will BTC price drop to $55k or recover to $65k in the next few days?

Bitcoin Traders Look for Cues

The Federal Reserve’s preferred gauge to measure inflation PCE and core PCE came in line last month, but Wall Street giants such as JPMorgan, Goldman Sachs, and Morgan Stanley anticipate inflation to cool, with the Fed rate cut starting in September.

The headline PCE inflation slows to 2.6% from 2.7%. Also, core PCE inflation to cool to 2.6% from 2.8%. Markets are already moving higher due to high speculation on Fed rate cuts as inflation globally cools and the Fed likely follows other central banks in rate cuts soon.

However, IMF Managing Director Kristalina Georgieva on Thursday said “The Fed should keep policy rates at current levels until at least late 2024.” She added that there are ongoing upside risks to inflation due to robust US economic growth. The strong US labor market is the key factor behind the delay in rate cuts. The IMF is more optimistic than the Fed about hitting the 2% target rate by mid-2025, which is ahead of the Fed’s own projection for 2026.

Analyst Says BTC Price Risk Falling to $55k

Markus Thielen, CEO of crypto market research firm 10x Research, predicts a drop in BTC price to $55k. He cited 10 factors including the double top pattern in BTC price that may push Bitcoin crashing to $55k.

Other reasons that risk a massive downfall in BTC price are weekly RSI declining despite buy-the-dip by investors, lack of institutional buying as seen in spot Bitcoin ETFs, and rising selling pressure due to macro.

Meanwhile, the US dollar index (DXY) is dropping from 106.12 ahead PCE, with the current reading at 105.91. The US 10-year Treasury yield jumped above 4.3% as US president Joe Biden and his predecessor Donald Trump clashed in their first presidential debate. Bitcoin moves opposite to DXY and Treasury yields, and the current data indicated volatility and uncertainty.

Also Read: Will Solana And Ether Outperform Bitcoin In Near Term Amid ETF Hype?

Bitcoin Options Data Shows Buying Activity

The Long-Term Holders (LTH) on-chain data and whales selling their BTC holding also currently pointing to a high pressure in the market, as reported by CoinGape.

However, Bitcoin options data indicate a transition toward recovery amid a rising call open interests, as per Deribit. Despite the large market fluctuations, the IV of Bitcoin has not witnessed a significant increase. The IV of BTC for each major term is below 50%. CoinGlass data also indicate a total increase in options open interest.

Spot Ethereum ETF launch next can avert a massive dropdown in BTC price as sentiment improves slowly. Investors must look for an increase in trading volumes, but a sudden recovery to $65k is challenging.

BTC price jumped 1% in the past 24 hours, with the price currently trading at 61,291. The 24-hour low and high are $60,561 and $62,292, respectively. Furthermore, the trading volume has increased by 3% in the last 24 hours.

Also Read: Bitcoin Miner Capitulation Ended? On-Chain Data Signals Market Recovery

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?