Bitcoin Price To Fall Deeper Or Preparing For A Rebound To $25K?

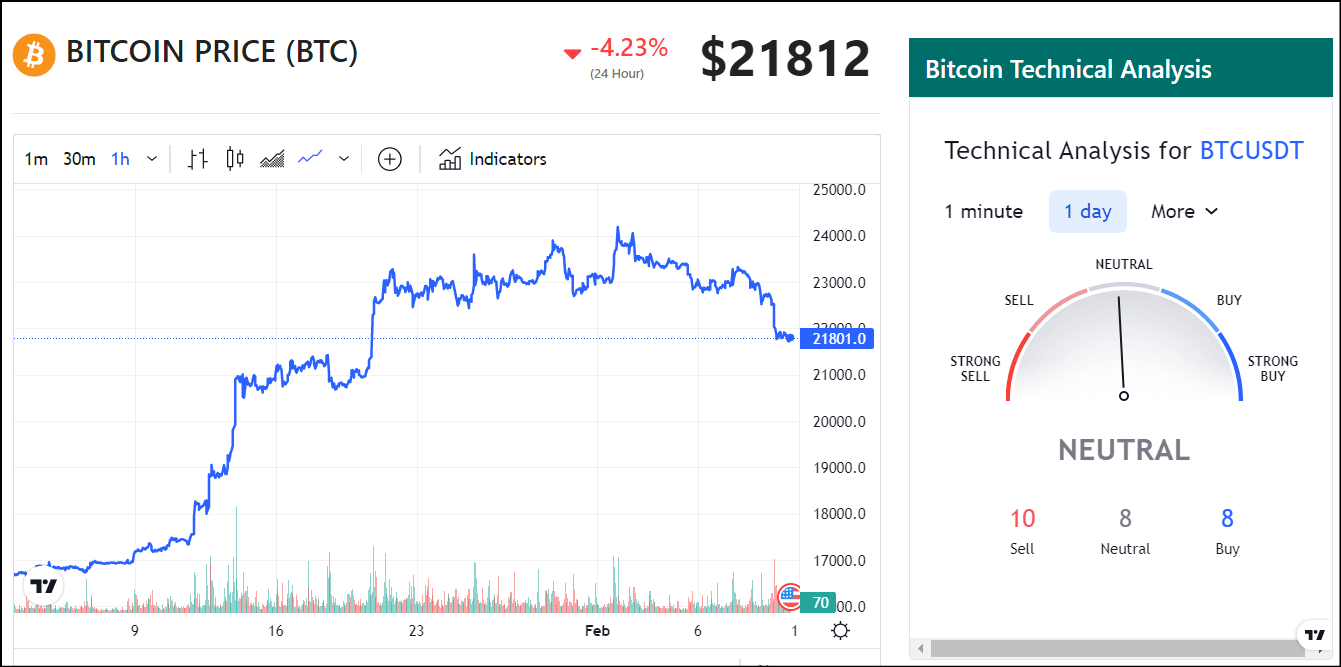

Mass panic rippled throughout the larger cryptocurrency market as the SEC accused Kraken, a cryptocurrency exchange based in California, of running an unregistered crypto staking scheme on Thursday. Bitcoin lost almost 5% at the time, resulting in hitting the fag end of the $21K level while reaching a peak of $24K few weeks back. However, current market data reveals a significant uptick in the price of Bitcoin (BTC) as it reclaims the $21,800 price mark in the past 1 hour.

Bitcoin Shows Bullish Signals

Bitcoin, as per certain on-chain data is currently fighting with the 50MA (moving average), and its monthly chart appears to be offering a buying opportunity with several indications. A recent post on CryptoQuant made by an analyst highlighted the fact that there has been an increase in the reserves held by crypto exchanges. An “exchange reserve” is an indicator that measures the total quantity of Bitcoin that is currently being stored in the wallets of a centralized exchange.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

When the value of this indicator rises, it indicates that investors are now adding their coins to the exchange where they are being traded. Since investors typically use spot exchanges for selling objectives, the reserve exhibiting this pattern could be adverse to the price of the cryptocurrency if the platform in issue is a spot exchange.

A declining reserve, on the other hand, may indicate that holders are currently withdrawing their coins from the exchange in question. In most cases, owners will transfer their coins to a cold wallet in order to store them securely for an extended length of time. As a result, this kind of trend might be bullish for the price in the long run because it indicates a reduction in the amount of selling pressure that is being exerted on the asset.

Bitcoin’s Price Recovery

While it is clear that this indication has been on an upward trajectory during the past two days–thanks to the spot deposits–the metric as a whole has been falling over the last two weeks, which shows that the market has been witnessing some level of net Bitcoin accumulation. If these withdrawals are considered as an indication of buying, then the coin might still see a bullish influence in the long run.

Additionally, it should be noted that BTC’s technical analysis (TA) indicators at CoinGape’s crypto market tracker recommend a neutral position as summarised from the moving averages; suggesting a “buy” at 8 and “sell” at a level 10. As things stand, the price of Bitcoin is currently trading at $21,812 which represents an increase of 0.14% over the past 1 hour, in contrast to a drop of 6.40% over the last seven days.

Also Read: Are These Tokens The Future of Crypto Gaming In 2023?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- TRUMP Coin Jumps as Team Announces Conference With President Trump as Keynote Speaker

- Breaking: Trump Calls For Emergency Fed Rate Cut Before Next Week’s FOMC Meeting

- Breaking: U.S. Senate Passes Bipartisan Housing Bill That Includes CBDC Ban

- Crypto Market Rebounds as Trump Mulls Suspending Jones Act to Ease Oil Price Pressures

- Goldman Sachs Revises Fed Rate Cut Forecast to September as Iran War Threatens Inflation

- What Happens to XRP Price If US Wins War Against Iran?

- COIN Stock Prediction as Crypto Crash Odds Jump as Expert Sees Inflation Hitting 3.4%

- Cardano Price Turns Bullish as ADA Futures OI Hits $416M Ahead Of Key Upgrades

- Dogecoin Price Outlook If Elon Musk’s X Money Integrates Crypto- Is $0.2 Possible This Week?

- Will XRP Price Rally After Ripple’s Strategic Acquisition in Australia?

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200