Bitcoin price trades under $48k as $6 billion worth of Options contract nears expiry

Bitcoin (BTC) price slid under $48K during the late hours of 28th December and currently trading at $47,589 with a 4% decline over the past 24-hours. The top cryptocurrency managed to break past the crucial resistance of $51K earlier this week but couldn’t hold onto its gains.

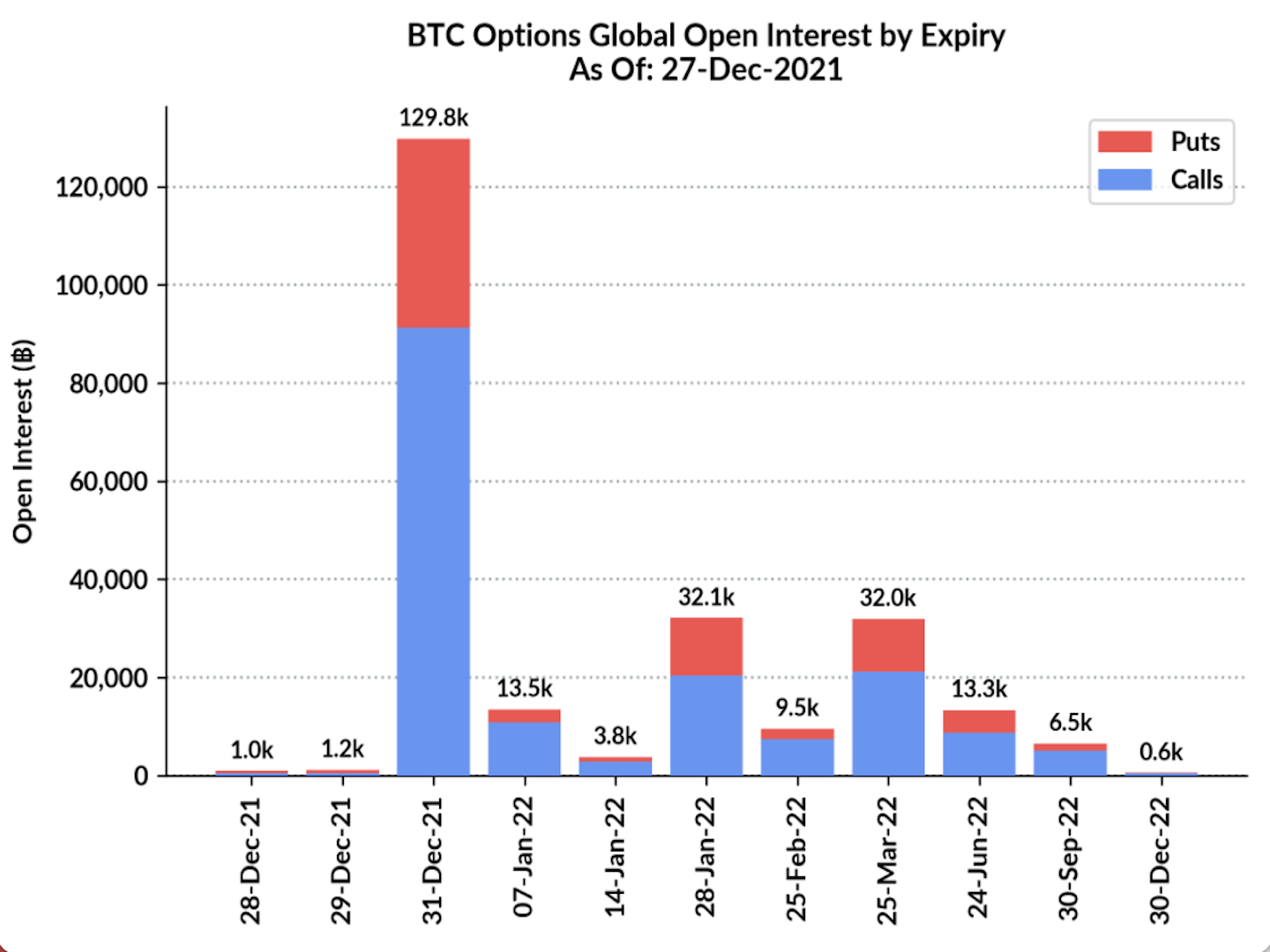

The current market downturn is being attributed to the upcoming expiry of 129.8K Options contracts this Friday. According to the skew data, the total valuation of the Options contract set for expiry is worth $6 billion. It has been a common occurrence in the crypto market where the price fluctuates and shows higher volatility in the run-up to the expiration date.

This price movement is typically caused by option sellers (mainly institutional traders) manipulating the spot market to push the spot price closer to the strike price at which the greatest number of open options contracts expire. For option buyers, this results in maximum losses (or “max pain”). According to a Cayman Islands-based crypto financial services firm, the maximum pain point for Friday’s option expiration is set at $48,000.

2. After the Christmas rise, the price of BTC is gradually approaching the max pain point of the options market. However, the volatility has not changed significantly for the time being. @DeribitInsights @GenesisVol pic.twitter.com/ZmEtI1JC6n

— Blofin (@Blofin1) December 28, 2021

Can Bitcoin price see a trend reversal post Options expiry?

Bitcoin price is currently moving in the second support zone below $51K i.e $46K-$48K and the market still looks optimistic for recovery despite the final quarter turning out to be bearish except for October. However, the overall market sentiments remain bullish as we near the end of the year. Crypto analysts have drawn comparison to the 2021 bull run to the preceding year of 2017 bull run and believe BTC would touch new highs in 2022 and we are far from a market top at the moment.

The price of the crypto market often turns green in the wake of the Options expiry, and given the upcoming expiry is one of the largest, the price fluctuations were anticipated.

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value